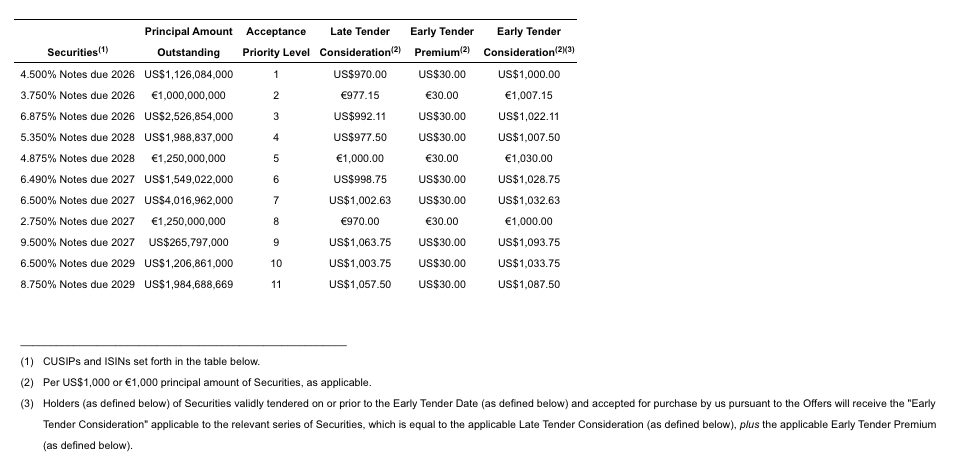

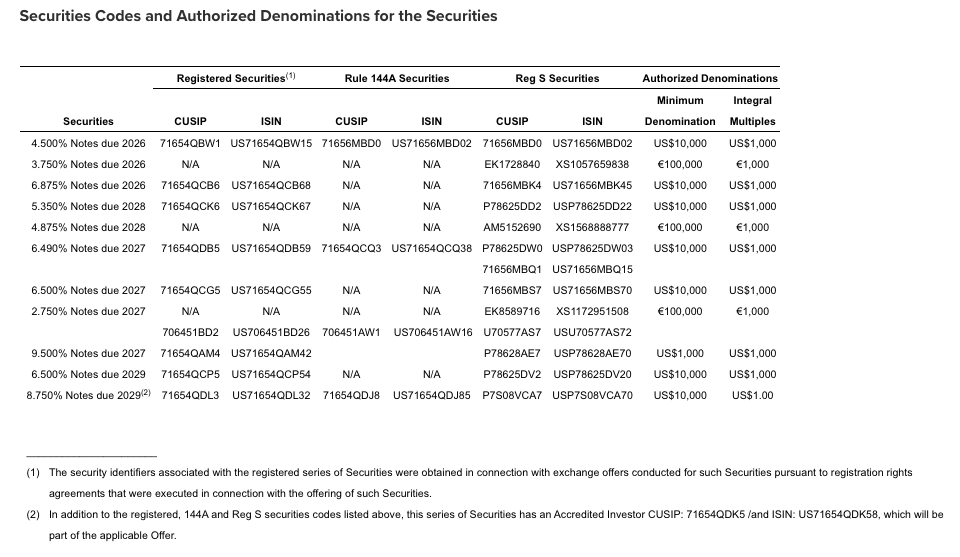

MEXICO CITY, MEXICO (By Pemex, 2.Sep.2025, Words: 2,500) — Petróleos Mexicanos (PEMEX), a state-owned public company of the Federal Government of the United Mexican States, announced today the commencement of offers to purchase for cash (the “Offers”) the series of PEMEX’s outstanding securities set forth in the table below (the outstanding securities targeted in the Offers collectively, the “Securities”), for a maximum cash amount of $9.9bn (the “Maximum Cash Amount”):

The Offers are being made on the terms and subject to the conditions set forth in the offer to purchase dated September 2, 2025 (the “Offer to Purchase”), which sets forth in more detail the terms and conditions of the Offers.

The Offers will expire at 5:00 p.m., New York City time, on 30 Sep. 2025 unless earlier terminated or extended by PEMEX (such time and date, as it may be extended with respect to an Offer, the “Expiration Date”). Securities tendered may be withdrawn at any time on or prior to 5:00 p.m., New York City time, on 15 Sep. 2025 unless extended, but not thereafter.

Holders of Securities validly tendered on or prior to 5:00 p.m., New York City time, on 15 Sep. 2025 (such date and time, as the same may be extended with respect to an Offer, the “Early Tender Date”) and accepted for purchase by PEMEX pursuant to the Offers will receive the Early Tender Consideration applicable to the relevant series of Securities reflected in the table above, which is equal to the applicable Late Tender Consideration set forth in the table above, plus the applicable Early Tender Premium.

Holders of Securities validly tendered after the Early Tender Date and on or prior to the Expiration Date and accepted for purchase by PEMEX pursuant to the Offers will receive the late tender consideration applicable to the relevant series of Securities (the “Late Tender Consideration”) and, together with the Early Tender Consideration, the “Consideration”) applicable to the relevant series of Securities, which does not include the Early Tender Premium.

Holders will also receive an amount in cash (such amount “Accrued Interest”) consisting of accrued and unpaid interest on Securities accepted for purchase in the Offers from, and including, the last interest payment date for each series of Securities to, but not including, the applicable Settlement Date (as defined below), plus any additional amounts as described in the Offer to Purchase. Under no circumstances will any interest be payable because of any delay in the transmission of funds to the holders by the Tender and Information Agent or the Covered Clearing Systems (defined below).

Following the Early Tender Date and at or prior to the Expiration Date, PEMEX will have the right to elect to accept the Securities validly tendered at or prior to the Early Tender Date, provided that all conditions of the Offers have been satisfied or, where applicable, waived by PEMEX (the “Early Settlement Right”). If PEMEX exercises its Early Settlement Right, PEMEX expects to settle the Offers in respect of Securities validly tendered at or prior to the Early Tender Date that are accepted for purchase (the “Early Settlement Date”) promptly following the date on which we accept for purchase such Securities and prior to the Expiration Date (the “Early Acceptance Date”). Assuming that such Early Settlement Date is not extended, and all conditions of the Offers have been satisfied or, where applicable, waived by PEMEX, PEMEX expects that the Early Settlement Date will occur no later than the third U.S. business day following the Early Acceptance Date.

PEMEX expects to settle the Offers in respect of Securities that have been validly tendered prior to the Expiration Date (exclusive of Securities accepted for purchase and settled on the Early Settlement Date, if any), and that are accepted for purchase promptly following the Expiration Date (the “Final Settlement Date”). Assuming that such Final Settlement Date is not extended, and all conditions of the Offers have been satisfied or, where applicable, waived by PEMEX, PEMEX expects that the Final Settlement Date will occur no later than the third U.S. business day following the Expiration Date.

The following acceptance priority procedures and proration procedures will apply to each Offer (the “Acceptance Priority Procedures”):

- If the purchase of all Securities validly tendered at or prior to the Early Tender Date would cause us to purchase an aggregate principal amount of Securities that would result in an aggregate Consideration (including the Early Tender Premium, as applicable), in excess of the Maximum Cash Amount then the Offers will be oversubscribed at the Early Tender Date, and we will not accept for purchase any Securities tendered after the Early Tender Date and we will (assuming satisfaction or, where applicable, the waiver of the conditions to the Offers) accept for purchase on the Early Acceptance Date (or, if there is no Early Acceptance Date, the Expiration Date), the Securities tendered at or prior to the Early Tender Date pursuant to the Acceptance Priority Procedures and proration procedures. If the Offers are not oversubscribed at the Early Tender Date and the purchase of all Securities validly tendered at or prior to the Expiration Date would cause us to purchase an aggregate principal amount of Securities that would result in an a aggregate Consideration (including the Early Tender Premium, as applicable) payable for Securities in excess of the Maximum Cash Amount, then the Offers will be oversubscribed at the Expiration Date, and we will (assuming satisfaction or, where applicable, the waiver of the conditions to the Offers) accept for purchase all Securities tendered at or prior to the Early Tender Date and accept for purchase any Securities tendered after the Early Tender Date pursuant to the Acceptance Priority Procedures.

- Subject to the satisfaction or, when applicable, the waiver of the conditions to the Offers and the priority of early tenders, we will accept for purchase validly tendered Securities in the order of the related Acceptance Priority Level set forth in the table above, beginning with the lowest numerical value of Acceptance Priority Level.

- Subject to the procedures described below for undersubscribed Offers by the Early Tender Date, if the aggregate Consideration (including the Early Tender Premium, when applicable) to be paid for all Securities validly tendered corresponding to an Acceptance Priority Level, when added to the aggregate Consideration (including Early Tender Premium, when applicable) to be paid for all Securities accepted for purchase corresponding to each higher Acceptance Priority Level (lower numerical value), if any, would cause us to pay an aggregate Consideration (including the Early Tender Premium, as applicable) that does not exceed the Maximum Cash Amount, then we will accept for purchase all such Securities of such series corresponding to such Acceptance Priority Level and will then apply the foregoing procedure to the next lower Acceptance Priority Level (next higher numerical value). If the condition described in the foregoing sentence is not met with respect to an Acceptance Priority Level, we will accept for purchase the maximum aggregate principal amount of tendered Securities of the series included in such Acceptance Priority Level (on a prorated basis), such that the aggregate Consideration (including the Early Tender Premium, as applicable) paid for the series of Securities with the lowest Acceptance Priority Level (the highest numerical value) accepted, when considered together with the aggregate Consideration (including Early Tender Premium, as applicable) paid for Securities with higher Acceptance Priority Levels (lower numerical values), comes as close as possible to, but not exceeding, the Maximum Cash Amount.

- Tendered Securities with an Acceptance Priority Level lower than the Acceptance Priority Level that results in the purchase of the full Maximum Cash Amount will not be accepted for purchase; provided that, if the Offers are not fully subscribed as of the Early Tender Date, Securities tendered at or before the Early Tender Date will be accepted for purchase in priority to other Securities tendered after the Early Tender Date, even if such Securities tendered after the Early Tender Date have a higher Acceptance Priority Level than Securities tendered prior to the Early Tender Date.

- If proration of a series of tendered Securities is required, we will determine the final proration factor as soon as practicable after the Early Tender Date or Expiration Date, as applicable, and will inform Holders of such series of Securities of the results of the proration. In the event proration is required with respect to a series of Securities, we will multiply the U.S. dollar equivalent of the principal amount of each valid tender of such series of Securities by the applicable proration rate and round the resulting amount down to the nearest U.S. dollar equivalent of US$1,000 or €1,000, principal amount, as applicable, in order to determine the principal amount of such tender that will be accepted pursuant to the applicable Offer. The excess principal amount of Securities not accepted from the tendering Holders will be promptly returned to such Holders. If, after applying such proration factor, any Holder would be entitled to a credit or return of a portion of tendered Securities of a series that is less than the Authorized Denominations, then, in our sole discretion, (i) all of the Securities of such series tendered by such Holder will be accepted without proration, or (ii) none of the Securities of such series tendered by such Holder will be accepted. With respect to EUR Securities, if such proration would result in us accepting validly tendered EUR Securities in an amount that is less than the Authorized Denominations then, in our sole discretion, (i) all of the EUR Securities of such series tendered by such Holder will be accepted without proration, or (ii) none of the EUR Securities of such series tendered by such Holder will be accepted.

- In determining the principal amount of Securities to be purchased against the Maximum Cash Amount pursuant to the Offers, the aggregate U.S. dollar-equivalent principal amount of Euro Securities shall be calculated at the applicable exchange rate, as of 2:00 p.m., New York City time, on the U.S. business day prior to the Early Tender Date or the Expiration Date, as applicable, as reported on Bloomberg screen page “FXIP” under the heading “FX Rate vs. USD” (or, if such screen is unavailable, a generally recognized source for currency quotations selected by PEMEX with quotes as of a time as close as reasonably possible to the aforementioned).

PEMEX’s obligation to accept the Securities tendered in the Offers is subject to the satisfaction or waiver of certain conditions set forth in the Offer to Purchase, at or prior to the Early Tender Date or the Expiration Date, as the case may be, including a financing condition, consisting of the successful closing of the Mexican Government Financing (as defined below) and the receipt by PEMEX on or prior to the applicable Settlement Date of a capital contribution, in cash, from UMS in an amount sufficient to fund the payment of the Consideration (including the Early Tender Premium, as applicable) for all Securities validly tendered in the Offers up to the Maximum Cash Amount and Accrued Interest due to Holders of such Securities.

The Offers of each series of Securities are not contingent upon the tender of any minimum principal amount of such Securities.

The consummation of an Offer is not conditioned on the consummation of the other Offers. Each Offer is independent of the other Offers, and PEMEX may, subject to applicable law, withdraw or modify any Offer without withdrawing or modifying other Offers.

Prior to the Expiration Date, Mexico expects to enter into and complete certain financing transactions in an amount and on terms and subject to conditions acceptable to Mexico (the Mexican Government Financing”), with an amount equal to the net proceeds of the Mexican Government Financing to be contributed to PEMEX, in cash, to allow PEMEX to fund the payment of the Consideration (including the Early Tender Premium, as applicable) for all Securities validly tendered and accepted for purchase in the Offers up to the Maximum Cash Amount and Accrued Interest due to Holders of such Securities. This announcement does not constitute an offer to sell or a solicitation of an offer to buy any securities that may be offered by Mexico as part of the Mexican Financing.

The Securities are held in book-entry form through either the facilities of The Depository Trust Company (“DTC”) or held in book-entry form through the facilities of Clearstream Banking, société anonyme (“Clearstream”), Euroclear Bank S.A./N.V., as operator of the Euroclear System (“Euroclear,” and together with DTC and Clearstream referred to herein as a “Covered Clearing System” and, collectively, as the “Covered Clearing Systems”). In the event of a termination of or valid withdrawal of Securities from any Offer, the Securities tendered pursuant to the applicable Offer will be credited to the Holder through the relevant Covered Clearing System.

Global Bondholder Services Corporation is acting as the Tender and Information Agent for the Offers. Questions or requests for assistance related to the Offers or for additional copies of the Offer to Purchase may be directed to Global Bondholder Services Corporation at +1 855-654-2014 (toll free) or +1 (212) 430-3775 (collect). You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Offers. The Offer to Purchase can be accessed at the following link: https://www.gbsc-usa.com/pemex/.

PEMEX has retained BofA Securities, Inc., Citigroup Global Markets Inc. and J.P. Morgan Securities LLC, to act as Joint Lead Dealer Managers, and HSBC Securities (USA) Inc., MUFG Securities Americas Inc. and Scotia Capital (USA) Inc. to act as Joint Dealer Managers, in connection with the Offers (the “Dealer Managers”).

Holders are advised to check with any bank, securities broker or other intermediary through which they hold Securities as to when such intermediary would need to receive instructions from such Holder in order for that Holder to be able to participate in, or withdraw their instruction to participate in, an Offer, before the deadlines specified herein and in the Offer to Purchase. The deadlines set by any such intermediary and the Covered Clearing Systems for the submission and withdrawal of tender instructions will also be earlier than the relevant deadlines specified herein and in the Offer to Purchase.

This announcement is for informational purposes only and shall not constitute an offer to purchase nor a solicitation of an offer to sell any Securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful.

The Offers are being made solely pursuant to the Offer to Purchase. The Offers are not being made to holders of Securities in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. In any jurisdiction in which the securities laws or blue sky laws require the Offers to be made by a licensed broker or dealer, the Offers will be deemed to be made on behalf of PEMEX by the Dealer Managers for the Offers or one or more registered brokers or dealers that are licensed under the laws of such jurisdiction.

____________________