(Energy Analytics Institute, Special Contributor Millan Arcia Einstein, 11.Apr.2022) — Exxon and the Guyana government claim total hydrocarbon “resources of around 10,000 million barrels of equivalent oil”. Important to understand that these are recoverable resources in equivalent oil barrels, and not commercially recoverable crude oil reserves. Establishing the difference between equivalent resources, and crude oil reserves is critical to understand the real financial potential for these assets.

While resources refer to an estimate of the amount of hydrocarbon that “might” be technically recovered if production were not constrained by economics, reserves refer to an estimate of the amount of hydrocarbon that can be technically and economically expected to be produced.

In general, at the end of the economic life of the asset, resource estimates are larger than reserves estimate in at least 60% to 40% of the initial figures, as a result of inherent uncertainties during the exploration, appraisal and development stages. This brings the most realistic scenario for the Guayana proven hydrocarbon reserves to between 6,000 to 4,000 million equivalent oil barrels (BOE).

But these are “equivalent barrels”, meaning the gas reserves have been accounted for as equivalent oil barrels. Because the hydrocarbon gas is not included as a source of revenue for Guyana in the Production Sharing Agreement (PSA), these equivalent barrels need to be deducted from the bulk figure. Based on the initial gas oil ratio, the most likely “total net recoverable volume of crude oil” for Guyana could be conservatively in a range of 4,800 and 3,100 million barrels (MMBbls), which is still an important figure.

These are total oil reserves for the combined Guyana assets, which as we may know, have still several challenges to overcome before the oil gets to the tank. Addressing only the Liza prospect which is currently under production, as per Exxonmobil the upper bound for recoverable reserves for the asset is 1,200 MMBOE, whereas lower bound 450 MMBOE. Under the same assumptions as above, this brings the likely figure for net recoverable oil reserves to between 1,040 MMBbls and 390 MMBbls.

It is worth noticing that in the event the lower bound for oil reserves is realized, Guyana should be very concerned under the terms of the current operating agreement for the Liza asset.

Guyana Still Waits to Become a Rich Economy?

After more than 3 years since first oil in December 2019, Guyana is still waiting to become not only an important oil supplier, but also a rich economy. But neither the economy, nor the locals have benefited from the oil production so far.

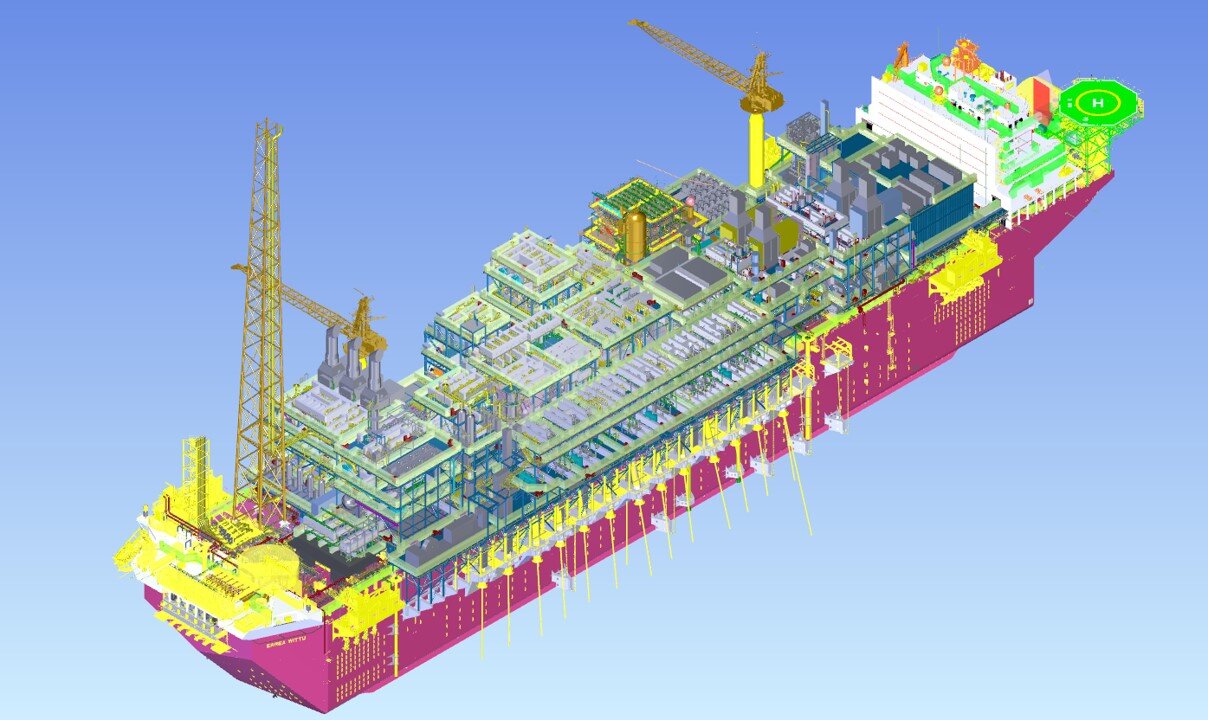

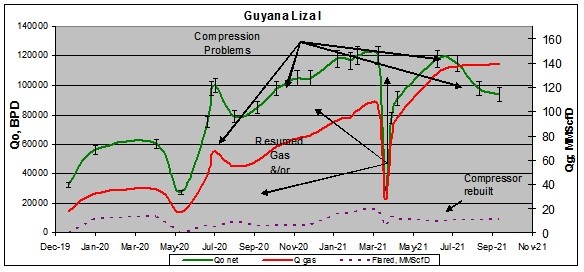

The initial plan according to Guyanese authorities comprised for Phase 1 Liza prospects a 2020 yearend production of 120,000 b/d, linked to a $4bn to $6bn Capex, with preliminary breakeven margin of $35 per barrel. But these operations faced several problems since first oil including failure in the compression facilities, excessive toxic gas flaring, and liquid effluents discharged into the ocean, as a consequence of a fast-increasing reservoir gas oil ratio, and inherent limitations in the design of the production and handling facilities aboard the Liza Destiny FPSO. Confirmed information suggests that expected Liza I production of 120,000 b/d was actually achieved by late January 2021, and not during 2020 as initially planned.

Exxon utilizes some of the produced gas for reinjection, and FPSO process. The rest of the excess gas is actually flared to the atmosphere as toxic emissions. No official information has been given about how the government of Guyana will be compensated for the produced and/or utilized gas, as it was really never negotiated as part of the revenue structure for Guyana in the PSA. Initial figures suggests that gas utilized for process, injected, and flaring by Exxon has a today’s market value of around $600.000 to $700.000 per day (Henry Hub price reference).

Since injection is capped by the number of gas injectors (3), while the producing gas oil ratio has been increasing since the first oil because of the volumetric nature of the reservoir, and the (still) lack of response of the Liza reservoir to fluid injection, flaring has been steadily increasing. That’s the reason why Exxon proposed the gas-to-shore (GTS) project for thermoelectric generation. Even though the country is the owner of the gas, and on top of that will solve a problem created by Exxon during the exploitation of the asset, the GTS project will come at a cost to the country [ Exxon’s gas-to-shore pipeline is the costlier option – PNCR – Kaieteur News (kaieteurnewsonline.com) ].

Positive monetization for Guyana in the case of Liza I will not be likely for the short or even the mid-term. For the low reserves case scenario, it could never be realized even if current market conditions prevail for a longer period of time, because of the low revenue ratio, and the heavy deductions charged to the project by the operator.

Net present value for the PSA in the upper reserve scenario won’t be positive in the near term, but beyond 2027-28 even at current barrel, because of the relative weight of the agreed 2% royalty over the effectively sold volume of crude oil; not the total produced volume, plus a 50% of the 25% cut remaining after a gigantic 75% is discounted by Exxon supposedly assigned to cost recovery. Ironically, cost recovery billed against Guyana “does” include the whole production. That’s the agreement reached between Exxon and Guyana [ Guyana’s royalty is for oil sold but Exxon recovers costs on everything produced – Kaieteur News (kaieteurnewsonline.com) ] in 2014-15.

The first crude oil cargo of nearly 975,000 barrels was shipped on 19 January. During 2021 Guyana had a total of seven lifts. Revenues to Guyana from these lifts plus royalties totaled $436mn, while Exxon pocketed around $3,470mn, including a fraction for cost recovery. A hell of a deal for Exxon.

Sadly, even before the first drop of oil was actually produced, local government was already committed to pay somewhere between $450mn to $950mn to Exxon in pre-contract costs, posing a big weight over the shoulders of the small Guyanese economy.

Recently, local authorities have informed that the second FPSO Liza Unity is expected to produce first oil by yearend 2022 at a target flowrate of 220,000 b/d, for a total-nation of 340,000 b/d; in theory.

Like any other operator would do, Exxon is accelerating CAPEX exposure to take advantage of the prevailing market conditions. But, as operations massifies in these assets, risks and challenges also grow, exponentially. A number of production and operation challenges and risks are expected to surface, most dealing with the very sensitive nature of the environment and the entrapment conditions.

Stabroek: An Important Green Field Area

Stabroek is an important green field area, costly to develop. Most reservoirs are located to depth of over 17.800ft (>5,400m) deep, in water column exceeding 5,700 ft (>1.700+m). There are sensitive environmental challenges, operational complexities, and concerning potential reservoir complexities. Looking at the acceleration criteria, net reserves will be depleted at above 10% during phase I and II, translating into very high gas production which will; as previously mentioned, grow exponentially.

Unconfirmed information suggests that some of these wells are being produced commingled. It has also been confirmed that most wells have significant free-gas volumes already, as well as intrinsic early production problems leading to formation dislodging, caused by large erosional velocities towards the sand face. These observations pose beyond doubt, a significant threat to offshore Guyana future development, as reservoir pressure drops with production.

Liza and Payara reservoir fluid is likely described as light-volatile or retrograde gas condensate. Since GOR increased since first oil, it is safe to assume that initial pressure conditions place the main pool at/or below saturation pressure, opening the possibility to ongoing formation damage caused by relative permeability changes leading to accelerated productivity decay.

As mentioned before, both Liza and Payara reservoirs are preferentially volumetric, meaning they have little or no additional-significant pressure support besides fluid & rock expansion. Accelerating these assets at such rate of over 10% will ensure a very short-live expectancy under primary production, reducing reserves expectation (in situ trapping), and demanding additional pressure support from project inception. That’s the main reason why Exxon considered, although not complied with, water/gas injection since first oil. For the water injector wells, most likely seawater will be used, which poses an additional environmental hazard as potential reservoir souring can become likely, if not properly treated. Reservoir souring occurs when the sulfate dissolved in the seawater promotes the growth of sulfate reducing bacteria generating hydrogen sulfide and other harmful sulfur compounds. All of these elements bring additional capital and operating costs to the project, all surfacing after the first few years of production.

____________________

By special contributor Millan Arcia Einstein: Senior Upstream Oil & Gas Global Adviser and Subject Matter Expert; Managing Director for Energy and Sequestration @ Fractal Software- Multiple Industries. Flexible Solutions (fractal-software.com)