(Canacol, 11.Apr.2022) — Canacol Energy Ltd. (TSX: CNE; OTCQX: CNNEF; BVC: CNEC) reported on the conventional natural gas prospective resources (resources other than reserves) for its Pola-1 prospect on the VMM-45 exploration block located in the Middle Magdalena Valley (“MMV”) basin of Colombia (the “Audited Area”).

Boury Global Energy Consultants Ltd. (“BGEC”), Canacol’s independent qualified resources auditor, was commissioned to conduct an independent prospective resources audit of Canacol’s internal estimates of prospective resources for the Audited Area effective 31 December 2021 (the “BGEC Report”). Canacol is a natural gas focused exploration and production company, and the largest independent gas producer in Colombia.

VMM-45 is one of five blocks that the corporation acquired in exploration bid rounds over the past three years. At 100% working interest in all five blocks, the corporation has now assembled 610,981 net acres within the deep conventional Cretaceous La Luna natural gas play in the MMV basin. Success in this deep conventional gas play would result in a new core gas producing area for the corporation within the next three years, a new core area that will rival the current level of production the corporation has in its historic current core producing area located in the Lower Magdalena Basin.

As detailed in a press release dated 6 April 2022, BGEC’s independent prospective resource audit evaluated and estimated conventional natural gas prospective resources that have been aggregated to an un‐ risked mean of 17.3 trillion standard cubic feet and a risked mean of 6.6 trillion standard cubic feet for all prospects in the new deep Cretaceous La Luna conventional gas play.

Pola-1 will be the first well targeting this new deep conventional Cretaceous La Luna gas play, testing the first of 18 prospects and leads that were included in the evaluation that underpinned those prospective resource estimates. The La Luna consists of up to 3,300 ft of marine carbonates and clastics, and is the primary source rock for most of the proven oil and gas reserves in Colombia, Venezuela, and Ecuador, and is productive in various oil and gas fields in Colombia.

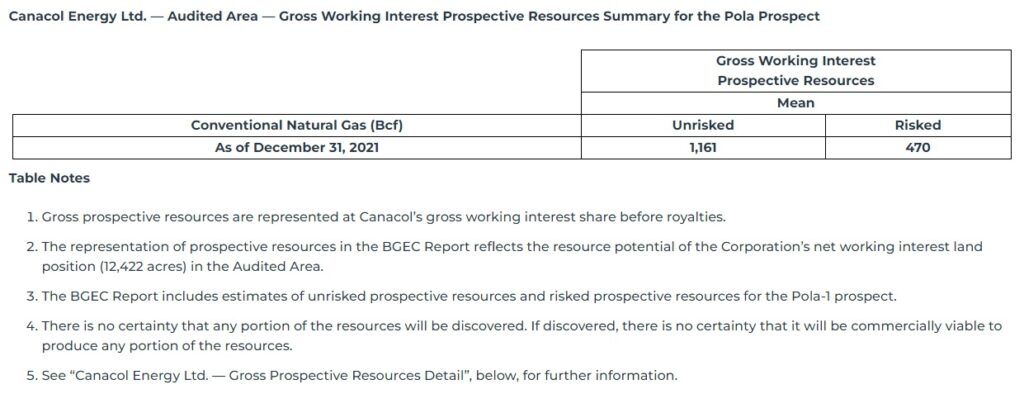

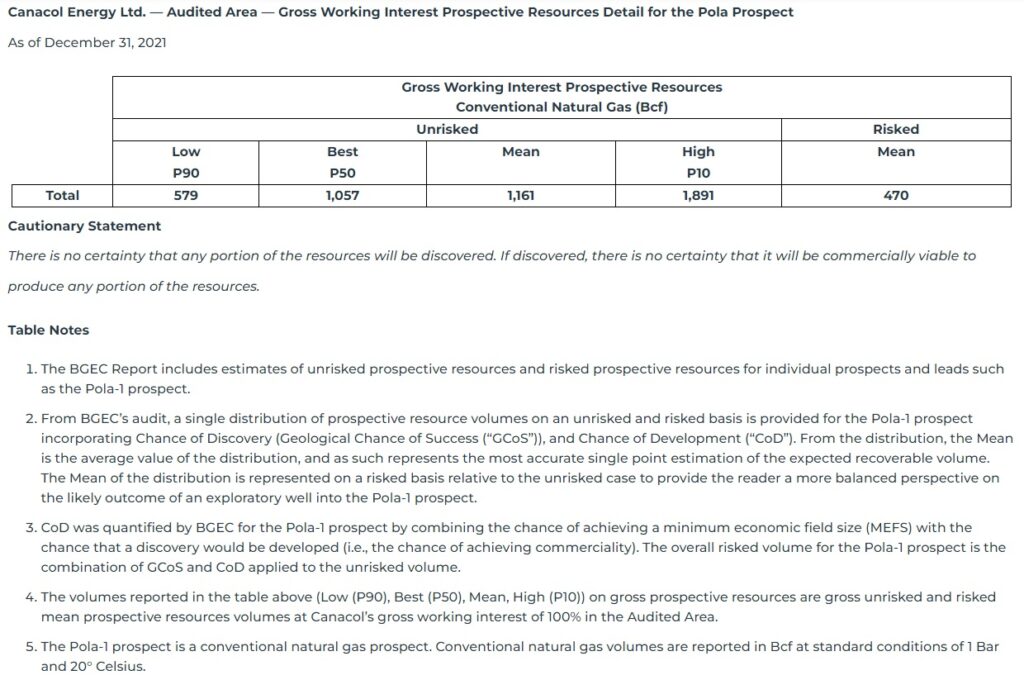

Mr. Mark Teare, Senior Vice President of Exploration for Canacol, stated, “The Pola-1 exploration well will be the first of several exploration wells the Corporation plans to drill to investigate the potential of a new deep Cretaceous La Luna conventional natural gas play located within the MMV basin, the oldest hydrocarbon producing basin in Colombia. BGEC’s independent prospective resource audit evaluated and estimated conventional natural gas prospective resources for the Pola-1 prospect of an unrisked mean estimate of 1,161 Bcf and a risked mean estimate of 470 Bcf. The Pola-1 exploration well is anticipated to spud in the third quarter of 2022, and the corporation estimates it will take approximately five months to drill, complete, and test.

As Colombia’s largest independent natural gas producer, with significant experience both operating and participating in the drilling of deep wells in the MMV basin, and with a technical team with experience in deep conventional gas plays elsewhere in the world, Canacol is well positioned to identify, pursue, and quickly commercialize potentially large new gas plays in Colombia.

The Pola-1 exploration well is located within 10 kilometers of the Transportadora de Gas Internacional (TGI) operated gas pipeline that transports gas from the declining Ecopetrol operated mature gas fields located in the Guajira region of the Caribbean coast to the interior of Colombia. The TGI pipeline currently has approximately 260 million standard cubic feet per day (“MMscfpd”) of spare capacity, meaning that any discovery made at Pola-1 can be quickly commercialized and sold into the interior market. Current consumption within the interior market of Colombia is approximately 600 MMscfpd, almost all of which is supplied from Ecopetrol’s mature declining gas fields. The corporation plans to commence drilling of the Pola 1 well in the third quarter of 2022 with results expected prior to yearend 2022.”

Third Party Independent Audit for Conventional Natural Gas Prospective Resources

(Resources Other Than Reserves, ROTR)

The following discussion is subject to a number of cautionary statements, assumptions and risks as set forth therein. See “Information Regarding Disclosure on Oil and Gas Resources and Operational Information” at the end of this release for additional cautionary language, explanations and discussion, and see “Forward‐looking Statements” for a statement of principal assumptions and risks that may apply. See also “Definitions” in this press release. The discussion includes reference to prospective resources as per the BGEC Report, which was prepared in accordance with definitions, standards, and procedures contained in the Canadian Oil and Gas Evaluation Handbook (“COGE Handbook”) and National Instrument 51-101 — Standards of Disclosure for Oil and Gas Activities (“NI 51-101”).

BGEC was commissioned to conduct an independent prospective resources audit of Canacol’s internal estimates of prospective resources for the Audited Area effective 31 December 2021, being the corporation’s 100% Pola-1 prospect on its 100% Working Interest position in exploration block VMM-45 in the MMV basin. All references in the following discussion to prospective resources are in reference to conventional natural gas in the Audited Area included in the BGEC Report.

On an unrisked and risked basis, the following table represents the distribution of gross prospective resources for Audited Area. Prospect is defined as a potential accumulation within a play that is sufficiently well defined to represent a viable drilling target.

For the exploratory opportunity on VMM-45 in the Middle Magdalena Valley basin, the corporation has identified a deep conventional natural gas play it will mature by means of investigative geological studies, the reprocessing of existing 2D and 3D seismic, seismic acquisition and drilling over the next three years.

Based upon the representation of prospective resources in the BGEC Report, management expects that significant additional resources will be developed in the future by means of 3D seismic acquisition and exploratory and appraisal drilling on the undeveloped block. In the future, significant factors that may change the prospective resource estimates include the outcome of further exploration and appraisal drilling that may change the estimates either positively or negatively. Furthermore, prospective resource estimates may be impacted by future improvements in technologies such as optimized seismic acquisition parameters, drilling fluid properties, and downhole petrophysical data acquisition methodologies. In addition, recoverable volumes may be enhanced by improved downhole completion and production technologies, additional processing capacity and compression.

In accordance with COGE Handbook 1.4.7.2, BGEC represents risked prospective resources as a function of the Chance of Development (CoD) of any future discovery. Estimating CoD requires that a future related development project be commercial such that the commerciality conditions for facilities, flowlines and access to markets are met subject to regulatory approval.

With respect to commerciality, the corporation has successfully secured sales contracts for its existing production in the past. It is confident of its ability to secure future contracts in an expanding market in the Colombian interior. Since 2012, the corporation has demonstrated its ability to manage other contingencies such as legal, regulatory, political, social license, internal and external approvals, and access to project finance to ensure the timely execution of its exploration and field development plans with respect to achieving existing production levels for natural gas in Colombia.

Appropriate levels of capital investment are anticipated to ensure future full field development including drilling, tie‐in, infrastructure buildout for facilities and flowlines, and abandonment and reclamation. The estimated total costs required to achieve commercial production are $90 million. The corporation has prepared a realistic time and capital schedule for the execution of its proposed exploration, appraisal, and development campaign over the next three years to ensure compliance with its contractual obligations during the exploratory phase of each block while accounting for additional time for follow‐up appraisal and development drilling, installation of flowlines, and plant expansion as required. The estimated date of first commercial production is between late 2023 and mid-2024. Dollar amounts are expressed in United States dollars.

Future field development will be for deep conventional natural gas. The corporation is equipped with the experience to manage any subsurface challenges related to HPHT (High Pressure High Temperature) reservoirs in its go forward exploration and development program. Any discovery will be developed using existing industry technology with standard gas completions in the wells, and standard surface treatment in accordance with best industry practice.

Canacol is in the early stages of exploration in the Audited Area. There are a number of positive and negative factors which BGEC considered in determining risk and overall uncertainty.

The key positive factors:

- Optimally positioned in the La Luna fairway, overlying the deepest part of the north Middle Magdalena Valley basin kitchen and on-trend with proven La Luna production

- Ideal combination of reservoir elements including high TOC, well established high thermal maturity, and carbonate source intervals and proven productivity

- Located in an established basin with significant existing gas infrastructure and proximity to TGI pipeline, Colombia’s main pipeline network, providing nearby access to the interior market

- In-country experience exists on similar HPHT projects such as Acorazado- Frontera Energy (2018), Cayena – Parex Resources (2019), Cupiagua – Ecopetrol (2020), Liria – Ecopetrol (2021)

- Strong market fundamentals for development of new gas in Colombia, underpinned by declining supply, economic growth, and a national plan to use gas as a transitional energy source

- Canacol is the largest independent gas producer in Colombia with an established record in exploration, operations, and regulatory approval

The key negative factors or critical risks:

- Operationally complex and capital-intensive, requiring upfront investment for long-lead items and potential for cost overruns

- Productivity and fluid type is still to be investigated

- The COVID-19 pandemic has negatively impacted global economies and disrupted global supply chains. The full extent of the risks surrounding the pandemic continues to evolve and create uncertainty.

____________________