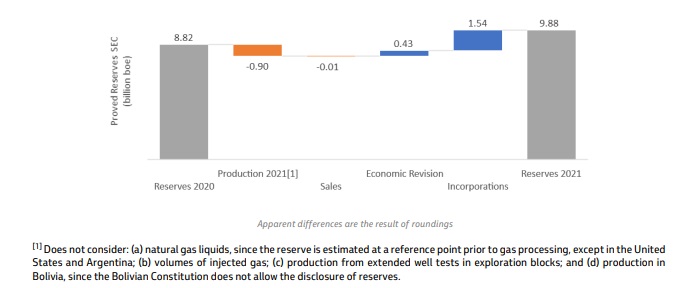

(Petrobras, 28.Jan.2022) — Petrobras discloses its proved reserves of oil, condensate and natural gas, according to SEC (US Securities and Exchange Commission) regulation, estimated at 9.88 billion barrels of oil equivalent (boe), as of 31 December 2021. Oil and condensate, and natural gas correspond to 85% and 15% of this total, respectively.

In 2021, Petrobras made the biggest reserves addition in its history (1.97 billion boe), resulting in a reserves replacement equivalent to 219% of the year’s production, already considering assets sales. These results are an evidence of our path of improving our management system, with focus on maximizing our assets value generation.

We added reserves mainly due to the progress in the development of Búzios field, as a result of the acquisition of the Transfer of Rights Surplus and of the signing of the coparticipation agreement, and of investments in new projects to increase recovery in other fields in Santos and Campos Basins, in addition to appropriations related to the good performance of reservoirs. The increase in reserves was also driven by the appreciation of the oil price.

The R/P ratio (ratio between proved reserves and production) increased to 11.0 years.

The evolution of proved reserves is shown in the graph below.

Petrobras historically submits at least 90% of its proved reserves according to SEC definition to independent evaluation. Currently, this evaluation is conducted by DeGolyer and MacNaughton (D&M).

Petrobras also estimates reserves according to the ANP/SPE (National Agency of Petroleum, Natural Gas and Biofuels / Society of Petroleum Engineers) definitions. As of 31 December 2021, the proved reserves according to these definitions reached 10.29 billion barrels of oil equivalent (boe). The differences between the reserves estimated by ANP/SPE definitions and those estimated using SEC regulation are mainly due to different economic assumptions and the possibility of considering as reserves the volumes expected to be produced beyond the concession contract expiration date in fields in Brazil according to ANP reserves regulation.

____________________