(Rhyolite Resources, 21.Dec.2021) — Rhyolite Resources Ltd. (TSXV: RYE) completed a “bought deal” brokered private placement of 16,000,000 common shares of the company at a price of C$0.88 per Common Share (the “Offering Price”) for gross proceeds of approximately C$14mn (the “Bought Deal Private Placement”). BMO Capital Markets acted as the sole underwriter in respect of the Bought Deal Private Placement and received a cash commission equal to 6.0% of the gross proceeds thereon.

Rhyolite also closed its previously announced non-brokered private placement of approximately C$4mn at a price per Common Share equal to the Offering Price (the “Non-Brokered Private Placement”, and together with the Bought Deal Private Placement, the “Offering”). No finders fees or commissions were paid in connection with the Non-Brokered Private Placement.

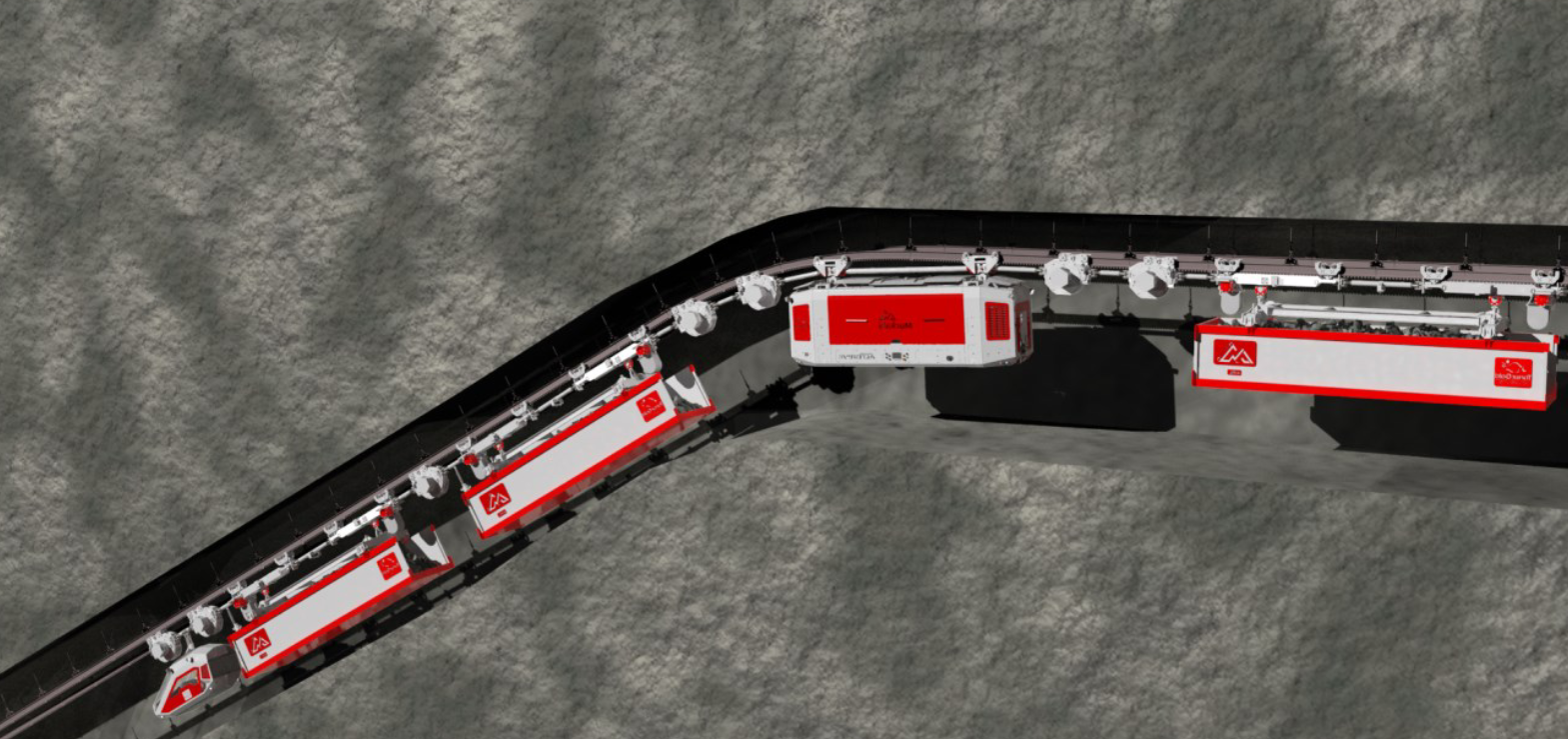

The Company intends to use the net proceeds of the Offering for furthering engineering work on Muckahi equipment, procurement of Muckahi equipment, exploration in Suriname, and corporate purposes.

Fred Stanford, CEO of Rhyolite, commented: “Regarding both financial and ESG outcomes, the Muckahi Mining System has the potential to be a positive disruptor of the underground hard rock mining industry. In an industry that is slow to change, at Rhyolite, with Muckahi, we are intent on picking up the pace. We appreciate the time and energy of investors and the BMO team to investigate and understand the opportunities that Muckahi provides. With this capital injection we intend to bring the Muckahi Mining System to commercial readiness. From that platform, we look forward to rapidly changing the industry to achieve superior financial and ESG outcomes.”

All Common Shares issued under the Offering are subject to a hold period expiring on 22 April 2022 in accordance with applicable securities laws.

____________________