(Frontera, 20.Dec.2021) — Frontera Energy Corporation (TSX: FEC) entered into an agreement to acquire 100% of the issued and outstanding shares in Petroleos Sud Americanos S.A. (PetroSud) with operations in Colombia in El Dificil (a 65% working interest), Entrerrios and Rio Meta Blocks.

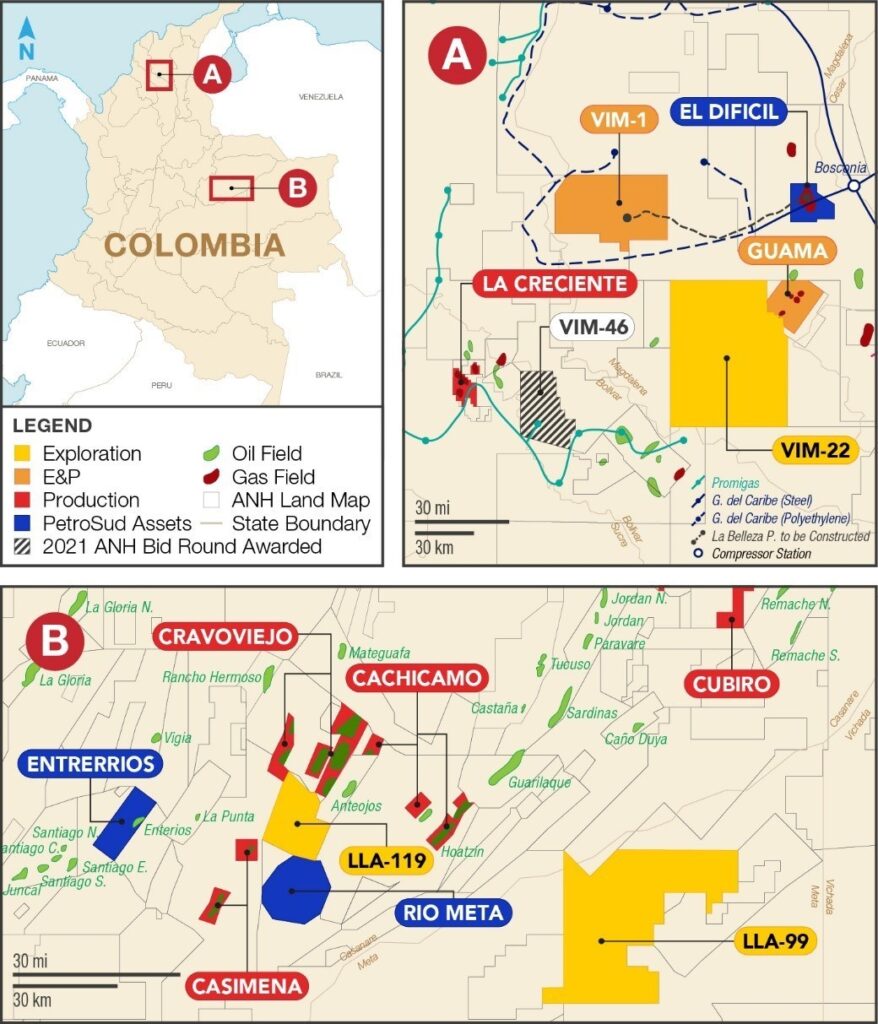

Assets to be acquired in the PetroSud and VIM-46 transactions:

Under the terms of the agreement, Frontera will acquire PetroSud for a total aggregate cash consideration of approximately $9mn plus the assumption of approximately $18mn in debt. The transaction is expected to close by 30 December 2021, subject to meeting certain closing conditions.

Orlando Cabrales, Chief Executive Officer (CEO), Frontera, commented:

“Frontera’s acquisition of PetroSud supports the company’s strategy to increase gas production, lowers carbon emissions and includes strategically located, high quality gas facilities adjacent to an emerging core area which may enhance our ability to commercialize recent gas discoveries in VIM-1 in a very competitive market. At $70/bbl average Brent prices, Frontera anticipates its acquisition of PetroSud will generate approximately US$8-10 million of annual EBITDA at a low production cost of $7.50-$8.50/boe and add approximately 1,300 boe/d of immediate production (comprised of approximately 5 mmcf/d of conventional natural gas, 80 bbl/d of natural gas liquids, 260 bbl/d of heavy oil and 60 bbl/d of light and medium crude oil) which the Company anticipates increasing to 2,000 – 3,000 boe/d between 2022 and 2024.”

El Dificil and VIM-46 blocks are located in an emerging core area close to the Company’s interests in La Creciente, VIM-22 and VIM-1 blocks. The Entrerrios and Rio Meta blocks are centrally located near the Company’s Cravoviejo, Cachicamo and Casimena producing assets.

Key anticipated benefits of the PetroSud acquisition include:

- No exploration commitments on any of the acquired blocks.

- Producing gas fields connected to existing distribution infrastructure.

- Immediate opportunities to increase production.

- Located approximately 75-kilometres from La Belleza (VIM-1) and VIM-22.

- Conventional natural gas assets further balance production profile.

- Possible synergies could be realized due to the close proximity of PetroSud’s Llanos assets to Frontera’s light oil assets.

____________________