(Petrobras, 17.Dec.2021) — Petrobras acquired the exploration and production rights of the volumes exceeding those of the Transfer of Rights in the Atapu and Sepia offshore fields in the 2nd Bidding Round for the Transfer of Rights surplus under the Production Sharing Regime, held today, by the National Agency of Petroleum, Natural Gas and Biofuels (ANP).

Petrobras exercised its the pre-emption right in the acquisition of the surplus volumes of the Sépia field, adhering to the winning consortium’s proposal. The consortium will have Petrobras as operator, with 30% participation, in partnership with TotalEnergies EP (28%), Petronas (21%) and QP Brasil (21%).

Petrobras acquired the rights to the surplus volumes of the Atapu field in partnership with Shell Brasil and Total Energies EP. The consortium will have Petrobras as the operator, with 52.50% participation, in partnership with Shell Brasil (25%) and TotalEnergies (22.50%).

With today’s bidding round results, Petrobras assures the maintenance of the operation in these fields, located in ultra-deep waters of the Santos Basin, for which it had already expressed the pre-emption right, as disclosed to the market on 28 April 2021, and confirms its leadership position in the Brazilian pre-salt, consistent with its strategy of focusing on the exploration and production of assets in deep and ultra-deep waters.

Atapu and Sépia are proven high-productivity assets, with good oil characteristics and significant potential to incorporate reserves. They have low lifting costs and are resilient to a low-price scenarios, which reflects Petrobras’ efficient and competitive performance in deep and ultradeep water assets.

The Atapu field started production in June 2020 through FPSO P-70 and reached its production capacity of 150,000 barrels of oil per day in July 2021. It has the capacity to treat up to 6 million m³/d of gas.

The Sépia field started its production in August 2021 through FPSO Carioca, the biggest platform in operation in Brazil in terms of complexity.

The offer of the percentage of the oil surplus to be made available to the Union was the only criterion adopted by the ANP to define the winning proposal, with the fixed value of the signature bonus already included in the tender protocol.

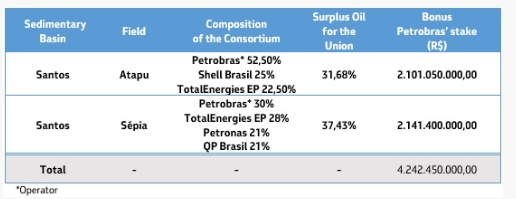

The total amount of the signing bonus to be paid by Petrobras is R$4.2bn. The table below summarizes the results of Petrobras’ participation in the 2nd Bidding Round for the Transfer of Rights surplus:

For Atapu and Sepia, the amount of compensation before gross up is respectively $3,253,580,741.00 and $3,200,388,219.00 and will be paid by the partner companies to Petrobras in proportion to their participation in the consortium. For Atapu, Petrobras will receive compensation by 15 April 2022. The compensation date for Sépia will be defined after negotiation with the consortium.

The participation in the 2nd Bidding Round for the Transfer of Rights surplus is aligned to the Petrobra’s long-term strategy and strengthens its profile as the main operator of oil fields located in ultra-deep waters.

____________________