(Fitch Ratings, 1.Jun.2020) — Fitch Ratings views the agreement reached between crude oil transportation companies and producers in Colombia as credit neutral for Oleoducto Central S.A (Ocensa) (BBB-/Negative) and A.I. Candelaria (Spain), S.L.’s ratings (BB+/Negative), as Fitch does not anticipate a material change in their capital structures.

The agreement announced by the oil transportation company Cenit Transporte y Logistica de Hidrocarburos S.A.S. (Cenit), Ocensa’s main shareholder, includes different relief measures to help oil producers to withstand the effects of the current low oil price environment and the coronavirus pandemic. The agreement contemplates financing schemes for roughly 50% of transportation tariffs for up to six months, and a discount of between 6% and 21% in the transportation tariffs, which is dependent on the segment of the pipeline and transported volumes. These agreements could be positive for some independent oil companies in Colombia, yet more information is still needed to determine the ultimate impact.

For Ocensa, additional working capital needs is expected to be around USD10 million for 2020, which is not estimated to materially affect the company’s FFO for 2020. Total debt to EBITDA would remain well below 0.5x, commensurate with the company’s current ratings. Under this scenario, Fitch does not anticipate a weakening of AI Candelaria’s ability to service its USD700 Million Secured Notes due 2028. Gross leverage, as measured by total debt to dividends received, reached 4.1x as of Dec. 31, 2019, and is expected to decrease to 3.5x over the next two years.

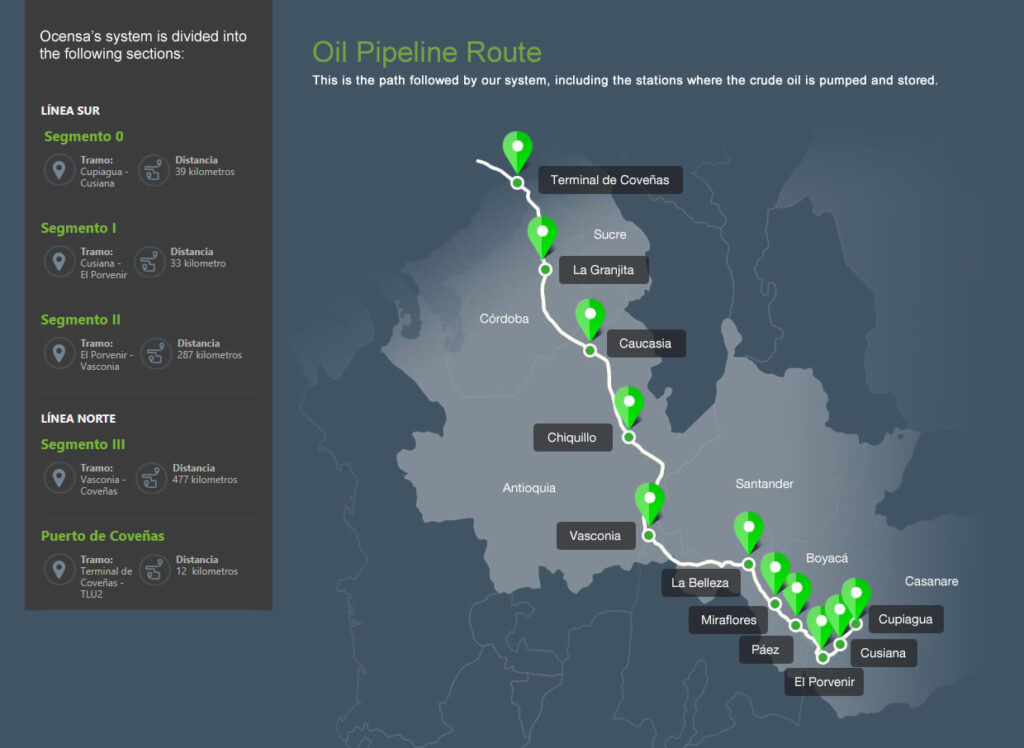

Ocensa’s ratings reflect the linkage with the credit profile of Ecopetrol (BBB-/Negative), which indirectly owns 72.648% of Ocensa. Fitch believes operational integration and strategic ties between both entities to be important enough to create economic incentives for Ecopetrol to effectively support Ocensa. The ratings also incorporate the company’s strong competitive position as the largest and reliable crude oil transportation company in Colombia, which gives them cost advantages over its main competitors.

A.I. Candelaria’s ratings continue to be linked to the credit profile of Ocensa, which makes up the only source of dividends to service its debt. A.I. Candelaria’s ratings also factor in its significant influence on Ocensa’s dividend policy, which lessens concerns regarding the dependence on a sole source of cash flow coming from its minority interest in Ocensa.

__________