(Petrobras, 16.Sep.2019) — Petrobras announced the expiration and expiration date results of the previously announced offers to exchange (the “Exchange Offers”), by its wholly-owned subsidiary Petrobras Global Finance B.V. (“PGF”), relating to seven series of its outstanding notes set forth in the tables below (the “Old Notes”).

The Exchange Offers and related offers to purchase for cash previously announced (the “Cash Offers” and together with the Exchange Offers, the “Offers”), expired at 5:00 p.m. (New York City time) on September 13, 2019 (the “Expiration Date”) and are expected to settle on September 18, 2019 (such date and time with respect to an Offer, as the same may be extended with respect to such Offer, the “Settlement Date”).

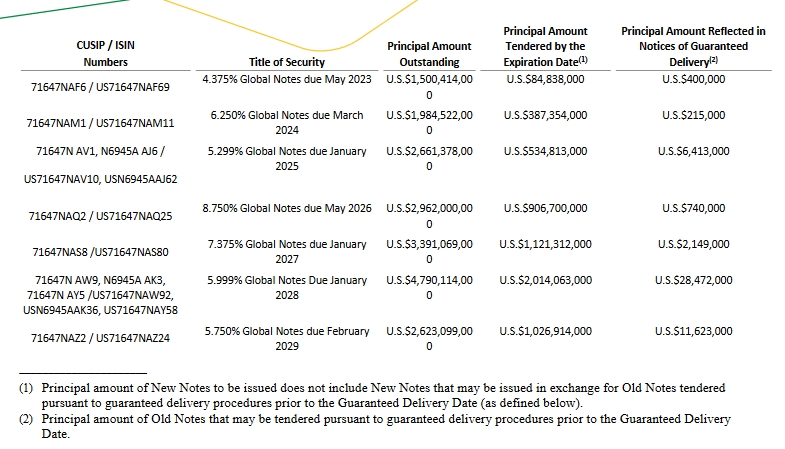

Exchange Offers

The Exchange Offers were made pursuant to the terms and subject to the conditions set forth in the Offering Memorandum dated September 9, 2019 (the “Offering Memorandum,” as amended and supplemented, and together with the related eligibility letter and notice of guaranteed delivery, the “Exchange Offer Documents”).

The table below provides the aggregate principal amount of each series of Old Notes validly tendered in the Exchange Offers and not validly withdrawn at or prior to the Expiration Date, which PGF expects to accept, subject to the satisfaction of the conditions set forth in the Offering Memorandum:

Upon the terms and subject to the conditions set forth in the Exchange Offer Documents, PGF expects that it will issue approximately U.S.$4,109,583,000 aggregate principal amount of 5.093% global notes due 2030 (the “New Notes”), and that it will pay U.S.$2,782,440,087.68 in cash, as consideration for the Old Notes expected to be accepted in the Exchange Offers, without taking into account additional New Notes that may be issued and additional cash that may be paid in exchange for Old Notes reflected in notices of guaranteed delivery received by PGF at or prior to 5:00 p.m. (New York City time) on September 17, 2019 (the “Guaranteed Delivery Date”) pursuant to guaranteed delivery procedures described in the Offering Memorandum (the “Guaranteed Delivery Procedures”). The pricing terms of the New Notes were announced by Petrobras on September 13, 2019.

In addition to the applicable exchange consideration, eligible holders whose Old Notes are accepted for exchange will be paid, in cash, accrued and unpaid interest on such Old Notes to, but not including, the Settlement Date. Interest will cease to accrue on the Settlement Date for all Old Notes accepted in the Exchange Offers, including those tendered through the Guaranteed Delivery Procedures. The total amount of accrued and unpaid interest to be paid by PGF, together with the total amount of cash to be paid by PGF in lieu of fractional amounts of New Notes, will be approximately U.S.$71,246,761.93 (excluding amounts payable in respect of Old Notes that may be tendered pursuant to the Guaranteed Delivery Procedures).

The actual aggregate principal amounts of New Notes that will be issued, and the total amount of cash , including accrued and unpaid interest, that will be paid, on the Settlement Date, are subject to change based on deliveries under the Guaranteed Delivery Procedures and final validation of tenders. PGF will not receive any cash proceeds from the Exchange Offers.

Given the amount of New Notes expected to be issued on the Settlement Date, the condition to consummate the Exchange Offers relating to the minimum issue requirement, described in the Offering Memorandum, is expected to be satisfied on the Settlement Date. All the other conditions for the consummation of the Exchange Offers were satisfied on the Expiration Date.

The New Notes have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) or any state securities laws. Therefore, the New Notes may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and any applicable state securities laws. PGF will enter into a registration rights agreement with respect to the New Notes.

Only holders who had duly completed and returned an eligibility letter certifying that they were either (1) “qualified institutional buyers” (“QIBs”) as defined in Rule 144A under the Securities Act or (2) non“U.S. persons” (as defined in Rule 902 under the Securities Act) located outside of the United States were authorized to receive the Offering Memorandum and to participate in the Exchange Offers.

Global Bondholder Services Corporation is acting as the Information Agent and the Exchange Agent for the Exchange Offers. Questions or requests for assistance related to the Exchange Offers or for additional copies of the Exchange Offer Documents may be directed to Global Bondholder Services Corporation at (866) 470-3800 (toll free) or (212) 430-3774 (collect). You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Exchange Offers. The Exchange Offer Documents can be accessed at the following link: https://gbscusa.com/eligibility/Petrobras.

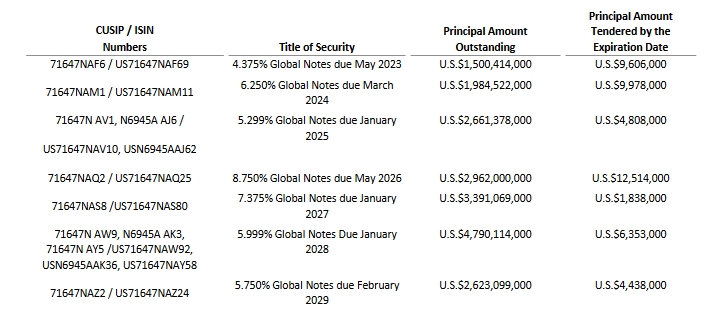

Cash Offers

The Cash Offers were made pursuant to the terms and subject to the conditions set forth in the Offer to Purchase, dated September 9, 2019 (the “Offer to Purchase” and, together with the related certification instructions letter and notice of guaranteed delivery, the “Cash Offer Documents”).

The table below provides the aggregate principal amount of each series of Old Notes validly tendered in the Cash Offers and not validly withdrawn at or prior to the Expiration Date, which PGF expects to accept, subject to the satisfaction of the conditions set forth in the Offer to Purchase:

Upon the terms and subject to the conditions set forth in the Cash Offer Documents, PGF expects that it will pay approximately U.S.$56,044,711 in cash, as consideration for the Old Notes expected to be accepted in the Cash Offers. In addition to the applicable tender consideration, Cash Offer Qualified Holders (as defined below) will be paid, in cash, accrued and unpaid interest on such Old Notes to, but not including, the Settlement Date. Interest will cease to accrue on the Settlement Date for all Old Notes accepted in the Cash Offers. The total amount of accrued and unpaid interest to be paid by PGF will be approximately U.S.$635,637.

Holders that were either (i) QIBs or (ii) non-“U.S. persons” (as defined in Rule 902 under the Securities Act) were not eligible to participate in the Cash Offers. All other holders of Old Notes were eligible to participate in the Cash Offers (such other holders, the “Cash Offer Qualified Holders”). Holders of Old Notes participating in the Cash Offers were required to certify that they were Cash Offer Qualified Holders.

Global Bondholder Services Corporation is acting as the Information Agent and the Tender Agent for the Cash Offers. Questions or requests for assistance related to the Cash Offers or for additional copies of the Cash Offer Documents may be directed to Global Bondholder Services Corporation at (866) 4703800 (toll free) or (212) 430-3774 (collect). You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Cash Offers. The Cash Offer Documents can be accessed at the following link: https://www.gbsc-usa.com/Petrobras/.

***