(AES, 8.Apr.2019) — AES Gener S.A. announced the final results of the previously announced offer to purchase for cash (the “Tender Offer”) of any and all of its 8.375% Junior Subordinated Capital Notes due 2073, listed in the table below (collectively, the “Notes.”). The Tender Offer for the 2073 Notes expired at 11:59 p.m., New York City time, on April 5, 2019 (the “Expiration Date”) and AES Gener has accepted all Notes validly tendered as of the Expiration Date. Capitalized terms used in this announcement and not otherwise defined shall have the meanings assigned to them in AES Gener’s Offer to Purchase and Consent Solicitation Statement, dated March 11, 2019 (the “Statement”).

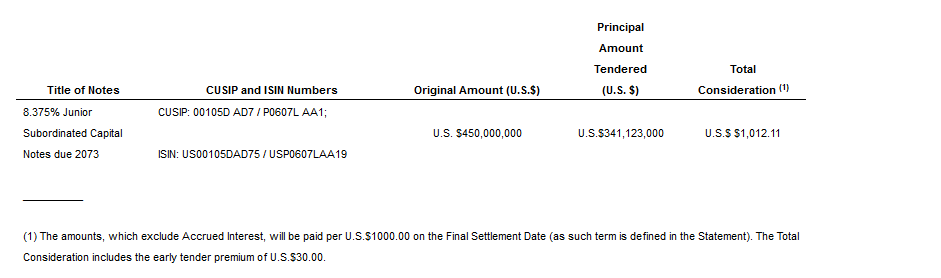

According to information received from D.F. King & Co., Inc., the Tender, Solicitation and Information Agent for the Tender Offer and concurrent Solicitation, as of the Expiration Date, AES Gener had received valid tenders and consents from holders of the Notes as outlined in the table below.

Of the aggregate principal amount of Notes tendered as of the Expiration Date shown in the table above, $334,693,000 principal amount of the Notes (or 74.38% of the principal amount outstanding at that time) were validly tendered and not withdrawn on or prior to the Early Tender and Consent Time. AES Gener accepted all such Notes for purchase and the Early Settlement Date for all such Notes was on March 26, 2019, on which date such Notes were cancelled. Holders of such Notes received the Total Consideration, which included the Early Tender Premium, plus accrued and unpaid interest up to, but not including, the Early Settlement Date.

A total of $6,430,000 principal amount of Notes were validly tendered after the Early Tender and Consent Time and on or prior to the Expiration Date and AES Gener has accepted all such Notes for purchase. The Final Settlement Date for such Notes will be April 8, 2019. As described in the Statement, as amended by the press release issued by AES Gener on March 26, 2019, Holders of such Notes will receive the Total Consideration (as set forth in the table above), which includes the Early Tender Premium plus accrued and unpaid interest up to, but not including, the Final Settlement Date.

Full details of the terms and conditions of the Tender Offer and concurrent Solicitation are set forth in the Statement, which is available from D.F. King.

Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC and Merrill Lynch, Pierce, Fenner & Smith Incorporated are the Dealer Managers in the Tender Offer and concurrent Solicitation. D.F. King & Co., Inc. is the Tender, Solicitation and Information Agent for the Tender Offer and concurrent Solicitation. Persons with questions regarding the Tender Offer and concurrent Solicitation should contact Goldman Sachs at (toll free) (800) 828-3182 or (collect) (212) 902-6351, J.P. Morgan at (toll free) (866) 846-2874 or Merrill Lynch at (toll free) (800) 292-0070 or (collect) (646) 855-8988. Requests for the Statement should be directed to D.F. King at (toll free) (888) 887-0082, (collect) (212) 269-5550 or email aesgener@dfking.com.

None of the company, its board of directors, its officers, the dealer managers, the depositary, the tender and information agent or the trustees with respect to the Notes, or any of their respective affiliates, makes any recommendation that holders tender or refrain from tendering all or any portion of the principal amount of their Notes, and no one has been authorized by any of them to make such a recommendation. Holders must make their own decision as to whether to tender their Notes and, if so, the principal amount of Notes to tender.

***