(Rystad, 30.Sep.2018) — Mexican national oil company Pemex is poised for a massive cash infusion earmarked for exploration and drilling, but a review of the company’s portfolio and recent track record suggests at least some of this money might be better spent developing fields it has already discovered.

Incoming Mexican President Andres Manuel Lopez Obrador declared last week that he would propose an additional $4 billion for Pemex to use specifically on drilling new wells in 2019, in a bid to reverse the country’s steep decline in oil and gas production in recent years. However, Pemex’s above-industry-average historical spend on exploration activities has not translated into new discoveries in recent years. Furthermore, the state company will not be alone as it looks for new finds and strives to mature its collection of greenfield opportunities towards potential sanctioning, as Eni and Talos Energy are both gaining momentum in progressing their own major projects in Mexico towards a final investment decision.

In 2017, Pemex spent $16.2 billion on onshore and offshore oilfield services. Over 70% of this expenditure was earmarked for offshore projects, making the state player the biggest spender in the Gulf of Mexico last year, including both sides of the US-Mexico maritime boundary.

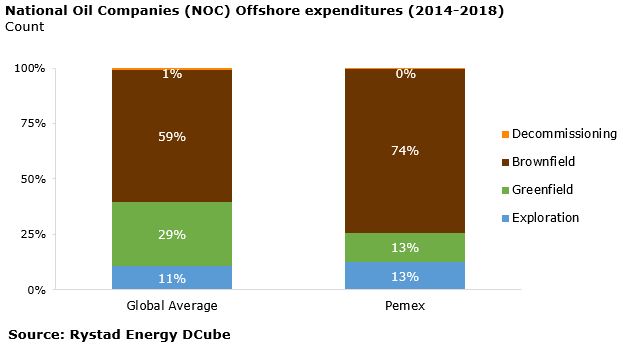

This leadership position in the gulf is nothing new for Pemex. The company’s operated projects accounted for nearly 30% of all spending within the Gulf of Mexico over the past five years. However, over that time 70% of its expenditure was tied to brownfield work. Pemex’s Cantarell Akal asset from the Cantarell project has required an annual average of nearly $1.9 billion in brownfield expenditure over the last five years. The company’s overall brownfield spending will exceed $9.6 billion in 2018, thus accounting for a remarkable 43% of all brownfield costs within the Gulf of Mexico.

While Pemex’s brownfield expenditures have been increasing, its exploration activities have trended in the opposite direction. The operator’s exploration costs have been halved from over $3 billion in 2015 to just under $1.5 billion in 2017, its lowest level of exploration expenditure since 2011 (measured in local currency).

The message that Pemex will again increase its exploration activities will be warmly welcomed by service companies operating in the Gulf of Mexico. Among drilling contractors, Transocean, Noble Drilling and Diamond Offshore appear well positioned in the market, as this trio collectively booked nearly 50% of all offshore drilling revenues in US and Mexican waters in 2017. In fact, Transocean led all drilling contractors in revenues in the region with a 25% market share last year.

Despite spending slightly more on exploration, in proportional terms, than its peers, Pemex has not seen this translate into new greenfield projects. The company’s first greenfield approval since 2014 was confirmed only in May 2018, when it sanctioned the Balam Redevelopment project. This steel platform in 50 meters of water will require over $2.7 billion in greenfield spending through 2021. EPCI contractors can expect nearly $1.2 billion of contracts to be awarded, while well services and drilling contractors will compete for more than $650 million of work. Pemex is targeting a 2019 year-end start-up.

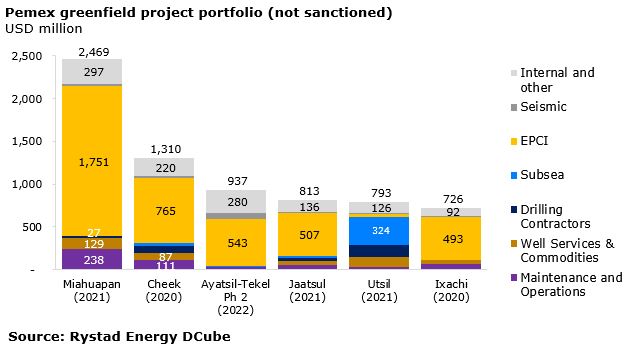

Meanwhile, Italian giant Eni will also be looking for a 2019 start-up of the Amoca Phase 1 project. The company’s development plans for the Amoca, Mizton and Tecoalli fields were recently approved by Mexican authorities, and initial plans for Amoca call for a steel platform and an FPSO to be deployed in less than 50 meters of water. Should Eni sanction all projects from its development plan, service companies could be looking at more than $7 billion in new contracts over the next five years. This would give competition to Pemex to secure contracts with service companies, should the Mexican operator wish to develop one of its non-sanctioned greenfield projects (see Figure 2).

While Pemex’s new upstream investments have been targeted primarily for exploration, the company would be well served to bring new field development projects to the decision table. Candidate projects include Miahuapan, Cheek, Ayatsil-Tekel Phase 2, Jaatsul, Utsil and Ixachi. This could be the surest bet to bring on new production, as its exploration efforts have not delivered desired results over the last few years.

***