(Petroleum Economist, 2.Dec.2020) — Crumbling oil prices and volatile energy demand have tipped Latin America into a sharp recession, exacerbated by one of the world’s worst Covid-19 mortality rates. But in Suriname and Guyana, at least, there are reasons to be cheerful.

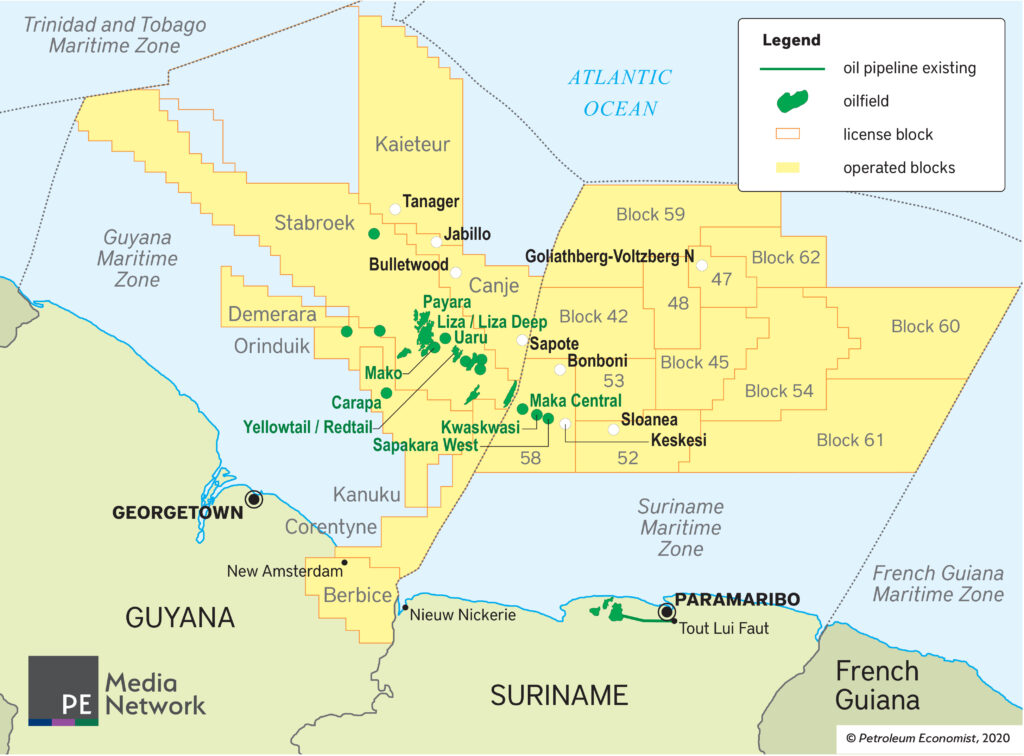

Although both countries face stark economic challenges, they have emerged from electoral turmoil with new governments eager to develop their hydrocarbon resources. And their shared offshore basin has added a further six major oil discoveries in 2020, confirming the region’s position as a global upstream hotspot.

Political developments have brought much-needed stability. English-speaking Guyana emerged from over a year of uncertainty, sparked by a vote of no-confidence in then-president David Granger, with the peaceful inauguration of Irfaan Ali in August. The Surinamese people rejected another five years in office for stalwart president Desi Bouterse—elected for the past decade but also de facto leader 1980-87—in March, and Chan Santokhi was sworn in less than four months later.

Opportunities abound

Both incoming governments are enthusiastic about the potential of their oil and gas sectors. Guyana recently approved a second major offshore upstream project, while Suriname launched a new shallow-water bidding round, open until April 2021.

“The Guyana-Suriname basin is one of the [world’s] most attractive basins with a breakeven below $40/bl for the Guyanese fields and around $45/bl for the fields within Surinamese waters,” says Palzor Shenga, senior upstream analyst at consultancy Rystad Energy. “However, we believe the breakeven price for the latter to go down as more and more resource gets discovered and we get closer to development scenarios.”

Guyana’s prolific Stabroek block appeared to provide the country with the exploration edge before 2020, with Suriname yet to make a major offshore discovery. But a trio of major finds announced this year by US independent Apache, in block 58 offshore Suriname, has helped derisk the basin.

And more exploration is underway in Suriname. Malaysian NOC Petronas spudded a well at its Sloanea prospect in block 52 and is waiting for the results. Apache is also in the process of drilling a well at the Keskesi prospect in block 58.

Heading into next year, Apache will drill its fifth target in the block at the Bonboni prospect, close to the border with block 53. Two wildcat wells were previously drilled in block 53; Kolibrie was declared uncommercial in 2015, while the results of Popokai were never revealed.

Fellow US producer Kosmos Energy had also planned to drill exploration wells. But Shell acquired a swathe of Kosmos assets earlier this year, including the firm’s operating stake in blocks 42 and 45. Kosmos had previously drilled an exploration well at the Pontonoe prospect in block 42 and another at the Anapai prospect in block 45, but both proved uncommercial.

Anglo-Irish independent Tullow Oil also plans to drill at Goliathberg-Voltzberg North in block 47 in Q1 next year. The operator had previously scheduled its exploration programme for Q4 2020, but the economic crisis ultimately pushed it into next year.

Exploration roadmap

Next door, rival Guyana also has plenty of additional oil output scheduled for the next five years and will likely see further exploration. ExxonMobil achieved first oil at its landmark Liza offshore project last December and is targeting a second floating production, storage and offloading (FPSO) vessel, aimed at ramping up production by mid-2022. Combined, FPSO capacity should rise to over 340,000bl/d.

Slightly north of Liza, ExxonMobil recently received approval from the new Guyanese government to develop its Payara discovery, the second announced in Guyanese waters. The $9bn project is scheduled to reach startup in 2024 and add 220,000bl/d in production capacity.

Beyond sanctioned projects, ExxonMobil is also evaluating further opportunities to develop its Redtail, Yellowtail, Mako and Uaru discoveries in the Stabroek block. Since 2015, the US operator has made 18 major oil finds in Stabroek, the highest return of any basin in the world.

ExxonMobil is also looking at other offshore assets in the basin. The major is in the process of drilling a well at its Tanager prospect in the Kaieteur block, spudded in August. It aims to drill a well in the Canje block at the Bulletwood prospect before the end of the year. Another two targets in the block could follow from 2021: Jabillo and Sapote.

For Tullow, the immediate priority in the region is Suriname, but there are still plenty of drill targets available in Guyana. In the Orinduik block alone, in which Tullow holds a 60pc operating interest, 27 potential targets have been identified.

However, the two oil discoveries announced last year in the block were heavier and more sulphurous than anticipated. Tullow’s Carapa find in the Kanuku block, made in January, was also below expectations, leaving the company to assess the commercial implications.

Prospects in reserve

Canadian operator CGX also remains bullish about drilling prospects at its three offshore Guyana blocks. The northern end of its Corentyne block abuts several major discoveries in the Stabroek block as well as block 58 in Suriname. Five major discoveries were announced less than 32km from the edge of Corentyne, all comprising light oil with low sulphur content. 3D seismic from the Kawa prospect in Corentyne also showed promise.

Under the original contract, CGX had until November 2020 to drill an exploration well at Corentyne. An additional well was then mandated for November 2022. But the Covid-19 pandemic has limited access to facilities this year, and the company has said it will resume regular activities only when safe to so, giving no timeline for drilling.

CGX is confident that its prospects in the Demerara block could be similar to those of Stabroek, despite being closer to heavier oil finds in Orinduik. CGX has identified five possible drill targets. The operator was originally contracted to drill an exploration well in the block by February 2021, with a second by February 2023, but again the pandemic has impacted the likely timeline.

Finally, CGX has an operator interest in the onshore Berbice block. Reported oil seepage along the coast, near to the block, suggests the presence of crude and similar geology to a trio of onshore Suriname heavy oil fields: Tambaredjo, Tambaredjo NW and Calcutta.

__________