(Oilprice.com, 30.Jun.2020) — Exxon is moving to rapidly expand its exploration footprint in this little-known venue, French Total SA is spudding its first well here, small-cap Eco Atlantic – of offshore Guyana fame – is stepping up offshore activity, and onshore, fellow junior Recon Africa is hoping to be sitting on the next Eagle Ford.

The next giant Brazil-style offshore pre-salt oilfield, or even the next thing to rival Eagle Ford, could very well be found in an emerging player in the final frontier of Africa that isn’t yet on investor radar.

The venue is Namibia.

And it’s not just about geology that could be analogous offshore to Brazil’s pre-salt bonanza, or onshore to the massive South African Karoo Basin… it’s about technological advancements that make the opportunities look that much more promising that just a few years ago.

The wild success of Exxon offshore Guyana, with 16 back-to-back commercial discoveries and first production launched ahead of schedule, hasn’t only led to hope for similar finds right across the maritime border in Suriname – it’s sent a message to explorers and investors alike that hydrocarbons we thought were out of reach, aren’t anymore.

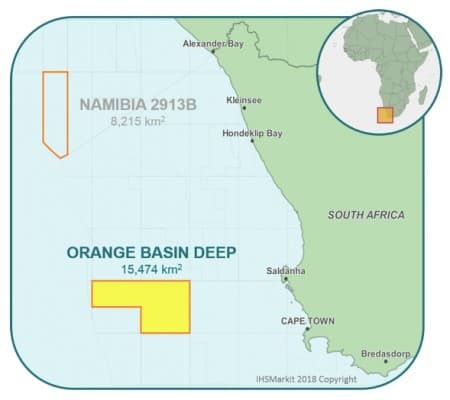

Offshore Namibia, research indicates that Namibia’s Orange Basin has similar a source rock to Brazil.

That’s why Exxon Mobil moved to expand its exploration acreage last year, adding another 28,000 square kilometers to its offshore holdings, with depths reaching 4,000 meters. This is in addition to XOM’s 40% stake on another 11,500-sq-km offshore oil and gas license in Namibia.

French oil giant Total SA is gearing up right now to start a three-well drilling campaign that includes one of the deepest wells ever drilled in Africa – two wells in Angola and one in Namibia. Drilling will start this month, with Maersk’s Voyager rig.

The potential hasn’t escaped Qatar Petroleum, which is farming into Total’s Namibia blocks.

Shell is also delineating a deep-water wildcat prospect offshore Namibia, planning to spud this year.

Eco Atlantic, which is also partnering with French giant Total and Irish mid-cap Tullow oil in Guyana’s Orinduik license offshore, owns four licenses offshore Namibia, including a majority stake in the Cooper Block. ECO has a drill target ready at the Osprey Prospect, and is looking for another partner right now, with three more years on its license.

Onshore, Reconnaissance Energy Africa has scooped up the entire 6.3-million-acre Kavango Basin (quite a feat for junior with a $40-million market cap). RECO has a 90% interest in the basin, while Namibia’s state-run company holds the other 10%.

RECO moved quickly to buy up this basin, which is as big in territory as Eagle Ford, when world-famous geologist to the majors, Bill Cathey, hinted that the shale play would likely produce commercial hydrocarbons. RECO has a 4-year exploration license leading to a 25-year production license starting on commercial discovery.

Why Namibia?

Namibia has no proven oil reserves. The only existing commercial discovery is the Kudu gas field discovered by Chevron in the 1970s.

That’s why explorers in the region tend to favor Angola – but that may be short-sighted.

__________

By Charles Kennedy