(S&P Global, 30.Oct.2023) — Asia may have little to cheer following the lifting of the sanctions on Venezuelan oil as increased competition for those Latin American cargoes could potentially make it difficult for buyers like China and India to source incremental cargoes from the supplier, prompting them to look at the Middle East to fill the vacuum, analysts and sources said.

While China’s independent refiners have remained active buyers of Venezuelan crude in recent years despite the sanctions, India and other Asian buyers have largely stayed away from those barrels. For the Shandong-based independent refiners, it has been relatively easy to source those barrels in the absence of many takers. But it may not be the case anymore.

“US oil companies are now allowed to begin to explore and advance investment in Venezuela. Of more immediate relevance is US oil refiners will now be able to buy oil directly from PDVSA. This may lead to less Venezuelan crude going to China — where it is used to pay back debt — and more to the US to generate cash. Venezuelan barrels will compete with other Latin American and Canadian heavy oil grades in USGC market,” said Ha Nguyen, executive director for global crude oil markets at S&P Global Commodity Insights.

Earlier this month, the US Department of the Treasury eased oil, trade, and financial sanctions on Venezuela for a six-month period, which could be renewed if the Maduro government follows through on its political and electoral commitments.

China’s independent refineries took about 360,000 b/d of crude and 110,000 b/d of fuel oil from the Latin American country in September, the month when Venezuela’s crude production averaged 770,000 b/d, S&P Global data showed.

But trade sources in China are now fearing that more potential buyers could emerge from the US, Europe and India following the lifting of the sanctions.

“The core question for China is whether Venezuela will boost, maintain or redirect its exports to China as a result of the incoming sanctions relief. Our view is that prices of those crudes will fluctuate as Venezuela’s overall exports recover,” said Sijia Sun, China oil analyst at S&P Global.

Varied approach by Asian buyers

During the pre-sanctions period from 2017 to 2019, India imported approximately 300,000 b/d of Venezuelan crude grades, with private refiners like Reliance Industries and Nayara Energy being the key buyers, S&P Global data showed.

Indian government officials said crude imports from Venezuela in the future would be guided by the country’s overall policy related to energy security.

But analysts added that even though the prospect of rising flows of Venezuelan crude to India appears to be remote, things could change over the medium to longer term.

“Going forward, we see an uptick in Venezuelan crude as India has to diversify its oil imports from the traditional Middle Eastern suppliers,” said Rajat Kapoor, managing director for oil and gas at Synergy Consulting. “Venezuelan crudes made the case for attractive refining margins for India’s private refiners since the discount for Venezuelan crude oil, particularly the heavy and extra-heavy varieties like Merey and Orinoco, tended to be relatively substantial compared to the Brent benchmark.”

Many Northeast and Southeast Asian refiners fretted that the eased sanctions on Venezuela could end up lifting spot Middle Eastern sour crude prices if Chinese independent refiners are forced to cut down on imports from Venezuela.

“Chinese and Indian refiners have been doing us a big favor by actively picking up politically sensitive barrels from countries like Venezuela, as well as Russia and Iran, freeing up ample supply of Persian Gulf sour crude for other refiners across Asia to take,” said a South Korean feedstock and logistics manager.

A Singapore-based crude trader added: “Chinese independent refiners will find it difficult to source Venezuelan crude as exclusively as they did before, so the big worry now is they may try to pick up more Middle Eastern spot cargoes instead and raise the Dubai market price complex.”

Market direction

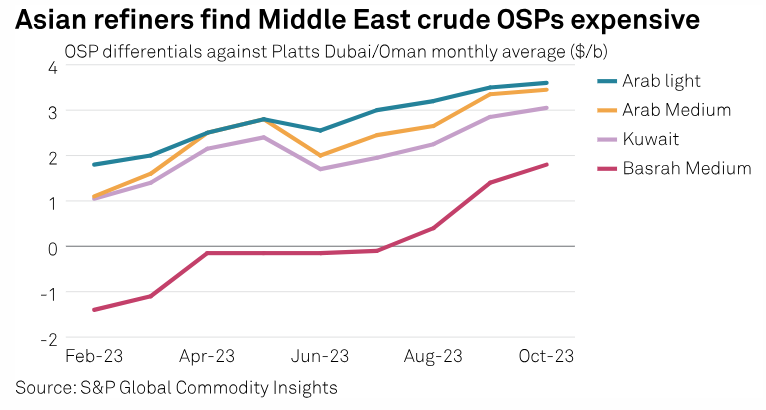

The Dubai crude price structure has started to come off early in the fourth quarter after a strong rally throughout June-September. The rally had led to major Middle Eastern suppliers including Saudi Aramco and Abu Dhabi National Oil Co. to hike their monthly official selling prices, or OSPs, multiple times.

“If Chinese private refiners aim to pick up more Middle Eastern spot cargoes, the Dubai market structure could turn higher and that would be a big disappointment since many are expecting the OSP hikes by Aramco and ADNOC to come to a halt,” said one trader.

The spread between front-month Platts cash Dubai and same-month Dubai swap – often used as an indicator for the strength of the Middle East sour crude market – jumped to $4.64/b on Sept. 29, marking the highest level since $4.99/b on Nov. 1, 2022, S&P Global data showed. The spread, which is widely known as the Dubai market structure, averaged $2.71/b month-to-datein October and it was last assessed at $1.775/b Oct. 27. The Dubai market structure is said to be a key component in Saudi OSP calculations.

Major refiners in South Korea, Thailand, Japan and Taiwan indicated that they have very little interest in importing Venezuelan crude.

For Asia’s third and fourth biggest crude importers South Korea and Japan, refiners have little to zero history of cracking Venezuelan crude in the last two decades, according to data from Korea National Oil Corp., and Japan’s Ministry of Economy, Trade and Industry.

____________________