(Citgo, 9.Nov.2023) — Citgo Petroleum Corporation reported its 2023 third quarter financial and operational results.

Highlights:

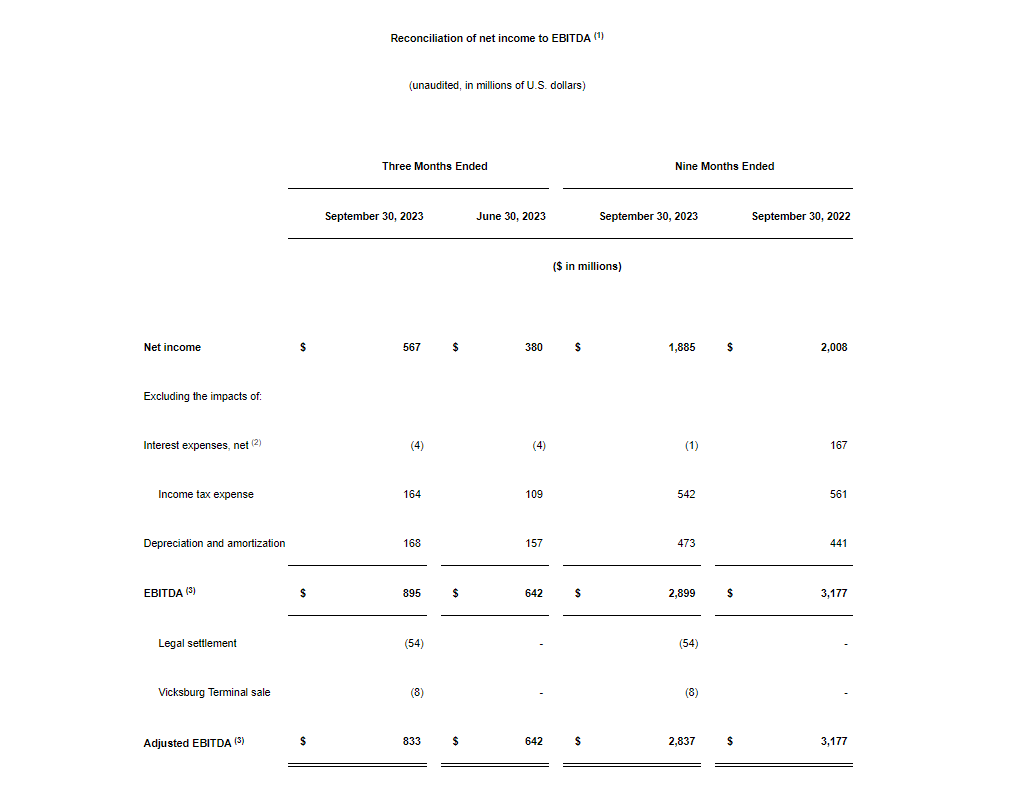

- Net income of $567mn and EBITDA 1 of $895mn, compared to net income of $380 mn and EBITDA of $642mn for the second quarter of 2023

- Adjusted EBITDA 1 for the third quarter was approximately $833mn, which included two special items related to a legal settlement and a gain on the sale of the Vicksburg terminal

- Occupational and process safety indexes remained better than the latest reported industry average indexes, and environmental performance is on track to be the second-best result in the last six years

- Crude oil processing in the third quarter was 765,000 barrels-per-day (bpd) with a crude capacity utilization of 95%, compared with 761,000 bpd and crude capacity utilization of 94% in the second quarter of 2023

- Citgo issued $1.10bn of Senior Secured Notes due 2029 in Sep. 2023 and paid dividends to Citgo Holding of $1.12bn to fund the redemption in full of $1.29bn aggregate principal amount of Citgo Holding’s senior secured notes due 2024

- Liquidity of $3.86bn at quarter end, including full availability under Citgo’s $500mn accounts receivable securitization facility

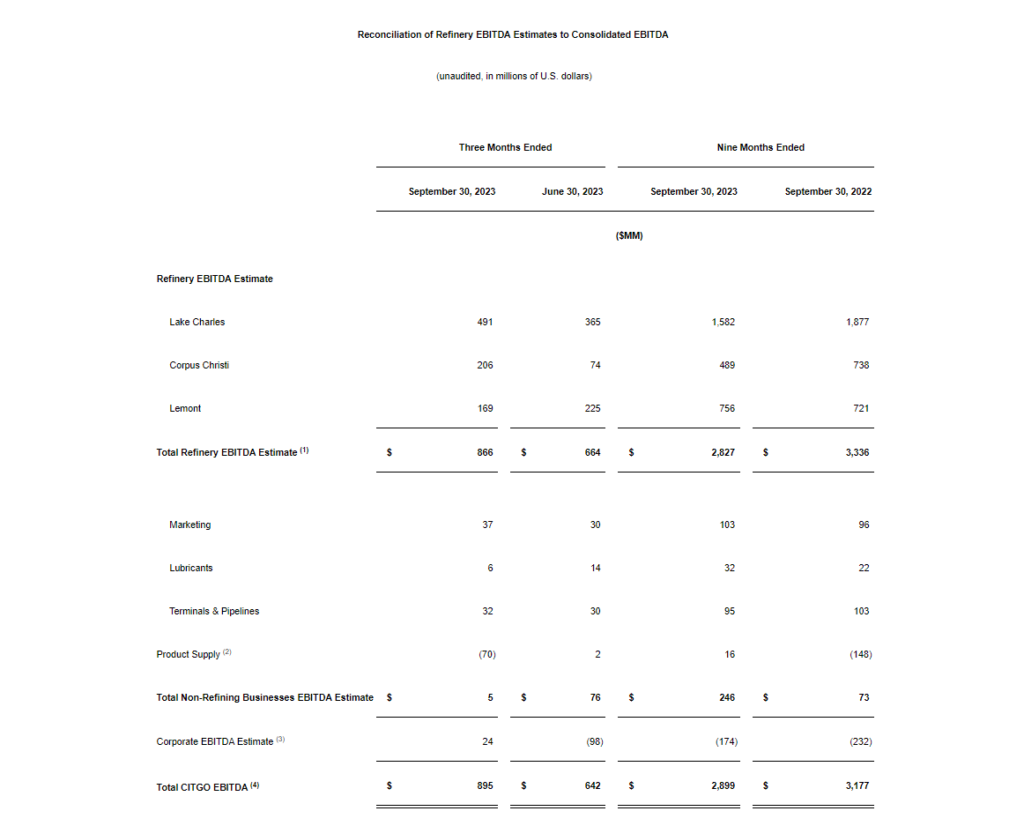

A strong pricing environment and solid operational and commercial results contributed to third quarter net income of $567mn and EBITDA of $895 mn, compared with net income of $380mn and EBITDA of $642 mn for the second quarter of 2023. Adjusted EBITDA for the third quarter was approximately $833mn, which included two special items related to a legal settlement and a gain on the sale of the Vicksburg terminal. Through the first nine months of 2023, net income was nearly $1.9bn, and EBITDA was nearly $2.9bn, compared with net income of $2bn and EBITDA of nearly $3.2bn for the first nine months of 2022.

“Strong reliability in a favorable margin environment allowed us to build liquidity, fund capital expenditures and turnarounds, and pay dividends to Citgo Holding,” said Citgo President and CEO Carlos Jordá, “We delivered another solid quarter both operationally and financially.”

Jordá also noted the company’s response to the late-August fuel contamination incident in Florida. “We successfully restored operations after the Tampa, Fla. fuel contamination event and have been working with affected customers to quickly process their claims through our Good Gas Guarantee program. We stand by the quality of our fuels and will continue working to ensure customer confidence in our products and the Citgo brand.”

Third Quarter Highlights:

Strategic and Operational

- Throughput – Total throughput for the third quarter was 802,000 b/d, of which crude runs were 765,000 b/d, with a total crude utilization rate of 95%. This compares to total throughput of 804,000 b/d, of which crude runs were 761,000 b/d, with a total crude utilization rate of 94% in the second quarter of 2023. This quarter marks the fourth consecutive quarter with crude runs over 760,000 b/d.

- Operational Excellence – Completed the third quarter with a continued focus on maintaining strong safety and operational standards among employees and contractors. Other highlights include:

- The company is on track to have the best process safety performance since 2010. Additionally, Terminals and Pipelines (TPL) achieved one year without an OSHA Recordable incident.

- The Lemont Refinery, Lubricants and TPL delivered strong environmental performance for the quarter, with no incidents resulting from the restoration activities associated with the Tampa, Fla. fuel contamination matter. Additionally, the Charlotte, N.C. terminal was awarded the Air Compliance Excellence Award from Mecklenburg County.

- Refinery reliability remained strong at 3.52 equivalent down time days across the Citgo refining system. Despite turnaround activities in September and an unplanned unit outage in August, the Lake Charles Refinery achieved a crude capacity utilization rate of 95% for the quarter. The Lemont refinery achieved a crude capacity utilization rate of 96% for the quarter, with both planned and unplanned outages, and set a new distillate processing record in August. The Corpus Christi refinery was affected by several unplanned events during the quarter, resulting in a crude capacity utilization rate of 92% for the quarter.

- Commercial Excellence – Domestic branded and unbranded sales volume was 418,000 b/d for the third quarter. Export volume was 157,000 b/d for the third quarter, an increase of 13% relative to second quarter volume. Additionally, Citgo’s Light Oils Marketing and Lubricants business units delivered strong margins for the quarter, while Lubricants continued investing in optimizing and modernizing operational and supply chain processes.

Financial

- During the third quarter, Citgo invested $59mn in turnaround and catalysts and an additional $82mn that primarily consisted of direct capital expenditures.

- Citgo issued $1.1bn of Senior Secured Notes due 2029 in Sep. 2023 and paid dividends to Citgo Holding of $1.12bn to fund the redemption in full of $1.29bn aggregate principal amount of Citgo Holding’s senior secured notes due 2024.

- At the end of the quarter, liquidity was $3.86bn, including full availability under Citgo’s $500mn accounts receivable securitization facility.

| 1 | EBITDA and Adjusted EBITDA are a non-GAAP financial measure. Adjusted EBITDA is defined as EBITDA adjusted by non-recurring items (special items) for the applicable period. For additional information, please see the information under “General Information – Non-GAAP Financial Measures” on page 3 of this press release and the reconciliation on page 4 of this press release. |

(2) Effective as of 1 Jan. 2023, interest expense is shown on a net basis, which includes interest income.

(3) EBITDA and adjusted EBITDA for the periods prior to 1 Jan. 2023, have been adjusted to present interest expense on a net basis.

(2) Includes activities related to selling refinery production both externally and to the CITGO Marketing function, along with any associated hedging activities. Includes immaterial reallocation of activity from Product Supply to Refinery EBTIDA in prior periods.

(3) Includes corporate staff and overhead costs, other corporate-related items and corporate-level derivative activity, if any. No longer includes results of the Pipelines business unit, which is now shown in the Terminals & Pipelines line. Includes immaterial reallocation of activity from Corporate EBITDA to Refinery EBTIDA in prior periods.

(4) EBITDA figures have been revised to reflect interest expense being shown on a net basis.

____________________