(Bristow, 12.Jun.2024) — Bristow Group Inc. (NYSE: VTOL) announced that Bristow Leasing Limited, a UK subsidiary, has entered into a new Export Development Guarantee term-loan facility for an aggregate amount of up to €100mn with National Westminster Bank Plc (NatWest) as the original lender and UK Export Finance guaranteeing 80% of the facility (the “UKEF Debt”). The proceeds from the financing will be used to support Bristow’s capital commitments related to the next generation of search and rescue (“SAR”) operations in Ireland.

UK Export Finance is the UK’s export credit agency and provides the Export Development Guarantee product to support the working capital and capital expenditure needs of UK exporters that meet certain criteria.

“The proceeds from the UKEF Debt will enhance our financial flexibility as Bristow grows its leading government services business with the new Irish Coast Guard contract investments,” said Chris Bradshaw, Bristow’s President and Chief Executive Officer. “We would like to thank NatWest and UK Export Finance for their confidence in Bristow and for helping facilitate our continued success.”

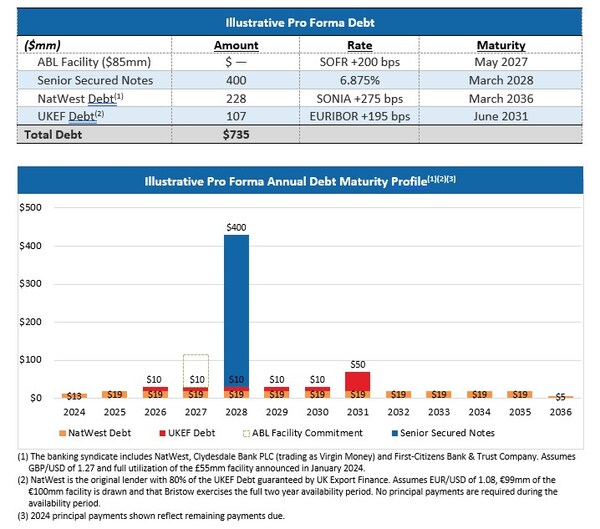

Bristow’s obligations will be secured by five new-delivery Leonardo AW189 SAR-configured helicopters. The UKEF Debt has a two-year availability period followed by a five-year term and is expected to fund during 2024, subject to delivery of the new SAR-configured helicopters. The UKEF Debt will bear interest at a rate equal to the Euro Interbank Offered Rate (“EURIBOR”) plus 1.95% per annum.

____________________