PARIS, FRANCE (SLB, 18.Jul.2025, Words: 1,004) — “SLB reported solid second-quarter results, leveraging our diversified portfolio and broad market exposure to deliver steady revenue and slightly higher adjusted EBITDA and margins sequentially. This demonstrates our resilience amidst softer upstream spending and macroeconomic uncertainty,” said SLB Chief Executive Officer Olivier Le Peuch.

“The market is navigating several dynamics — including fully supplied oil markets, OPEC+ supply releases, ongoing trade negotiations and geopolitical conflicts. Despite this, commodity prices have remained range bound. Meanwhile, customers have selectively adjusted activity, prioritizing key projects and planning cautiously, particularly in offshore deepwater markets.

“In this context, the upstream market has remained relatively resilient, underscoring the enduring strength of our industry,“ Le Peuch said.

SLB’s Broad Market Exposure Helps to Overcome Regional Headwinds

“Our broad exposure across geographies and business lines enabled us to effectively overcome the impact of certain regional activity slowdowns. As a result, we achieved a 2% sequential increase in international revenue, driven by robust growth in some parts of the Middle East, Asia, Europe and North Africa, which more than offset declines in select key markets.

“Our performance was supported by steady results in digital, with double-digit sequential revenue growth from our platforms, applications and digital operations largely offset by lower sales of exploration data following a strong first quarter. Additionally, we continue to benefit from strategically diversifying the portfolio outside of oil and gas businesses,” Le Peuch said.

Customers Increasing Focus on Production and Recovery Efforts

“Production Systems revenue climbed 3% sequentially and marked the 17th consecutive quarter of year-on-year growth. The sequential growth was driven by strong sales of artificial lift and midstream production systems.

“In today’s capital-disciplined environment, customers are focused on maximizing the value of their assets while improving efficiency in the production phase of their operations. SLB’s technology portfolio and domain expertise across reservoir, wellbore and surface systems are aligned with these efforts. As a result, demand for production and recovery solutions has risen, particularly in the U.S. and mature basins.

“Moving forward, we will increase our exposure to the less cyclical and growing production and recovery space with the recent closing of our acquisition of ChampionX. Our combined portfolio, technology capabilities and digital leadership will position SLB to create value for our customers and stakeholders while delivering best-in-class workflow integration across production chemicals and artificial lift,” Le Peuch said.

SLB Sees Industry Demonstrating Resilience

“Despite pockets of activity adjustments in key markets, the industry has shown that it can operate through uncertainty without a significant drop in upstream spending. This has been driven by the combination of capital discipline and the need for energy security.

“Looking ahead, assuming commodity prices stay range bound, we remain constructive for the second half of the year. This is supported by our position in key markets, the depth of our diversified portfolio, and our increased exposure to the growing production and recovery market through the acquisition of ChampionX. We will also continue to manage costs in line with market conditions as we remain focused on delivering peer-leading adjusted EBITDA margins.

“Overall, I am confident that SLB’s differentiated technology and global footprint will continue to deliver positive results for our customers and shareholders,” Le Peuch concluded.

Other Events

On June 26, 2025, SLB completed its sale of its working interests in the Palliser Block located in Alberta, Canada.

On July 16, 2025, SLB completed its acquisition of ChampionX. The combined portfolio, technology capabilities and digital leadership will position SLB to create value for its customers and stakeholders by increasing its exposure to the growing production and recovery market while delivering best-in-class workflow integration across production chemicals and artificial lift.

On July 17, 2025, SLB’s Board of Directors approved a quarterly cash dividend of $0.285 per share of outstanding common stock, payable on October 9, 2025, to stockholders of record on September 3, 2025.

International

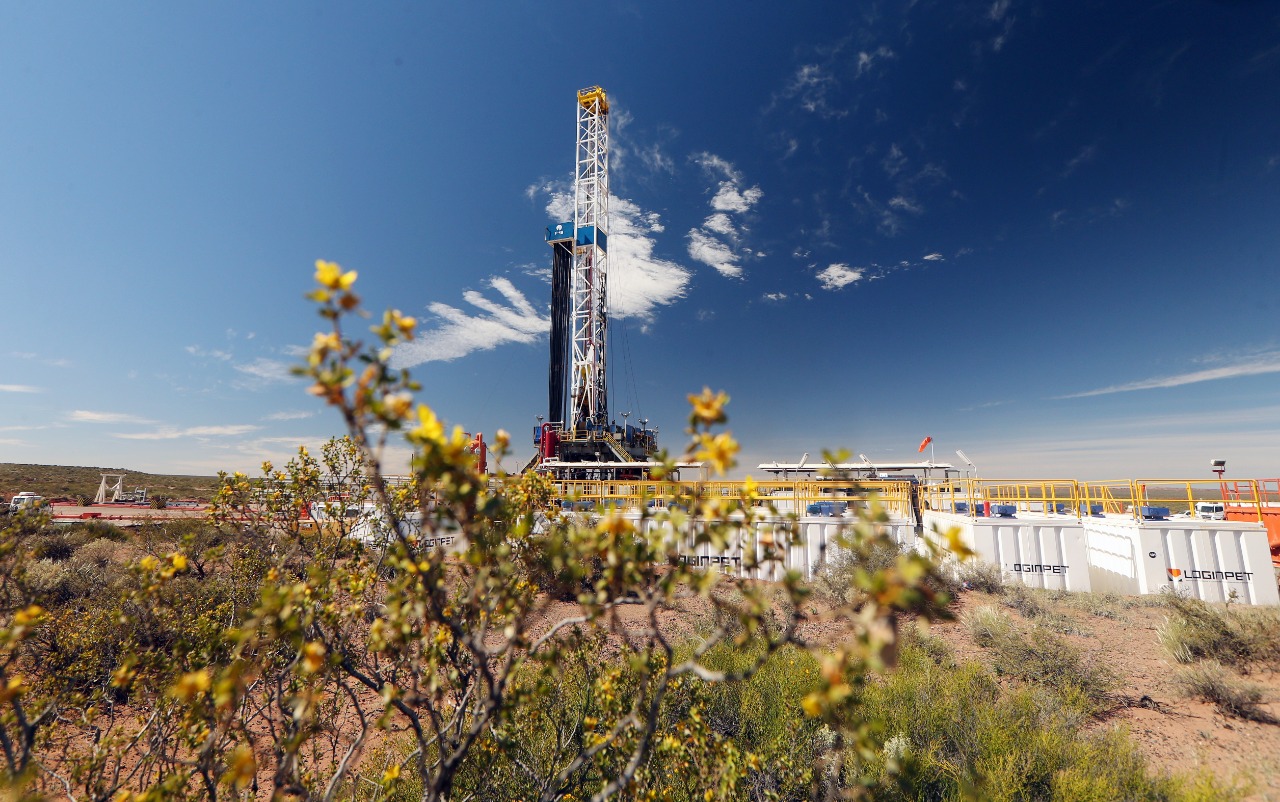

Revenue in Latin America of $1.49 billion was essentially flat sequentially. Growth from offshore activity in Brazil coupled with increased land activity in Argentina was offset by reduced sales of production systems in Guyana.

Year on year, revenue declined 14%, primarily due to a significant reduction in land drilling activity in Mexico, partially offset by robust unconventional stimulation activity in Argentina.

Europe & Africa revenue of $2.37 billion increased 6% sequentially, driven by significant sales of artificial lift in North Africa, subsea production systems in Nigeria, and higher digital revenue and increased sales of production systems in Europe. These increases were partially offset by lower offshore drilling, evaluation and stimulation activity in Namibia due to project conclusions and a pause in exploration activity.

Year on year, revenue declined 3% as a result of reduced deepwater activity, partially offset by strong sales of artificial lift in North Africa and increased sales of production systems in Europe.

Revenue in the Middle East & Asia of $2.99 billion was essentially flat sequentially as solid drilling performance and higher production system sales in Iraq and the United Arab Emirates, along with increased activity across Asia, were offset by activity decline in Saudi Arabia and Qatar.

Year on year, revenue declined 9% due to reduced activity and lower production system sales in Saudi Arabia. Declines were also noted in Asia, Egypt and Qatar, partially offset by significantly higher revenues in the United Arab Emirates, Kuwait and Iraq.

North America

North America revenue of $1.65 billion decreased 4% sequentially. The decline stemmed from lower Asset Performance Solutions (APS) revenue in the Palliser block that was divested and reduced drilling activity due to the Canadian seasonal spring breakup. Offshore revenue fell as a result of lower exploration data sales. These decreases were partially offset by modest gains in U.S. land revenue, supported by increased sales of production systems, higher digital sales and growth in data center infrastructure solutions.

Year on year, revenue was slightly higher, driven by strong growth in data center infrastructure solutions but largely offset by reduced APS revenue in Canada and a sharp decline in U.S. land drilling activity.

____________________