(Frontera, 3.May.2023) — Frontera Energy Corporation (TSX: FEC) reported financial and operational results for the first quarter ended March 31, 2023. All financial amounts in this news release are in United States dollars unless otherwise stated.

Gabriel de Alba, Chairman of the Board of Directors, commented:

“Frontera’s first quarter results were in-line with its 2023 capital and production guidance. The company delivered average daily production of 41,586 boe/d, generated $91.9mn of operating EBITDA, and invested $131.5mn in capital expenditures.

Consistent with its strategic priorities, the company successfully refinanced Puerto Bahía’s existing legacy project finance debt via a new $120mn loan facility with a group of lenders led by Macquarie Capital, which extended the tenor of the borrowings and provided for up to $30mn in additional funding to pursue strategic investment opportunities within its Midstream business. With the refinancing complete, Frontera’s standalone midstream business is fully capitalized with funding to grow. Subsequent to the quarter, the company designated Frontera Energy Guyana Holding Ltd. and Frontera Energy Guyana Corp. as unrestricted subsidiaries and released Frontera Energy Guyana Corp. as a note guarantor for its senior bonds due 2028. The designation is a positive forward step as the company nears the completion of its exploration obligations in Guyana and supports ongoing capital discipline.

The company remains focused on aligning its Upstream, Midstream, and Guyana core businesses to achieve the company’s strategic priorities and unlock shareholder value.”

Orlando Cabrales, Chief Executive Officer (CEO), Frontera, commented:

“I’m pleased with Frontera’s first quarter operational and financial results. Despite community blockades in early February which temporarily shut-in production at our Quifa and CPE-6 operations, the company’s first quarter production was largely in-line with last quarter. YTD, we are delivering average daily production of approximately 41,800 boe/d and in March and April we averaged 42,500 boe/d. This is due to better than expected performance from our new Cajua wells where current gross average heavy oil production is 4,860 bopd, higher VIM-1 liquids and NGL production, better performance at CPE-6, Coralillo 1 and 3 wells, as well as the Tapiti-1 well.

The company continues to focus on managing costs across the business. Frontera’s field breakeven of approximately $34/boe – $38/boe ensures operational resilience even in volatile market conditions and under varying oil price scenarios.

We expect improved profitability throughout the rest of the year as we advance our development portfolio in Colombia and Ecuador, increase Quifa and CPE-6 water-handling infrastructure and facilities as we lay the foundation for the company’s path to grow production to 50,000 boe/d, leverage our advantaged transportation and logistics structure to maximize realized prices and mature our self-sustaining and growing midstream business.

During the quarter, Frontera and its Joint Venture partner spud the Wei-1 well and we are currently at 19,142 feet. We have encountered oil-bearing intervals so far and are currently drilling ahead to our planned total depth.

Importantly, during the quarter, Frontera was recognized for a third consecutive year by Ethisphere as one of the World’s Most Ethical Companies in 2023. The company was added to the 2023 Bloomberg Gender-Equality Index, achieved ISO certification in Ecuador and was recognized by Friendly Biz for our LGBT+ friendly workplace.”

First Quarter 2023 Operational and Financial Summary

| Q1 2023 | Q4 2022 | Q1 2021 | ||

| Operational Results | ||||

| Heavy crude oil production (1) | (bbl/d) | 22,270 | 22,144 | 21,214 |

| Light and medium crude oil production (1) | (bbl/d) | 16,518 | 17,073 | 17,248 |

| Total crude oil production | (bbl/d) | 38,788 | 39,217 | 38,462 |

| Conventional natural gas production (1) | (mcf/d) | 8,590 | 9,097 | 9,530 |

| Natural gas liquids production (1) | (boe/d) | 1,291 | 993 | 966 |

| Total production (2) | (boe/d) (3) | 41,586 | 41,806 | 41,100 |

| Inventory Balance | ||||

| Colombia | (bbl) | 1,032,876 | 683,416 | 937,583 |

| Peru | (bbl) | 480,200 | 480,200 | 480,200 |

| Ecuador | (bbl) | 98,125 | 75,164 | 16,328 |

| Total Inventory | (bbl | 1,611,201 | 1,238,780 | 1,434,111 |

| Oil and gas sales, net of purchases (4) | ($/boe) | 69.16 | 82.67 | 90.12 |

| Realized (loss) on risk management contracts (5) | ($/boe) | (1.16) | (1.32) | (1.06) |

| Royalties (5) | ($/boe) | (3.36) | (6.04) | (7.58) |

| Other dilution costs (5) | ($/boe) | (0.09) | (0.07) | (0.12) |

| Net sales realized price (4) | ($/boe) | 64.55 | 75.24 | 81.36 |

| Production costs (5) | ($/boe) | (12.07) | (11.56) | (13.34) |

| Transportation costs (5) | ($/boe) | (11.20) | (10.55) | (9.72) |

| Operating netback per boe (4) | ($/boe) | 41.28 | 53.13 | 58.30 |

| Financial Results | ||||

| Oil and gas sales, net of purchases (6) | ($M) | 189,376 | 261,059 | 228,826 |

| Realized (loss) on risk management contracts | ($M) | (3,175) | (4,182) | (2,682) |

| Royalties | ($M) | (9,213) | (19,076) | (19,244) |

| Other dilution costs | ($M) | (256) | (235) | (298) |

| Net sales (6) | ($M) | 176,732 | 237,566 | 206,602 |

| Net income (loss) (7) | ($M) | (11,330) | 197,796 | 102,228 |

| Per share – basic | ($) | (0.13) | 2.29 | 1.08 |

| Per share – diluted | ($) | (0.13) | 2.25 | 1.05 |

| General and administrative | ($M) | 12,669 | 12,761 | 14,656 |

| Outstanding Common Shares | Number of Shares | 85,188,573 | 85,592,075 | 94,070,294 |

| Operating EBITDA (6) | ($M) | 91,922 | 144,994 | 132,998 |

| Cash provided by operating activities | ($M) | 845 | 138,312 | 114,748 |

| Capital expenditures (6) | ($M) | 131,452 | 134,165 | 113,545 |

| Cash and cash equivalents – unrestricted | ($M) | 162,272 | 289,845 | 257,373 |

| Restricted cash short and long-term (8) | ($M) | 30,877 | 23,202 | 66,146 |

| Total cash (8) | ($M) | 193,149 | 313,047 | 323,519 |

| Total debt and lease liabilities (8) | ($M) | 519,471 | 511,552 | 558,281 |

| Consolidated total indebtedness (Excl. Unrestricted Subsidiaries) (9) | ($M) | 400,361 | 407,808 | 410,161 |

| Net Debt (Excl. Unrestricted Subsidiaries) (9) | ($M) | 279,843 | 178,534 | 199,303 |

| 1. References to heavy crude oil, light and medium crude oil combined, conventional natural gas and natural gas liquids in the above table and elsewhere in this news release refer to the heavy crude oil, light and medium crude oil combined, conventional natural gas and natural gas liquids, respectively, product types as defined in National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities (“NI 51-101“). |

| 2. Represents W.I. production before royalties. Refer to the “Further Disclosures” section. |

| 3. Boe has been expressed using the 5.7 to 1 Mcf/bbl conversion standard required by the Colombian Ministry of Mines & Energy. Refer to the “Further Disclosures – Boe Conversion” section. |

| 4. Non-IFRS ratio (equivalent to a “non-GAAP ratio”, as defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure (“NI 52-112” ). Refer to the “Non-IFRS and Other Financial Measures” section. |

| 5. Supplementary financial measure (as defined in NI 52-112). Refer to the “Non-IFRS and Other Financial Measures” section. |

| 6. Non-IFRS financial measure (equivalent to a “non-GAAP financial measure”, as defined in NI 52-112). Refer to the “Non-IFRS and Other Financial Measures” section. |

| 7. Net (loss) income attributable to equity holders of the company. |

| 8. Capital management measure (as defined in NI 52-112). Refer to the “Non-IFRS and Other Financial Measures” section. |

| 9. “Unrestricted Subsidiaries” as of March 31, 2023, include CGX Energy Inc. (“CGX“), listed on the TSX Venture Exchange under the trading symbol “OYL”, Frontera ODL Holding Corp., including its subsidiary Pipeline Investment Ltd. (“PIL“), Frontera BIC Holding Ltd., and Frontera Bahía Holding Ltd. (“Frontera Bahia“), including its subsidiary Sociedad Portuaria Puerto Bahia S.A (“Puerto Bahia“). On April 11, 2023, Frontera Energy Guyana Holding Ltd. and Frontera Energy Guyana Corp. were designated as unrestricted subsidiaries. Refer to the “Liquidity and Capital Resources” section on page 23 of the PMD&A. |

First Quarter 2023 Operational and Financial Results:

- The company recorded a net loss of $11.3mn or $0.13/share in the first quarter of 2023, compared with net income of $197.8mn or $2.29/share in the prior quarter and net income of $102.2mn or $1.08/share in the first quarter of 2022. The company’s first quarter net loss included an operating loss of $2.7mn (including $30.3mn in impairment, exploration expenses, and other costs), finance expenses of $15.2mn, foreign exchange loss of $11.8mn, and income tax expense $7.5mn partially offset by $13.6mn of share of income from associates and finance income of $4.3mn.

- Production averaged 41,586 boe/d in the first quarter of 2023, compared to 41,806 boe/d in the prior quarter and 41,100 boe/d in the first quarter of 2022. See the table above for production by product type for the prior quarter and first quarter of 2022. First quarter production was impacted by temporary production shut-ins at the company’s Quifa and CPE-6 blocks in early February due to road blockades in the municipality of Puerto Gaitan, Meta Department, Colombia. Year to date to May 1, 2023 Frontera has averaged approximately 41,800 boe/d (consisting of 22,600 bbl/d of heavy crude oil, 16,500 bbl/d of light and medium crude oil, 8,500 mcf/d of conventional natural gas and 1,200 boe/d of natural gas liquids). In March and April 2023, Frontera averaged approximately 42,500 boe/d consisting of consisting of 23,300 bbl/d of heavy crude oil, 16,500 bbl/d of light and medium crude oil, 8,500 mcf/d of conventional natural gas and 1,200 boe/d of natural gas liquids).

- Operating EBITDA was $91.9mn in the first quarter of 2023 compared with $145mn in the prior quarter and $133mn in the first quarter of 2022. The decrease in operating EBITDA quarter-over-quarter was primarily a result of lower commodity prices and lower sales volumes.

- Cash provided by operating activities in the first quarter of 2023 was $0.8mn, compared with $138.3mn in the prior quarter and $114.7mn in the first quarter of 2022. The decrease in cash provided by operating activities quarter-over-quarter was primarily due to lower Brent benchmark oil prices and fluctuations in working capital.

- The company reported a total cash position of $193.1mn at March 31, 2023, compared to $313mn at December 31, 2022 and $323.5mn at March 31, 2022. During the quarter, the company invested $131.5mn in capital expenditures including $75.7mn in capital expenditures related to Guyana, $3.5mn in debt service payments and $4.2mn in share buybacks. In addition, the company obtained net proceeds from the PIL Loan Facility of $114.9mn, which was used to fully repay the 2025 Puerto Bahia Debt.

- The company’s restricted cash position was $30.9mn at March 31, 2023 compared to $23.2mn at December 31, 2022 and $66.1mn in the first quarter of 2022. The increase in the company’s restricted cash position was primarily due to funding a Debt Reserve Account related to the new PIL loan facility.

- As at March 31, 2023, the company had a total inventory balance of 1,611,201 bbls compared to 1,238,780 bbls at December 31, 2022 and 1,434,111 bbls at March 31, 2022. The company actively manages its volumes, ending the quarter with more than 370,000 bbls of increased inventory balance in the first quarter compared to the prior quarter, which was subsequently sold in the second quarter of 2023.

- Capital expenditures were approximately $131.5mn in the first quarter of 2023, compared with $134.2mn in the prior quarter and $113.5mn in the first quarter of 2022. Capital expenditures in the first quarter included $75.3mn on the Wei-1 well offshore Guyana, $32mn on development drilling in the Quifa, Cajua, CPE-6 and Cubiro blocks, $12.4mn on exploration activities in Colombia and Ecuador and $8.6mn on development facilities including construction of a storage tank in the CPE-6 block and the expansion of fluid transfer and the interconnection of fields in the Quifa block.

- The company’s net sales realized price was $64.55/boe in the first quarter of 2023, compared to $75.24/boe in the prior quarter and $81.36/boe in the first quarter of 2022. The decrease in the company’s net sales realized price quarter-over-quarter was primarily driven by the decrease in the Brent benchmark oil price and higher differential prices, partially offset by lower royalties.

- The company’s operating netback was $41.28/boe in the first quarter of 2023, compared with $53.13/boe in the prior quarter and $58.30/boe in the first quarter of 2022. The decrease in operating netback quarter-over-quarter was primarily due to lower net sales realized price as a result of lower average Brent benchmark oil prices, higher differentials and incremental increases in transportation costs.

- Production costs averaged $12.07/boe, within the company’s 2023 guidance range, in the first quarter of 2023 compared with $11.56/boe in the prior quarter and $13.34/boe in the first quarter of 2022. The increase in production costs quarter-over-quarter was primarily as a result of inflationary pressures and increased tariffs on products and services.

- Transportation costs averaged $11.20/boe, within the company’s 2023 guidance range, in the first quarter of 2023 compared with $10.55/boe in the prior quarter and $9.72/boe in the first quarter of 2022. The increase in transportation costs quarter-over-quarter was mainly due to additional volumes transported and increased trucking tariffs for 2023.

- The company recorded a realized loss on risk management contracts of approximately $3.2mn in the first quarter of 2023 compared to a realized loss of approximately $4.2mn in the prior quarter and a loss of $2.7mn in the first quarter of 2022. The realized loss on risk management contracts in the first quarter of 2023 was primarily a result of cash paid for premiums related to put options settled during the period. See the Hedging section below for more information.

- The company has various uncommitted bilateral credit lines. As of March 31, 2023, the company had increased its uncollateralized credit lines to $125.3mn, an increase of $6.9mn compared to December 31, 2022.

Continuing Progress On Frontera’s ESG Strategy

On March 13, 2023 Frontera was recognized for a third straight year by Ethisphere, a global leader in defining and advancing the standards of ethical business practices, as one of the 2023 World’s Most Ethical Companies. In 2023, 135 honourees were recognized spanning 19 countries and 48 industries. Frontera was one of only two honourees in the oil and gas industry.

On January 31, 2023 Frontera was included in the 2023 Bloomberg Gender-Equality Index (“GEI“), a modified market capitalization-weighted index developed to gauge the performance of public companies dedicated to reporting gender-related data. This reference index measures gender equality across five pillars: leadership & talent pipeline, equal pay & gender pay parity, inclusive culture, anti-sexual harassment policies, and external brand.

Frontera was also recognized in the first quarter as a Top 20 Best Places to Work in Colombia by the Great Place to Work® Institute (“GPTW“) and achieved ISO certification for its operations in Ecuador and its recognition for operations safety.

Enhancing Shareholder Return

Frontera remains committed to enhancing shareholder returns. As part of its 2023 plan, the company strives to unlock shareholder value from its upstream Colombia and Ecuador business, its standalone and growing midstream business and its potentially transformational offshore exploration program in Guyana

During the first quarter of 2023, under the company’s NCIB which expired on March 16, 2023, Frontera repurchased approximately 0.5mn of the company’s common shares (“Common Shares“) for cancellation for approximately $4.1mn. In total, the company repurchased 4.3 million Common Shares (or approximately 89% of its shares outstanding).

Consistent with its strategic priorities, the Company successfully refinanced Puerto Bahía’s existing legacy project finance debt, via a new $120mn loan facility with a group of lenders led by Macquarie Capital, which extended the tenor of the borrowings and provided for up to $30mn in additional funding to pursue strategic investment opportunities within its Midstream business. With the refinancing complete, Frontera’s standalone midstream business is fully capitalized with funding to grow.

Subsequent to the quarter, the company designated Frontera Energy Guyana Holding Ltd. and Frontera Energy Guyana Corp. as unrestricted subsidiaries and released Frontera Energy Guyana Corp. as a note guarantor for its senior bonds due 2028. The designation is a positive forward step as the Company nears the completion of its exploration obligations in Guyana and will ensure future capital discipline.

Frontera’s Three Core Businesses

Frontera has three core businesses: (1) its Colombia and Ecuador Upstream Onshore business, (2) its standalone and growing Colombia Midstream business, and (3) its potentially transformational Guyana Exploration business offshore Guyana.

The Company is focused on unlocking shareholder value from its business and is committed to providing greater clarity and insight through its various disclosures including quarterly results press releases such as this one.

1. Colombia and Ecuador Upstream Onshore

During the quarter, Frontera produced 40,581 boe/d from its Colombian operations (consisting of 22,270 bbl/d of heavy crude oil, 15,513 bbl/d of light and medium crude oil, 8,590 mcf/d of conventional natural gas and 1,291 boe/d of natural gas liquids). The Company continued to diversify its production mix in the first quarter of 2023, increasing natural gas liquids production to 1,291 boe/d, up 30% compared to 993 boe/d in the prior quarter and 966 in the first quarter of 2022.

In the first quarter of 2023, the company drilled 17 development wells at Quifa, Cajua, CPE-6 and Cubiro blocks. This compares to 17 development wells in the prior quarter. In 2023, the company intends to drill 55 gross development wells.

Currently, the company has 5 drilling rigs and 2 workover rigs active at its Quifa, CPE-6, Cubiro and Corcel/Guatiquia blocks in Colombia.

Quifa and Cajua

Production from the Quifa and Cajua blocks averaged approximately 16,829 bbl/d of heavy crude in the first quarter of 2023 compared to approximately 16,470 bbl/d of heavy crude oil in the fourth quarter of 2022. The company drilled 12 production wells (seven wells at Quifa and five wells at Cajua) on the blocks in the first quarter of 2023. During the quarter, the Company also expanded fluid transfer and the interconnection of fields in the Quifa block.

Increasing water handling capacity at Quifa is key to Frontera’s efforts to grow production at Quifa. The Company’s current water handling capacity is approximately 1.5 million bwpd. In 2023, Frontera began commissioning SAARA (previously Agrocascada), its reverse osmosis water treatment facility. As of April 2023, the plant has already processed 1.5 million barrels of water as part of its commissioning program, providing irrigation source water to the Company’s nearby ProAgrollanos palm oil plantation.

At Cajua, the company drilled five horizontal wells in the first quarter which increased gross average production to 3,873 bopd of heavy crude in March compared to 2,226 bopd in December 2022. Current gross average production at Cajua is 4,860 bopd.

CPE-6

At CPE-6, production averaged approximately 4,850 bbl/d of heavy crude oil in the first quarter 2023 compared with approximately 5,214 bbl/d in the fourth quarter of 2022. First quarter production was impacted by temporary production shut-ins at the Company’s Quifa and CPE-6 blocks in early February due to road blockades in the municipality of Puerto Gaitan, Meta Department, Colombia. During the quarter, the company drilled four production wells and constructed an additional storage tank which will increase on-site storage capacity to 20,000 bbls.

Guatiquía

At Guatiquia, production averaged approximately 7,333 bbl/d of light and medium crude oil in the first quarter of 2023 compared with approximately 7,941 bbl/d in the fourth quarter of 2022. The company completed a workover of the Coralillo 3 well in February, increasing production by 500 bbl/d and supporting additional opportunities for potential production growth from existing wells and new wells in the area.

Cubiro

During the quarter, the company drilled three producing wells (two horizontal and one vertical) in the Cubiro block (Copa 36H, Copa 32H and Copa K Norte 1), increasing production by 360 bopd of 39° API light oil to 2,145 bbl/d in the first quarter of 2023, successfully implementing new solids control technology in the completion of the horizontal sections of the wells.

VIM-1

At VIM-1 (Frontera 50% W.I., non operator), production averaged 1,675 bbl/d of light and medium crude oil in the first quarter of 2023 compared to approximately 1,370 bbl/d of light and medium crude oil in the fourth quarter of 2022. During the quarter, the operator successfully began gas reinjection, increasing liquids production to approximately 4,000 bbl/d.

VIM-22

At VIM-22, the Chimi-1 and Winner-1 wells were spudded on February 16, 2023 and March 30, 2023 respectively. Non-commercial gas was found in the Tubara Formation, however interpretation of logging while drilling logs and integration with drilling data concluded that the wells did not contain commercial net hydrocarbon pay. The wells were subsequently plugged and abandoned. Also during the quarter, the company completed civil works for the Tubara Sur-1 exploratory well. During the three months ended March 31, 2023, the company recorded an impairment charge of exploration and evaluation assets in Colombia of $15.2mn as a result of the company’s decision to proceed with steps to relinquish the VIM-22 block, which remains subject to approval by the Agencia Nacional de Hidrocarburos (“ANH“).

VIM-46

At VIM-46, the company has begun pre-seismic and pre-drilling activities to the environmental management plan in advance of completing a 100 km2 3D seismic acquisition program. Socialization and land permitting is expected to commence in August 2023.

Llanos 99

At Llanos 99, the company successfully completed the acquisition of 165 km2 of 3D seismic, without security or social issues between the end of February and the end of April 2023. The company is currently completing the restoration phase of the operation. Social and administrative closure is anticipated to be completed in the second quarter of 2023. The company is also advancing consultation activities and an environmental impact study as part of the environmental permitting process for future exploration drilling.

Llanos 119

At Llanos 119, Frontera has begun pre-seismic activities related to the environmental management plan in advance of completing an 80 km2 seismic acquisition program. Socialization and land permitting is expected to commence in August 2023. Pre-drilling activities including land permitting, civil work designs and goods and services contracting procedures are underway in advance of civil works activities which are expected to begin in December 2023 for the Solopiña Norte-1 well.

Ecuador

In Ecuador, first quarter 2023 gross production averaged approximately 2,010 bbl/d of light and medium crude oil, compared to approximately 2,492 bbl/d in the fourth quarter of 2022. Frontera’s share of production in Ecuador for the three months ended March 31, 2023 was 1,005 bbl/d of medium crude oil compared to 1,246 bbl/d in the prior quarter.

At the Perico block (Frontera 50% W.I. and operator), the company has drilled three out of four exploration commitment wells (Jandaya-1, Tui-1 and Yin-1 exploration wells), which are currently on long-term test as the company completes environmental impact assessments in advance of obtaining production environmental licenses. Pre-drilling activities for the Yin Sur-1 exploratory well is underway, which the company expects to drill in the third quarter of 2023.

At the Espejo block (Frontera 50% W.I. and non-operator), the operator has drilled two out of four commitment wells (Pashuri-1 and Caracara-1 exploration wells), where preliminary logging information from both wells indicates the presence of hydrocarbons. The Pashuri-1 well has been producing from U sandstone since November 2022. Current production is 305 bopd with 38.5% watercut at stable conditions. Further analysis is being carried out and the operator is currently interpreting a new 3D seismic survey data to define the location of the third exploratory commitment well.

Peru

During the three months ended March 31, 2023, the company recognized an asset retirement obligation expense resulting from the acquisition of the remaining 51% working interest (“W.I“). in Block Z1 in Peru from BPZ Resources Inc.

Subsequent to the quarter, the company reached an agreement to finalize the sale of Frontera Energy OffShore Perú, the 100% consolidated entity that owns the 100% W.I. in Block Z1, for a payment of $10 million to a third party, subject to completion of certain conditions precedent. As a result of this transaction, the Company expects to no longer recognize any asset retirement obligation related to Block Z1 and to generate a $35.8 million asset retirement obligation recovery once the agreement is finalized.

2. Midstream Colombia

Frontera has investments in certain infrastructure and midstream assets, including storage, port and other facilities in Colombia and the company’s investments in pipelines (“Midstream Colombia Segment“).

The Midstream Colombia Segment principally includes a 35% equity interest in the Oleoducto de los Llanos Orientales S.A. (ODL) pipeline through Frontera’s wholly-owned subsidiary, Pipeline Investment Limited (PIL) and the company’s 99.80% interest in Puerto Bahia.

About ODL and Puerto Bahia

The ODL pipeline is a 260-kilometre, 24-inch pipeline with throughput capacity of 300,000 bbl/d at 18° API that transports Frontera’s heavy crude oil from the Quifa SW and Cajua fields and part of the CPE-6 field, as well as other third-party production from the Llanos basin, including from Ecopetrol, Hocol, Geopark and Parex, and connects the OCENSA pipeline at Cusiana and Monterrey to the export terminal in Coveñas. Ecopetrol’s Cenit Transporte y Logística de Hidrocarburos S.A.S. owns the remaining 65% of ODL.

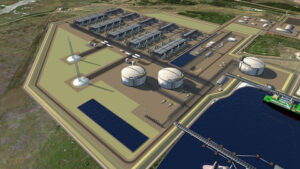

Puerto Bahia is a state-of-the-art liquids and dry cargo facility port terminal strategically located on a 155-hectare site in the Bay of Cartagena.

Midstream Colombia Segment Results

| March 31 | ||

| ($M) | 2023 | 2022 |

| Revenue | 11,146 | 10,332 |

| FEC liquids port facility | 1,664 | 1,452 |

| Third party liquids port facility | 5,832 | 5,358 |

| General Cargo | 3,650 | 3,522 |

| Cost | (5,117) | (4,679) |

| General administrative expenses | (1,342) | (1,671) |

| Depletion, depreciation and amortization | (1,232) | (1,476) |

| Restructuring, severance and other costs | (103) | (174) |

| Puerto Bahia Income from operations | 3,352 | 2,332 |

| Share of income from associates – ODL | 13,572 | 9,094 |

| Segment income | 16,924 | 11,426 |

| Segment cash flow from operations activities | 7,608 | 17,024 |

The company’s Midstream Colombia Segment income increased $5.5mn for the three months ended March 31, 2023 to $16.9mn, compared with $11.4mn in the same period of 2022. For the three months ended March 31, 2023, the Puerto Bahia liquids terminal revenues increased by 10% compared with the same period of 2022. The liquids terminal revenues during the first quarter of 2023 and 2022, correspond to 67% and 66% of total revenues, respectively. General cargo terminal revenues increased by 4% compared with the same period in 2022, due to higher volumes of breakbulk cargo.

Cash provided by operating activities of the Midstream Colombia Segment for three months ended March 31, 2023 was $7.6mn compared to $17mn in the same period of 2022, the reduction is mainly due to $9mn of dividends collected during first quarter of 2022, while $18.2mn of dividends were collected following the quarter end, in April 2023.

| Three months endedMarch 31 | ||

| ($M) | 2023 | 2022 |

| Adjusted Midstream Revenue(1) | 38,231 | 23,003 |

| Adjusted Midstream Operating Cost(1) | (7,741) | (6,296) |

| Adjusted Midstream General and administrative(1) | (2,314) | (2,312) |

| Adjusted Midstream EBITDA | 28,177 | 14,395 |

| 1. Non-IFRS financial measure (equivalent to a “non-GAAP financial measure”, as defined in NI 52-112). Refer to the “Non-IFRS and Other Financial Measures” section. |

The Adjusted Midstream EBITDA for the first quarter of 2023 was $28.2mn compared to $14.4mn in the same period of 2022, with the increase a result of the company’s increased indirect ownership interest in ODL from 59.93% to 100% as of September 2022, higher volumes transported at the pipeline facility and handled at the liquids terminal facility.

For additional information regarding the company’s Midstream segment please refer to the company’s MD&A.

Puerto Bahia

Puerto Bahía continues to streamline its cost structure, and increased its operating margin to 30% in the three months ended March 31, 2023, from 23% in the same period of 2022. This cost reduction is the result of the implementation of efficiency initiatives such as an optimized tariff model for logistic operators, the substitution of hired services for in-house solutions, and the negotiation of contracts with suppliers.

In the first quarter of 2023, the roll-on roll-out business continued to increase its market share by capturing new car brands and by entering the transshipment business. As a result, total roll-on roll-out units increased by 25% in the first quarter of 2023, when compared with the same period in 2022. In the liquids terminal, revenues increased by 10% in the first quarter of 2023, when compared with the same period in 2022, driven by increased throughput volumes.

Puerto Bahia has an $8mn capital program for 2023, up from $1.5mn in 2022, which is focused on port infrastructure and acquiring the necessary equipment to capture mature business opportunities. In addition, Puerto Bahia is strengthening its project and engineering team to expand its execution capabilities, while also advancing the necessary permits and licensing for the new business operations, which includes the expansion of the port utilized area.

3. Guyana Exploration

On January 23, 2023 Frontera and CGX, joint venture partners (the “Joint Venture“) in the Petroleum Prospecting License for the Corentyne block offshore Guyana (the “License“), announced the spud of the Wei-1 well (the “Well“), on the Corentyne block, approximately 200 kilometres offshore from Georgetown, Guyana. The Well, planned to be drilled to a total depth of 20,500 feet, to date has been successfully drilled to a depth of 19,142 feet (5,834 metres). The Wei-1 well is located approximately 14 kilometres northwest of the Joint Venture’s previous Kawa-1 light oil and condensate discovery.

The Well has encountered oil-bearing intervals in the western channel fan complex of the northern portion of the Corentyne block in formations of Maastrichtian and Campanian ages. A comprehensive logging campaign in the Maastrichtian and Campanian intervals indicated the presence of oil, confirmed by downhole analysis. Logging while drilling (LWD) and cuttings indicate the presence of hydrocarbons in the upper portion of the Santonian; fluid samples have not yet been fully obtained. Side-wall core samples will be attempted in the Santonian interval when drilling resumes. Preliminary indications from the secondary targets in the Maastrichtian and Campanian are positive, however no assurance can be given that these activities will ultimately produce hydrocarbons in commercial quantities.

While performing additional well logging and data acquisition operations, a wireline fluid sampling tool became stuck in the Well and was not recovered. An open hole sidetrack will begin shortly from below the last casing point and will progress to the planned total depth. The Joint Venture expects to complete Wei-1 operations within the original 4-5 month timeframe as announced on January 23, 2023.

The Joint Venture has updated its Well total cost estimates to $175mn-$190mn to successfully reach the target total depth, and complete its drilling program. The increase in cost includes the delays associated with the late arrival of the rig, costs associated with fishing and sidetrack operations and associated post well evaluations.

During the three months ended March 31, 2023, Guyana exploration and infrastructure expenditures were $75.3mn compared to $53.5mn during the same period of 2022.

Hedging Update

As part of its risk management strategy, Frontera uses derivative commodity instruments to manage exposure to price volatility by hedging a portion of its oil production. Consistent with this strategy, the company entered into new put hedges totaling 1,275,000 bbls to protect a portion of the company’s production through June 2023. The following table summarizes Frontera’s 2023 hedging position as of May 3, 2023.

| Term | Type ofInstrument | Open Positions(bbl/d) | Strike PricesPut/ Call |

| April | Put | 14,333 | 70 |

| May | Put | 13,871 | 70 |

| June | Put | 13,833 | 70 |

| 2Q-2023 | Total Average | 14,011 |

Frontera Energy Provides Notice of First Quarter 2023 Financial Results Conference Call

A conference call for investors and analysts will be held on Thursday, May 4, 2023 at 11:00 a.m. Eastern Time. Participants will include Gabriel de Alba, Chairman of the Board of Directors, Orlando Cabrales, Chief Executive Officer, René Burgos, Chief Financial Officer and other members of the senior management team.

Analysts and investors are invited to participate using the following dial-in numbers:

Participant Number (Toll Free North America): 1-888-664-6383

Participant Number (Toll Free Colombia): 01-800-518-4036

Participant Number (International): 1-416-764-8650

Conference ID: 49513969

Webcast Audio: www.fronteraenergy.ca

A replay of the conference call will be available until 11:59 p.m. Eastern Time on May 11, 2023.

Encore Toll free Dial-in Number: 1-888-390-0541

International Dial-in Number: 1-416-764-8677

Encore ID: 513969

____________________