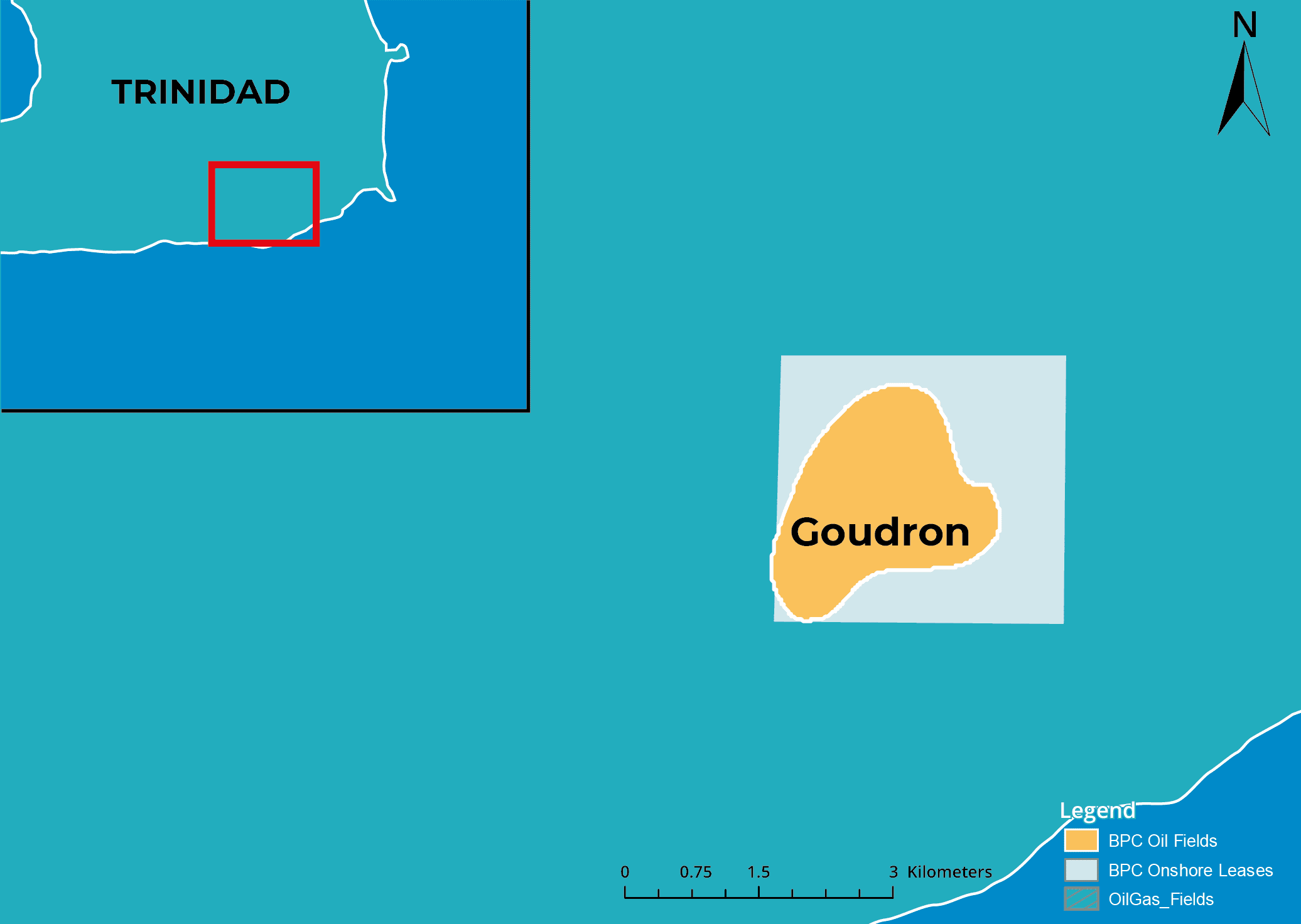

(BPC, 30.Nov.2020) — Bahamas Petroleum Company plc (BPC) advised the Goudron Enhanced Production Sharing Contract (ESPC) has been signed. As a consequence, the company will proceed to issue 35,759,140 new ordinary shares in BPC, the issue of which was conditional on signing of the Goudron EPSC.

Goudron EPSC

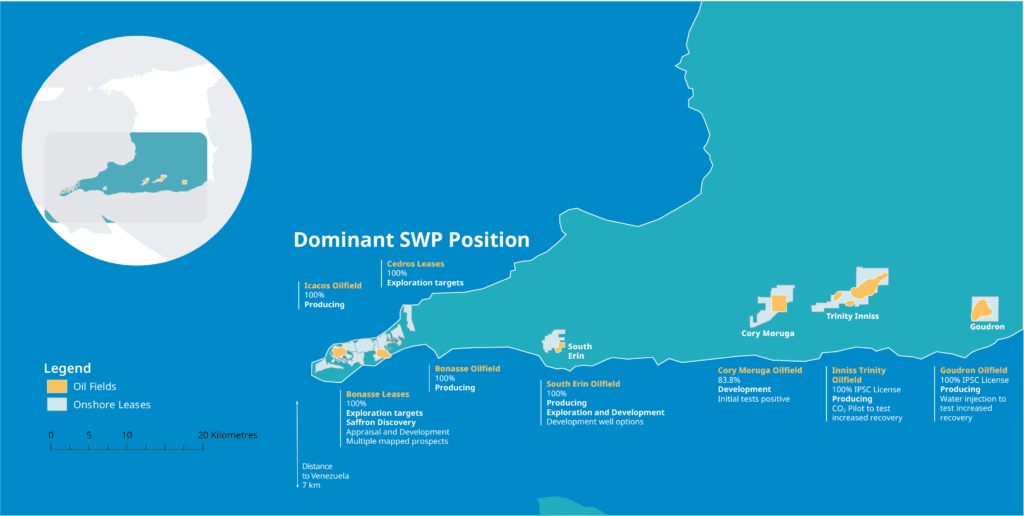

The company has entered into an EPSC in respect of the Goudron Block in Trinidad and Tobago, with Heritage Petroleum Company Ltd. The EPSC provides the company with the continuing exclusive right to extract petroleum on Goudron until 30 June 2030. The EPSC was entered into after consent of the Trinidad and Tobago Ministry of Energy and Energy Industries was duly obtained.

The EPSC replaces the existing 10-year Production Sharing Contract (as amended and extended) in respect of Goudron that was otherwise due to expire at the end of 2020. Signing of the new Goudron EPSC had been anticipated earlier in 2020 but had been delayed as a result of delays to obtaining the necessary consents arising from the Covid-19 pandemic.

The terms of the EPSC are largely consistent with the terms that previously prevailed under the existing Goudron Production Sharing Contract.

Production from Goudron currently accounts for approximately 40% of BPC’s baseline daily production in Trinidad and Tobago.

Issuance of new shares and options

On 7 August 2020, in conjunction with the completion of the merger with Columbus Energy Resources Plc, BPC advised that until such time as the Goudron EPSC was entered into, BPC and Columbus’s management had agreed to delay the issuance of 25,562,167 new ordinary shares due to various members of Columbus’s management pursuant to their respective settlement and termination arrangements (8,579,079 of these to be issued to Leo Koot). It was agreed that these new BPC ordinary shares would be issued on entering into the Goudron EPSC.

On 15 October, the company advised that the Board’s Remuneration Committee had resolved to make a number of option awards and bonus payments conditional on entering into the Goudron EPSC. These were an award of 6,250,000 Series B Options and a US$200,000 bonus (payable in the form of ordinary shares) to the company’s CEO, and an award of 6,250,000 Series B Options and a $200,000 bonus (payable in the form of ordinary shares) to a member of the Company’s senior management. The new ordinary shares to be issued in satisfaction of these previously agreed bonus payments to each of the CEO and the member of senior management is 5,098,486 shares (the bonus award shares being issued at 2.95p (3.92 cents), representing the volume weighted average share price for the 20 trading days prior to execution of the Goudron EPSC).

Given that the Goudron EPSC has now been entered into, all of these new ordinary shares and options, as previously advised, will now be issued.

Accordingly, on Admission, Simon Potter, CEO of the company, and Leo Koot, a Non-Executive Director of the company, will be interested in 81,217,700 and 28,093,156 ordinary shares respectively, representing approximately 2.0% and 0.7% of the company’s then enlarged issued share capital. Mr Potter is interested in 20,000,000 Series A Options, 27,500,000 Series B Options and 25,000,000 Series C Options.

Total Voting Rights

Application will be made for a total of 35,759,140 new ordinary shares to be admitted to trading on the AIM market of the London Stock Exchange and it is expected that admission will take place and trading in the shares will commence from 8.00 a.m. on or around 4 December. Upon Admission, the company’s issued share capital will consist of 4,090,548,549 ordinary shares, with each ordinary share carrying the right to one vote. The company does not hold any ordinary shares in treasury. This figure of 4,090,548,549 ordinary shares may therefore be used by shareholders in the company, as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change in their interest in, the share capital of the company under the FCA’s Disclosure Guidance and Transparency Rules.

Regulatory Statements

The information communicated in this announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

__________