(Frontera, 4.Nov.2020) — Frontera Energy Corporation reported financial and operational results for the third quarter ended 30 September 2020. All financial amounts in this news release are in United States dollars, unless otherwise stated. During the third quarter, the company acquired control of Infrastructure Ventures Inc. (“IVI“), the parent company of Puerto Bahia which owns and operates a bulk liquid and dry cargo port in Cartagena, Colombia. As a result, the company now fully consolidates IVI’s results in the Financial Statements, impacting the comparability of various financial metrics. Please see the section entitled the Acquisition of Infrastructure Ventures Inc (“IVI“) in the Financial Statements for full details.

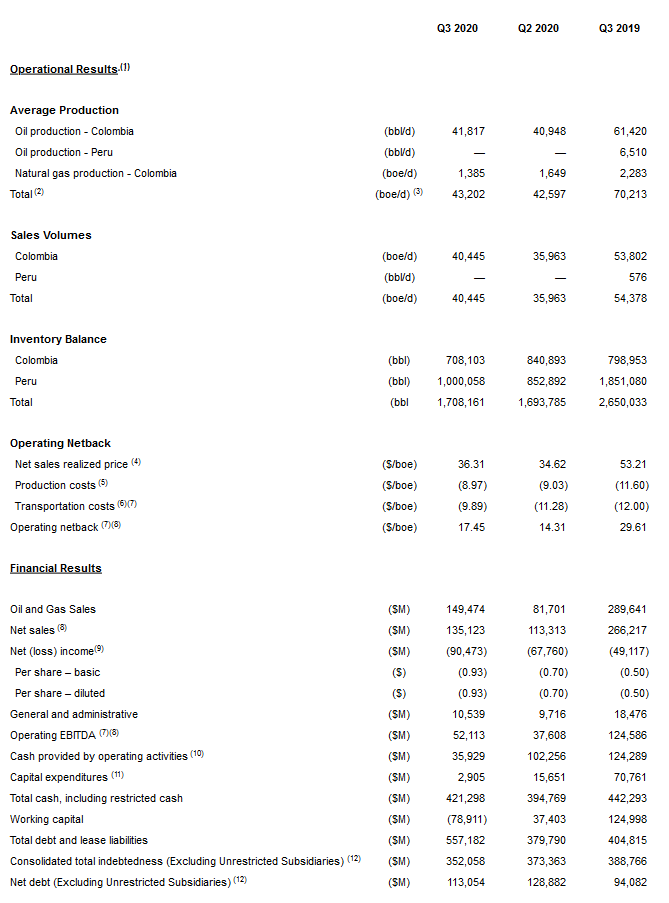

Third Quarter Operational and Financial Results:

— Third quarter production averaged 43,202 boe/d, all from Colombia, compared to second quarter 2020 production of 42,597 boe/d. In August, the company brought back online most of the Colombian fields which it had shut-in earlier in the year. In Peru Block 192, production remained closed during the third quarter.

— The company reported a net loss of $90 million ($0.93/share), compared to a net loss of $68 million ($0.70/share) in the second quarter of 2020. The loss in 3Q was primarily related to non-cash adjustments due to the acquisition of IVI.

— Production costs in the third quarter averaged $8.97/boe, compared to $9.03/boe in the second quarter of 2020 reflecting the company’s success in controlling costs in the current environment.

— Transportation costs averaged $9.89/boe in the third quarter, compared to $11.28/boe in the second quarter of 2020 largely as a result of the consolidation of IVI. In the third quarter of 2020, the acquisition of IVI lowered reported transportation costs by $0.94/boe compared to the second quarter of 2020. In addition, we have reclassified $8 million in third quarter expenses ($20 million year-to-date 2020) related to non-cash transportation ancillary contracts to Costs under terminated pipeline contracts.

— General & Administrative Expenses were $10.5 million in the third quarter, compared to $9.7 million in the second quarter, reflecting $1.2 million in additional costs as a result of the IVI consolidation.

— Operating EBITDA was $52 million compared to $38 million in the second quarter of 2020. Revenue increased due to sales volumes deferred from the second quarter (which resulted in an additional cargo in the third quarter) and improved Brent prices. In addition, production and transportation costs improved in the quarter.

— Capital expenditures in the third quarter were $3 million, versus $16 million in the second quarter of 2020 as the company’s focused on conserving cash during the quarter.

— The company ended the third quarter of 2020 with total cash of $421 million, as compared to $395 million in the previous quarter. Of total cash, at the end of the third quarter, restricted cash totaled $161 million as compared to $139 million at the end of the second quarter of 2020. The consolidation of IVI resulted in an increase of $26 million of restricted cash and $2 million of cash and cash equivalents.

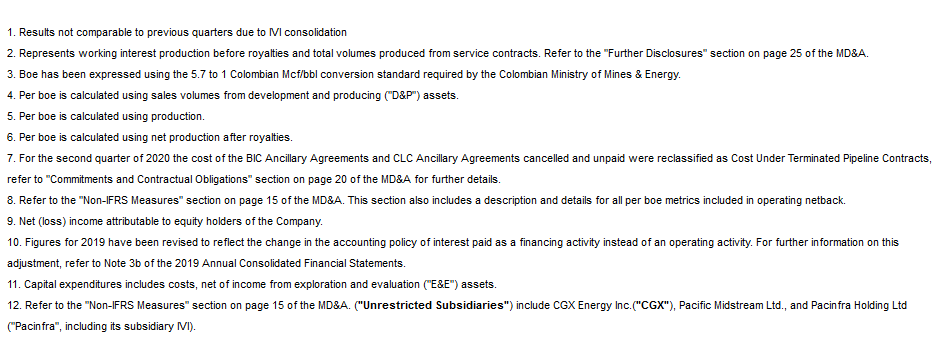

The company’s total debt and lease liabilities ended the third quarter of 2020 at $557 million, including an increase in debt and lease liabilities due to the consolidation of $203 million of 2025 Puerto Bahia debt as a result of the IVI acquisition. The bank loan is non-recourse to Frontera (other than as provided for by the equity contribution agreement). Net debt (ex. Unrestricted Subsidiaries) was $113 million as of September 30, 2020.

Gabriel de Alba, Chairman of the Board of Directors, commented:

“Frontera continues to demonstrate operational and financial discipline against the backdrop of a difficult oil price environment. In the third quarter, the Company finished with higher production volumes, stable production costs, and a cash position virtually unchanged quarter over quarter. Purchasing a controlling interest in Puerto Bahia provides several benefits for Frontera: (i) it gives the Company authority to shape the strategic direction in order to release value from the port, and (ii) removes both the special voting provisions and a put option held by former shareholders which created potential uncertainty around the port. We believe the port is a unique asset, combining a liquids terminal with a dry cargo facility, in a strategic location. We will continue to explore means to maximize the value of the port, and Frontera’s other midstream assets. Our focus in the fourth quarter remains on maintaining our production volumes and our strong balance sheet, while ensuring we are positioned for long-term growth and value creation.”

Richard Herbert, Chief Executive Officer of Frontera, commented:

“In the third quarter, we brought back online and stabilized a portion of the production previously shut-in while maintaining the improvements in costs and processes achieved earlier in the year. Quarterly production was above the high end of our second half guidance while production costs remained stable. We achieved this while upholding our commitment to the health and well-being of our field and office staff and people in the local communities where we operate.

In Peru, with ongoing disruption caused by the pandemic and the closure of the Norperuano pipeline, we have maintained the fields in Block 192 shut-in throughout the quarter. Frontera has notified PeruPetro of the lifting of force majeure on July 30 and that the six-month extension of our service contract, which was negotiated in March, will now expire in February 2021.

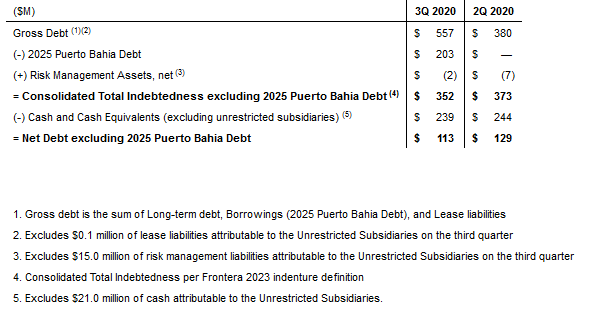

We are affirming our guidance for the remainder of the year, adjusted for the recent consolidation of Puerto Bahia, as we expect stable operations and results for the remainder of 2020. Remaining work this year will include infrastructure investments in the Lower Magdalena Valley and other preparatory work in Colombia, Ecuador and Guyana for our future exploration and development projects. Our strategy is designed to give us flexibility for the future, depending on oil prices, while maintaining the highest capital discipline. We expect to release our 2021 capital budget and guidance in December.”

Operational and Financial Summary:

Operational Update:

In the upstream heavy oil business unit, we reactivated CPE-6 and the Quifa satellite Cajua field during the third quarter. Subsequently, the Sabanero block was shut-in due to ongoing issues partially stemming from Covid-19, in the surrounding communities.

In the light and medium district, we reactivated the Cubiro, Casimena, and Canaguaro blocks during the quarter. Subsequently, we performed successful workovers and stimulations on several key wells including Ardilla-3, Yatay-2, and Candelilla-6 wells.

Capital expenditures were $3 million in the quarter as stable production allowed us to defer some well service and workovers into the fourth quarter. In the fourth quarter, Frontera expects to ramp up activity and capital expenditures, including workover / well service work in key oil fields in Colombia and to begin construction on facilities in the Lower Magdalena Valley (“VIM”), well test in Asai and other projects in anticipation of next year’s development plans. The Company initiated work with 1 rig in the third quarter and expects to have 4 rigs running during the quarter.

In Ecuador, Frontera continues working to obtain environmental permits to start exploration activities in the Perico block. The permit is expected to be received in late 2020 and the first well is planned for drilling in late 2021.

Operational activities in Guyana have been affected throughout most of 2020 due to the COVID-19 Pandemic. Our Joint Venture with CGX Energy continues to have constructive collaborative discussions with the regulatory authorities in Guyana regarding work commitments in that country.

In our midstream business, as previously disclosed, on 6 August 2020, Frontera closed an agreement with the International Finance Corporation and related funds (the “IFC“) to purchase all of IFC’s interests in IVI. IVI is the parent company of Sociedad Portuaria Puerto Bahia (“Puerto Bahia”), which owns and operates a bulk liquid and dry cargo port in Cartagena, Colombia. The acquisition terminated a put option and special governance rights held by the IFC. Therefore, Frontera has acquired control over the future strategic direction of the port with a view to unlocking material value for the Company. Frontera, through its wholly owned subsidiary Pacinfra, now owns approximately 71.57% of the issued and outstanding shares of IVI and as a result from the third quarter of this year is consolidating IVI in its financial results.

Financial Liquidity:

As of the third quarter of 2020, the company now consolidates IVI / Puerto Bahia, including its $203 million of debt (non-recourse to Frontera) and $26 million of restricted cash.

The Company’s debt as of September 30, 2020, is outlined in the table below.

Guidance Restatement for the Consolidation of IVI

On August 6, 2020, the company released updated guidance for full-year and second-half 2020. At the time, the prevailing Brent oil price of close to $45/bbl was projected forward for the remainder of 2020. We are reaffirming our guidance only adjusting transportation costs for the acquisition of IVI and changes to accounting treatment of unused ancillary contracts. To make the guidance comparable given those changes, we have reduced transportation cost guidance in the full year by $2.0 per boe (to $11.0 – $12.0 per boe from $13.0 – $14.0 per boe) and in the second half by $4.0 per boe (to $9.5 – $10.5 per boe from $13.5 – $14.5 per boe).

Sustainability Disclosures

During the third quarter, Frontera released its 2019 Sustainability Report along with a brand new ESG presentation, detailing its key environmental, social, and governance (“ESG”) initiatives. The report and presentation are aligned with the Sustainability Accounting Standard Board framework and available at www.fronteraenergy.ca.

Hedging Update:

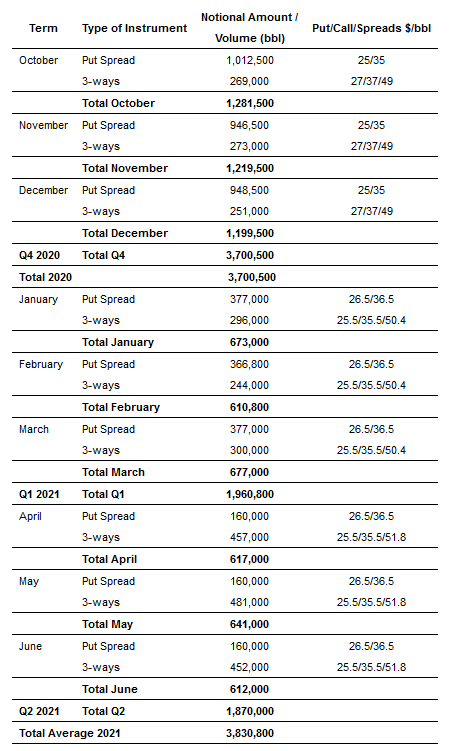

The goal of the hedging program is to protect the revenue generation and cash position of the company. The forward hedging position was also increased in part to support restarting production and protect the break-evens of the previously shut-in fields. The company has now hedged approximately 3.7 million bbls (approximately 100% of expected production) at Brent $35/bbl for the fourth quarter of 2020 and 3.8 million bbls at Brent $35 – $37/bbl for the first half of 2021.

The following is the current hedging portfolio as of the date of this release:

Third Quarter 2020 Conference Call Details

The company will host a conference call for investors and analysts to discuss its results on Thursday, 5 November at 8:00 a.m. (MST) and 10:00 a.m. (EST/GMT-5). Participants should use the following dial-in numbers:

| Participant Number (Toll Free North America): | 1-888-664-6392 |

| Participant Number (Toll Free Colombia): | 01-800-518-4036 |

| Participant Number (International): | 1-416-764-8659 |

| Conference ID: | 19881048 |

| Webcast: | https://produceredition.webcasts.com/starthere.jsp?ei=1383964&tp_key=732c45bd20 |

| A replay of the conference call will be available until 11:59 p.m. (EST/GMT-5) Thursday, November 12, 2020. | |

| Encore Toll free Dial-in Number: | 1-888-390-0541 |

| International Dial-in Number: | 1-416-764-8677 |

| Encore ID: | 267364 |

__________