(Frontera, 5.Dec.2019) — Frontera Energy Corporation announced full year 2020 capital plan and guidance information. All values in this news release and the Company’s financial disclosures are in United States dollars, unless otherwise noted.

Gabriel de Alba, Chairman of the

Board of Directors, said:

“Frontera’s 2020 plan demonstrates the Company’s continued confidence

in its ability to generate strong excess cash with EBITDA significantly

exceeding capital expenditures. Our midpoint operating EBITDA guidance of $425 million is $75 million

above the midpoint of capital expenditures guidance. The capital program

continues to invest $250 million per year to

sustain production and reserves in Colombia. We

are investing an additional $75 million in major

exploration opportunities offshore Guyana and

onshore in Ecuador and Colombia

which is targeted to deliver production and reserves growth, for the Company

over the medium-term.

As announced in our third quarter 2019 results, Frontera has had a strong 2019 and remains on track to deliver fiscal year results that are at the favorable end of guidance metrics. Year to date, we have made dividend distributions to shareholders of $108 million and the Company’s balance sheet remains very strong with over $442 million of total cash, including restricted cash, at the end of the third quarter.

I would also like to welcome René Burgos Díaz to Frontera’s Board of Directors. He will be joining the Board as an independent director and as our eighth member. René is very knowledgeable about Frontera and the Latin America oil and gas sector, particularly through his time at CarVal Investors. His understanding of the Company, combined with significant capital markets’ knowledge, makes René a valuable addition to our Board.”

Richard Herbert, Chief Executive

Officer, commented:

“Frontera built on its track record of delivery in 2019, with stable

production, focused reduction of costs and strong cash generation. We have also

grown our portfolio with new exploration opportunities in Colombia, Ecuador, and Guyana, providing Frontera with excellent growth

opportunities in the future.

Our 2020 plan reflects the continuing benefits of cost savings and efficiency projects combined with exciting exploration opportunities. During 2020 the Company plans to test some of its most promising exploration opportunities, for natural gas in northern Colombia in the first quarter, exploration in the CPE-6 heavy oil block in Colombia in the second quarter, exploration offshore Guyana in the third quarter and our first exploration well in Ecuador in the fourth quarter.

Our expected 2020 production reflects the impact of the scheduled expiry of the service contract on Block 192 in Peru in March 2020. Even with a lower assumed Brent oil price of $60/bbl for 2020, we are maintaining our operating EBITDA and capital expenditures guidance with our original 2019 plan, as we again generate more cash than is needed to sustain and grow the business. In Colombia, we will invest in growing production from CPE-6 following successful exploration and horizontal development well drilling in 2019. With the availability of a new well pad, we will resume appraisal drilling on the Coralillo light and medium oil field in the Guatiquia block and continue our successful efforts to mitigate decline in the Quifa field.”

Board of Directors Update:

The Company is pleased to announce the appointment of Mr. René Burgos Díaz to the Board of Directors. With this appointment, the Company’s Board is at eight members, all of whom are independent. Mr. Burgos Díaz is a financial markets executive with approximately 20 years of experience in investment management, leveraged financing, restructuring and financial advisory expertise across multiple industries and geographies, specifically in Latin America. Mr. Burgos Díaz’s career has included the position of Director in the Emerging Markets team at CarVal Investors, a leading global alternative investment management firm with $10 billion in assets under management. Prior to CarVal Investors, Mr. Burgos Díaz also held roles at Deutsche Bank and Bank of America, including the role of Director with Deutsche Bank’s Emerging Markets Structured Credit Trading team. Mr. Burgos Díaz holds a Bachelor of Business Administration, Accounting and Finance from the Universidad de Puerto Rico.

2020 Capital Plan and Guidance:

Frontera’s 2020 plan and guidance has been developed with the following four key objectives:

- Delivering sustainable levels of production and reserves in Frontera’s core Colombian operations;

- Ensuring that the capital expenditures in core operations have strong financial returns;

- Pursuing continuous operational improvements and greater cost efficiencies;

- Creating opportunities for future growth in production and reserves through new exploration and development activities.

These objectives, combined with flexible capital allocation, will enable the Company to maximize shareholder returns. Annual budgets are developed and scrutinized throughout the year and changed if necessary in the context of project returns, product pricing expectations, and the balancing of project risks and time horizons.

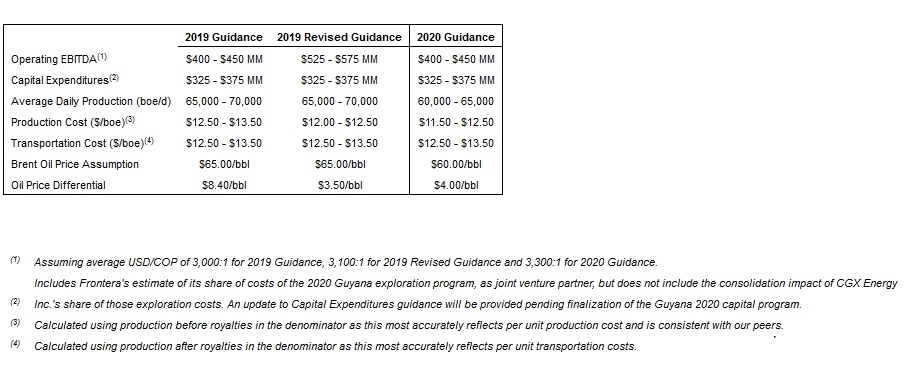

2020 Guidance Metrics:

The Company expects to deliver 2020 Operating EBITDA guidance that is flat with original 2019 guidance, despite an 8% decrease to its Brent oil price assumption of $60/bbl in 2020 compared to $65/bbl in 2019. The Company has used an average oil price differential in 2020 of $4.00/bbl, slightly above realized differentials in 2019, reflecting improved production in Venezuela and the impact of International Marine Organization 2020 regulations. The Brent less WTI spread is estimated at $5.00/bbl for the purposes of estimating high priced royalties paid in kind at Quifa.

Average annual production in 2020 is expected to be in the range of 60,000 to 65,000 boe/d. Peru production will be impacted by the scheduled expiry of Frontera’s service contract for Block 192 in March 2020. The Company is entitled to sell pipeline inventory following the relinquishment of the contract which will result in sales volumes in 2020 in Peru being similar to those in 2019.

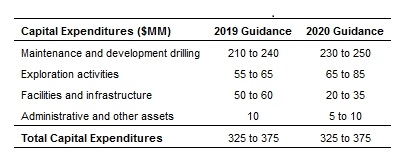

2020 Capital Expenditure Program:

Capital expenditures are expected to be flat in 2020 compared to 2019 with an increasing mix of exploration growth capital and a reduction in facilities and infrastructure spending.

Development Drilling Projects:

- Facilities expansion at CPE-6 combined with continued horizontal well development drilling expected to increase average production from 1,500 bbl/d in 2019 to over 4,000 bbl/d in 2020, with exit rate 2020 production targeted at over 6,000 bbl/d.

- Continued deployment of AICD subsurface water diversion devices throughout the Quifa development drilling program as well as continued vertical and deviated development drilling with the purpose of expanding the Quifa field limit.

- Appraisal drilling at Cajua in the ongoing evaluation of a new field area within the Quifa North block.

- Continued development of Coralillo field on the Guatiquia block with appraisal drilling to evaluate the eastern part of the block with the potential for multiple productive reservoir intervals.

- Evaluation of the updated reservoir model of the Copa fields within the Cubiro block to recommence the water flood pressure maintenance project or additional development drilling.

Exploration Projects:

- Near field exploration in Colombia, on existing producing blocks, building on successes in 2019, where the Company has a success rate of over 90% on blocks including CPE-6, Sabanero, Quifa North, and Mapache.

- The drilling of two exploration wells offshore Guyana, one well on each of the Demerara and Corentyne blocks, expected during the third and fourth quarters. The Company, along with its joint venture partner, CGX Energy Inc., expects to select drilling locations for each block during the first half of the year. Additionally, during the first half of 2020 the Company will be providing a resource report for the two blocks offshore Guyana.

- In Ecuador, the Company will drill the Jandaya-1 exploration well on the Perico block, expected in the fourth quarter, as well as the acquisition, interpretation and processing of a 3D seismic program on the Espejo block.

- Drilling in the Lower Magdalena Valley on the Guama block targeting natural gas and natural gas liquids with the Asai-1 exploration well and Asai Shallow-1 exploration well.

- Continued exploration drilling to the north and south of the Hamaca field on the CPE-6 block, following on from exploration successes during 2019.

Hedging Program:

For 2020, the Company has, to date, hedged approximately 30% of expected production with a combination of Brent oil price linked purchased put options, zero cost collars, put spreads, and three-way collars at strike prices above $55/bbl Brent between January and September 2020. In order to hedge oil prices, the Company will use a variety of financial instruments on a go-forward basis sufficient to protect the Company’s capital program and financing costs, as well as potential future dividends.

Update on Normal Course Issuer Bid and Dividend:

During October and November 2019, the Company repurchased 722,300 shares at an average price C$10.71/share or $5.9 million under the Company’s ongoing Normal Course Issuer Bid which expires on October 17, 2020.

On November 7, 2019, the Company announced a regular quarterly dividend of C$0.205 to be paid on or about January 17, 2020 to shareholders of record on January 3, 2020.

***