(Petroleum Economist, Charles Waine, 2.Aug.2019) — Mexico’s Comisión Federal de Electridad (CFE), the state-owned electricity utility, has started legal proceedings against seven natural gas pipelines. The move intensifies fears about both the anti-business agenda of the country’s president Andres López Obrador and further delays to a much-needed release valve for associated gas production in the prolific Permian Basin.

The López Obrador regime had previously vowed to respect existing energy market contracts. But the fact that a government-backed entity initiated arbitration procedures on 23 June—relating to legislation passed by the previous administration—signals a significant escalation of hostility.

The dispute centres on a force majeure clause. CFE promised to pay the pipeline companies capacity charge fees from a certain date even if no gas was being transported—so long as the lack of supply was due to delays in construction and obtaining permits. The Secretary of Energy (Sener) is responsible for organising consultations with local groups but objections have meant many of the permits were not forthcoming or delayed. The fees alone for the Sur de Texas-Tuxpan pipeline total $899mn.

“The López Obrador administration is attempting to argue that those clauses were unfair and represent an undue burden on CFE,” says Robert Rindlaub, a petroleum and energy economist at Rindlaub Energy Consulting, a Mexico-focused consultancy. “In this way, they will attempt to claw back or cancel payment on $800mn [relating to Sur de Texas-Tuxpan] in capacity charge payments.”

The construction delays mean CFE is incurring costs for infrastructure it cannot use. “CFE wants to renegotiate the contracts, as, according to the company, they are paying for pipelines they are not using, paying in excess for construction and paying for more than the actual capacity they are importing,” says Estefania Gutierrez Rosas, senior analyst at Spanish bank BBVA.

The project developers say it is not their fault. TC Energy—the Canadian operator responsible for three of the pipelines including the recently completed but now on-ice 2.6bn ft3/d Sur de Texas-Tuxpan pipeline—blames Sener.

Both TC Energy and Mexican midstream firm Fermaca, which is developing the La Laguna-Aguascalientes and Villa de Reyes-Guadalajara links, have faced opposition from ejidos (local collectives), while Mexico’s National Anthropology and History Institute (INAH) flagged up new archaeological issues on agreed routes, according to consultancy Energy Aspects.

Permian pileup

The construction delays have already frustrated Permian producers’ hopes of expanding exports to the Mexican market and the arbitration process could frustrate them further. In December, energy data provider Genscape predicted the new Mexican infrastructure would provide 1.1bn ft3 /d in debottlenecking relief. This would have been particularly welcome while US midstreamer Kinder Morgan continues to develop the Gulf Coast Express and Permian Highway pipelines, connecting the Permian basin to Houston and Corpus Christi seaborne export options.

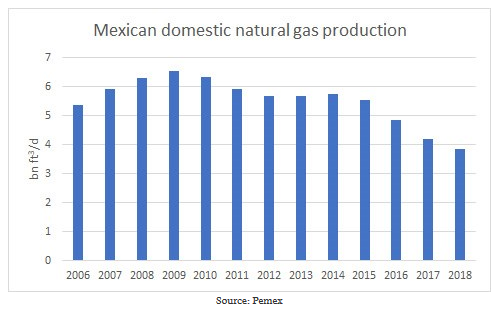

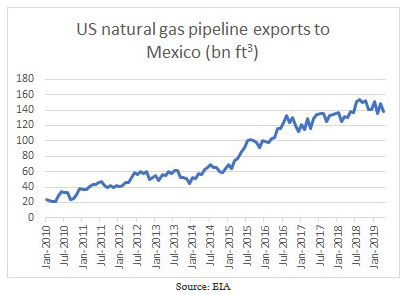

Exports from the Permian to Mexico have been well below cross-border capacity, primarily because sections downstream connecting the northern Sistema Nacional de Gasoductos (SNG) pipeline infrastructure to the industrial expanse surrounding Guadalajara, the country’s second largest city, remain unfinished. Last year, US natural gas pipeline exports to Mexico averaged 4.62bn ft3/d, while January-May 2019 exports averaged around 4.77bn ft3/d-despite capacity at the cross-border point standing at around 11bn ft3/d.

Once complete, the so-called Wahajara system—which runs south from the Permian and comprises Fermaca’s three pipelines—La Laguna-Aguascalientes, Villa de Reyes-Aguascalientes-Guadalajara and the fully-operational El Encino-La Laguna—will help transport around 1.6bn ft³/d from its most northerly stage, 1.3bn ft³/d at its central point and 0.89bn ft³/d into Guadalajara. The Sur de Texas-Tuxpan pipeline is also expected to boost Mexico’s de facto import capacity by 40pc, but remains out of action while the dispute continues.

“There is currently plenty of capacity to bring gas from the Waha and the Agua Dulce hubs to the border with Mexico, but without the completion of the pipelines subject to the arbitration there is essentially nowhere for the gas to go,” says Rindlaub.

Domino effect

The decision to pursue arbitration has escalated political tensions in the López Obrador administration. Finance minister Carlos Urzúa resigned on 9 July citing frustration at the government’s economic policy. He was quickly replaced by his deputy, Artur Herrera.

“There is essentially nowhere for the gas to go” Rindlaub, Rindlaub Energy Consulting.

The arbitration process could also risk or delay USMCA—the Nafta replacement ratified by Mexico but not yet Canada or the US—and could potentially trigger counter lawsuits. In 2016, TC Energy filled a $15bn lawsuit against the US government, claiming the rejection of the Keystone XL pipeline violated the terms of Nafta. The lawsuit was suspended in 2017 when Trump signed an executive order to allow TC Energy to reapply for a permit to develop the pipeline project.

“The arbitrations have raised concerns among investors in the energy sector pertaining to the sanctity of their contracts and the interventionist tendencies of the López Obrador administration,” says Karla Schiaffino, Americas political analyst at Verisk Maplecroft, a geopolitical consultancy. “As this has affected Canadian and US companies, these questions will complicate the ratification of the USMCA.”

Canada’s ambassador to Mexico, Pierre Alarie, said he hoped the dispute could be resolved but did not rule out employing Nafta or the Trans-Pacific Partnership (TPP), despite the US’ withdrawal, if negotiations fail.

***