(Talos, 10.Jul.2019) — Talos Energy Inc. provided an update on the results of its semi-annual borrowing base redetermination and recent hedging activities.

Effective July 3, 2019, the Company’s borrowing base of $850 million was unanimously reaffirmed by participants of its syndicated credit facility. In conjunction with the regularly scheduled redetermination, Talos elected to increase the banks’ commitments under the facility from $600 million to $850 million and added three additional lenders to the syndicate. The next borrowing base redetermination is expected in the fall.

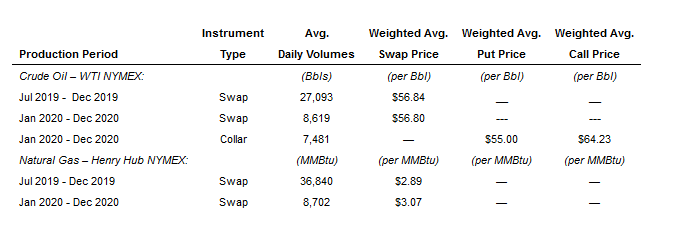

During the second quarter of 2019, Talos also entered into a series of derivative contracts, comprised of swaps and costless collars, to hedge additional fiscal year 2020 oil production of 3,423,500 Bbls. The weighted average price the Company will receive under the swap contracts was $56.59/bbl and the weighted average floor and ceiling prices for the costless collars were $55.00 and $66.63, respectively. The table below reflects the contracted volumes and weighted average prices the Company will receive under its derivative contracts as of June 30, 2019.

Talos President and Chief Executive Officer Timothy S. Duncan commented, “The reaffirmed borrowing base and increased commitments, both in terms of dollars and number of participants, is a strong endorsement of the Company’s asset base and strategic direction. With the additional commitments, we have further enhanced our already solid liquidity position and improved our optionality and flexibility moving forward. We expect that our recent hedging additions, when coupled with our attractive basis differentials, will continue to generate robust price realizations into 2020.”

***