(Kallanish Energy, 27.Mar.2019) — The introduction of a higher royalty for asset bidders by Trinidad and Tobago may prove counterproductive long-term, Kallanish Energy learns.

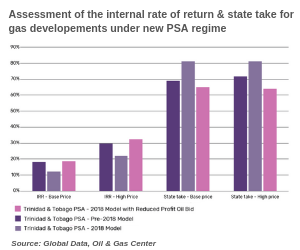

Analytics company GlobalData said in a note published Monday the imposition of a 12.5% fee on offshore bid rounds could compromise the attractiveness to investors and the state’s share of future production.

The fee, which was not previously applicable to the Production Sharing Agreement (PSA), may raise the fiscal burden.

“Alternatively, interested parties may seek to offer relatively lower profit oil sharing bids for future contracts to offset these higher royalty payments, which could end up yielding less overall revenue for the government,” said Oil and Gas analyst Toya Latham, in a statement.

The new measures could hinder opportunities, as investors may choose to seek more convenient bids, or bid lower sums. In the latter case, a constant royalty payment would not make up for the missed revenue coming from high bids.

The overall effect of such a change may still depend on the level of bids accepted by the government, according to GlobalData.

Trinidad and Tobago is the largest oil and gas producer in the Caribbean. According to the Energy Information Administration (EIA), proved reserves of oil and gas in 2018 were 0.2 billion barrels and 11 trillion cubic feet, respectively.

***