(Frontera Energy, 14.Mar.2019) — Frontera Energy Corporation released its consolidated financial statements, management discussion and analysis (MD&A), Annual Information Form (AIF) and Form 51-101 F1 – Statement of Reserves Data and Other Oil and Gas Information for the Company (the F1 Report) for the year ended December 31, 2018. These documents, among others, will be posted on the company’s website at www.fronteraenergy.ca and SEDAR at www.sedar.com. All values in this news release and the company’s financial disclosures are in United States dollars unless otherwise stated. All production numbers in this news release are before royalties unless otherwise stated.

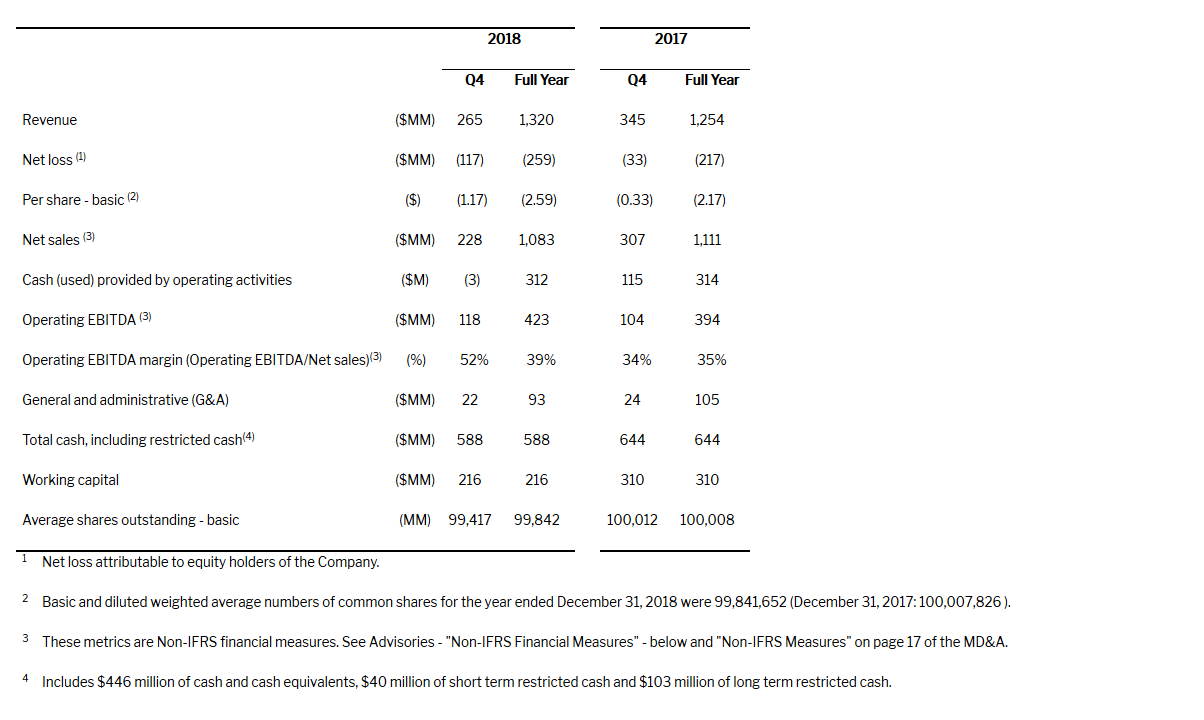

FOURTH QUARTER AND FULL YEAR 2018 HIGHLIGHTS

Strong Fourth Quarter Operational and Financial Results

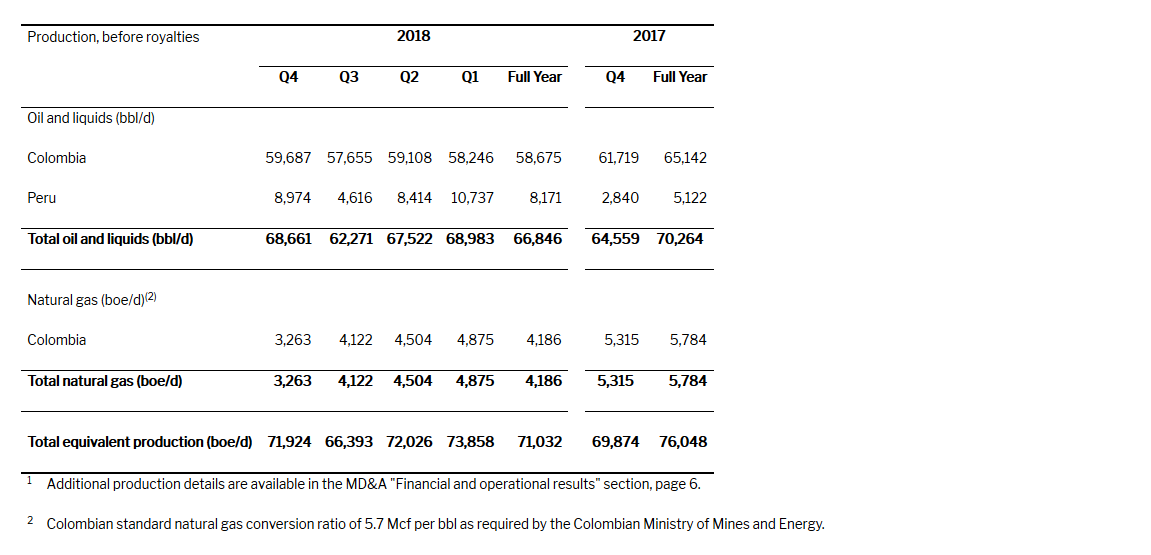

— Production averaged 71,924 boe/d, an increase of 8% compared to the third quarter of 2018 and a 3% increase compared to the fourth quarter of 2017.

— Oil production represented over 95% of total company production in the fourth quarter of 2018, compared to 94% in the third quarter of 2018 and 92% in the fourth quarter of 2017.

— Net loss of $116.6 million ($1.17/share) in the fourth quarter of 2018 includes $143.9 million of non-recurring charges relating to payments under terminated pipeline contracts, impairments on infrastructure investments, oil and gas assets and on the carrying values of investments in associates offset by the benefit of the reversal of provisions related to high-price clause. This compares to a net loss of $32.5 million ($0.33/share) in the fourth quarter of 2017 which included a net benefit $63.8 million from the reversal of a provision related to high-price clause, offset by impairments on oil and gas assets and transmission line assets. Refer to notes 7 and 26 of the consolidated financial statements for more detail.

— Operating EBITDA of $118.4 million was 27% higher than the prior quarter and 13% higher than the prior year quarter.

— General and administrative expenses (G&A) of $21.8 million in the fourth quarter of 2018 declined 5% from the third quarter of 2018 and 11% from the fourth quarter of 2017, reflecting the benefit of the company’s ongoing focus on efficiency and cost reduction projects throughout the organization.

— Capital expenditures of $156.4 million were 26% higher than in the third quarter of 2018 and 41% higher than the fourth quarter of 2017, as anticipated, reflecting the completion of the Quifa SW water handling expansion project which has added over 3,000 bbl/d to company production so far in 2019.

— Cash used by operating activities of $3.5 million in the fourth quarter of 2018 reflected the normalization of timing of accounts receivable and payable through the cash management process.

— The company repurchased for cancellation 1.3 million shares at a cost of $13.3 million (C$13.87/share) under its normal course issuer bid during the fourth quarter of 2018. To date the company has repurchased for cancellation 2.4 million shares at a cost of $24.9 million (C$13.96/share), representing 47% of the authorized buyback under the normal course issuer bid.

— Total cash, including restricted cash, was $588.4 million as at December 31, 2018, down 25% from the third quarter of 2018 and down 9% compared to December 31, 2017.

— Hedged on approximately 27% of expected 2019 production after royalties using put options with a Brent price of $55.00/bbl.

2018 Operational and Financial Results

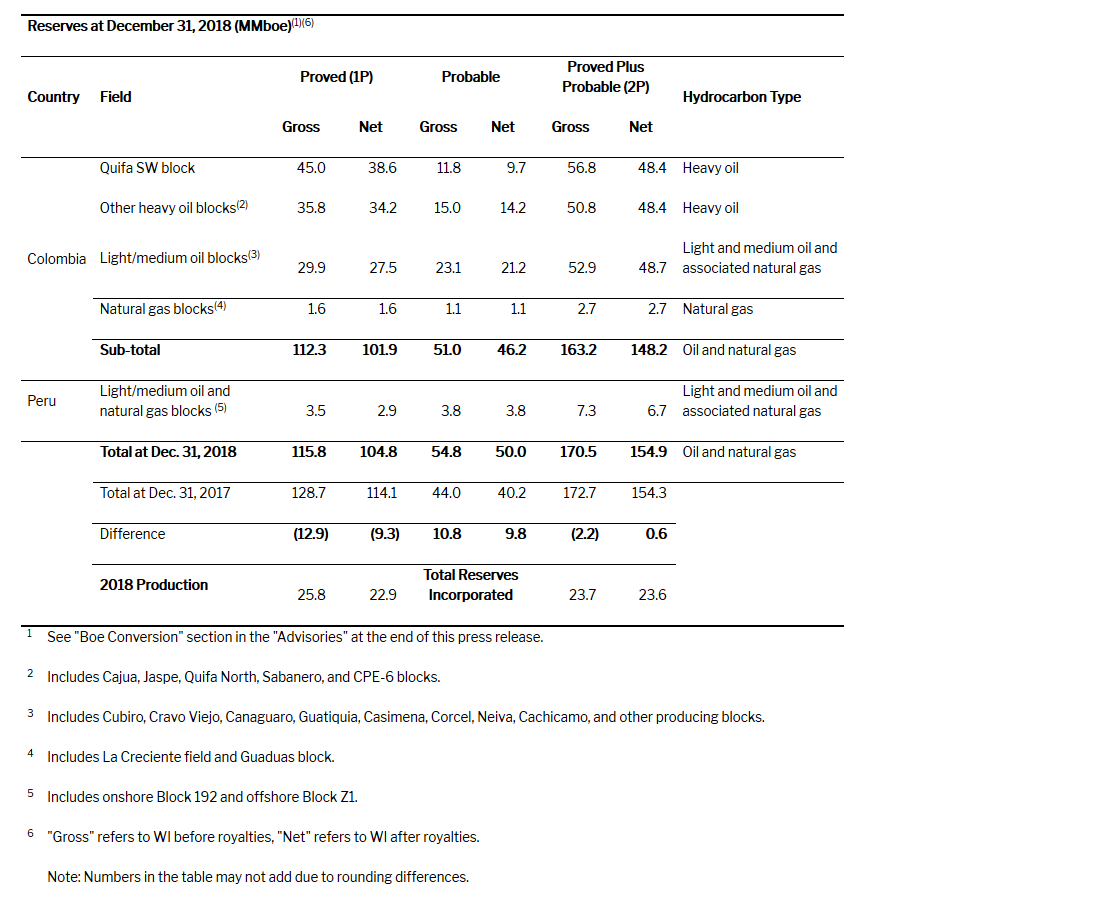

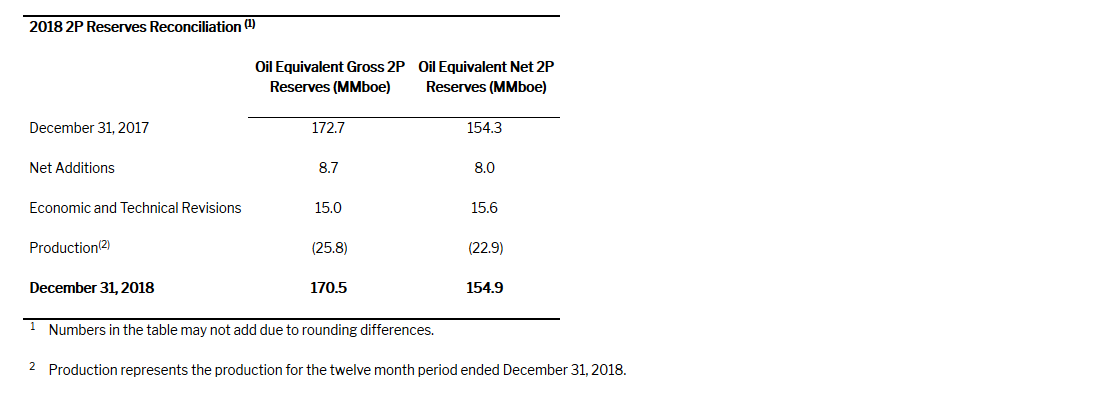

— Frontera’s 2P Reserves as at December 31, 2018, were 154.9 MMboe after royalties, which was 0.4% higher than at the end of 2017.

— The company achieved a 2P Reserves Replacement Ratio of 103% based on 2018 production after royalties of 23.6 MMboe.

— The company’s 2P Reserve Life Index increased to 6.8 years in 2018 from 6.1 years in 2017.

— Net present value of 2P reserves discounted at 10%, before taxes, was $2.2 billion at the end of 2018, a decrease of 13% compared to 2017. The decrease reflects lower heavy oil price assumptions of $3.00/bbl over the first 10 years, partially offset by an increase of $0.80/bbl in light oil price assumptions. Heavy oil represents 62% of proved plus probable reserves, light oil 36% and natural gas 2%.

— Net present value of proved plus probable reserves discounted at 10%, after taxes, was $1.9 billion, a decrease of 1% compared to 2017.

— 2018 production averaged 71,032 boe/d before royalties (63,187 boe/d after royalties) within the annual guidance range of 70,000 to 72,000 boe/d before royalties (63,000 to 65,000 boe/d after royalties).

— Net loss of $259.1 million ($2.59/share) in 2018 includes $327.0 million of non-recurring charges relating to payments under terminated pipeline contracts, impairments on infrastructure investments, oil and gas assets and on the carrying values of investments in associates offset by the benefit of the reversal of provisions related to high-price clause. This compares to a net loss of $216.7 million ($2.17/share) in 2017 which included $27.2 million of non-recurring charges relating to impairments offset by the reversal of a provision related to high-price clause. Please refer to notes 7 and 26 of the consolidated financial statements for more detail.

— Operating EBITDA in 2018 increased by $28.7 million, or 7%, to $422.5 million compared to the prior year.

— Oil and gas sales and other revenue of $1.4 billion in 2018 were 15% higher compared to the prior year. Net sales for the year (including the impact of realized losses on risk management contracts, royalties, and diluent costs) decreased by 2% compared to 2017.

— Operating netback for 2018 was $25.98/boe, 14% higher than $22.79/boe in 2017.

— The company generated $312.0 million in cash provided by operating activities in the year compared to $314.4 million in the prior year, contributing to a strong balance sheet with a total cash position, including restricted cash, of $588.4 million as at December 31, 2018.

— Capital expenditures during 2018 were $446.1 million compared to $236.4 million in the prior year.

Dividends

— On December 5, 2018, the company’s Board of Directors declared a dividend, payable on January 17, 2019 of C$0.33 per share (approximately $25 million in aggregate), to common shareholders of record on January 3, 2019.

— On March 13, 2019, the company’s Board of Directors declared a dividend, payable on or about April 16, 2019 of C$0.165 (approximately $12.5 million in aggregate), to common shareholders of record on April 2, 2019.

2018 Guidance

The company achieved or exceeded its original 2018 guidance targets, with the exception of production guidance where it achieved revised guidance. Average production before royalties of 71,032 boe/d (within guidance range of 70,000 to 72,000 boe/d), operating EBITDA of $422.5 million (within guidance range of $400 to $450 million), capital expenditures of $446.1 million (within revised guidance range of $440 to $460 million, below original guidance of $450 to $500 million) and G&A expenses of $93.0 million (below revised guidance range of $95 to $105 million).

Richard Herbert, Chief Executive Officer of Frontera, commented:

“Frontera stabilized its core production base in 2018 as the company began enhancing the portfolio to deliver growth. As planned, we replaced over 100% of produced reserves in 2018, which was enabled by the completion of the Quifa water handling expansion project, as well as exploration successes at Alligator and Coralillo in the Guatiquia block and Jaspe in the Quifa North area. Significant investment in Colombia in 2018 has contributed to a strong start in 2019, particularly in the Quifa SW field with new water handling facilities in operation. In addition, after last year’s interruptions, production from Block 192 in Peru has recently restarted. As it returns to peak levels, total company production is the strongest it has been in over a year. With solid production and cash flow generation, we are executing a number of initiatives to drive production and reserves growth including; successfully being awarded two highly prospective blocks in an exploration bid round in Ecuador, and testing the deliverability of natural gas production from our Z-1 block, offshore Peru. We are also very excited by upcoming drilling on the VIM-1 block in Colombia and on the Corentyne block offshore Guyana later this year.”

Gabriel de Alba, Chairman of the Board of Directors of the Company, commented:

“Thanks to substantial progress by the Frontera team in 2018, the company is better positioned than ever to deliver returns to shareholders. With improved capital allocation and a plan to sustain production and reserves from our existing production base at current levels for the next five years – both of which we’re already delivering on – Frontera can generate sufficient cash flow to drive growth initiatives in the upstream business, as well as take steps to further enhance shareholder returns, as oil prices permit. Continuing on our progress in reducing G&A in 2018, we are pursuing additional opportunities to improve the efficiency and cost structure of the business, especially in the field, and to monetize non-core assets. These actions will generate additional cash flow and capital for growth and enhanced equity returns. Frontera is off to a positive start in 2019. Production is strong, Brent oil prices are averaging close to $63.00/bbl, in line with our guidance, and the company is currently benefiting from narrow oil price differentials.”

Financial Results

The average Brent oil benchmark price decreased in the fourth quarter of 2018 to an average of $68.60/bbl, down 9.5% from $75.84/bbl in the third quarter of 2018. Brent oil benchmark price averaged $61.46/bbl in the fourth quarter of 2017. The company’s realized oil price of $62.15/bbl in the fourth quarter of 2018 excludes the impact of $5.55/bbl of realized losses on risk management contracts.

During the fourth quarter of 2018, net loss attributable to equity holders of the company was $116.6 million ($1.17 /share), compared with net income of $45.1 million ($0.45/share) in the third quarter of 2018. The net loss primarily reflects several one-time items, including impairments on investments in associates, exploration expenses and payments under terminated pipeline contracts offset by the reversal of provisions related to high-price clause which in aggregate amounted to $143.9 million in the fourth quarter of 2018. Please refer to notes 7 and 26 of the consolidated financial statements for more detail.

For the fourth quarter of 2018, net sales of $228.4 million were 23.7% lower than the third quarter of 2018 reflecting lower sales price and volumes, and 25.5% lower than the fourth quarter of 2017 as a result of losses on risk management contracts and lower sales volumes partially offset by higher oil prices.

Cash used by operating activities was $3.5 million in the fourth quarter compared to cash provided by operating activities of $177.6 million in the third quarter of 2018, reflecting lower sales volumes and oil prices as well as one-time cash payments associated with the termination of pipeline contracts.

Operating EBITDA of $118.4 million in the fourth quarter of 2018 increased 26.7% in comparison with the third quarter of 2018, and was 13.5% higher than in the fourth quarter of 2017 as a result of a reversal of the overlift accumulated in the second and third quarters of 2018.

Frontera continued taking actions to improve its cost structure in the fourth quarter by completing a project to increase organizational efficiency and reduce costs. These efforts helped the company deliver lower G&A expenses of $21.8 million in the fourth quarter of 2018, a decrease of 4.9% from the third quarter of 2018, and a decrease of 10.7% from the fourth quarter of 2017. Going forward, the company will look to further improve operational efficiency to drive additional cost savings.

Production and Development Summary(1)

Current production before royalties is over 67,500 boe/d (over 63,000 boe/d after royalties), as production from Block 192 continues to ramp up following the repair of the NorPeruano pipeline. Production, before royalties in the fourth quarter of 2018 averaged 71,924 boe/d (63,898 boe/d after royalties), an increase of 8.3% compared with the third quarter of 2018. The increase in quarterly production was a result of increased production from Peru while the NorPeruano pipeline was in service during October and November, as well as increases from light, medium and heavy oil in Colombia. Production from Colombia increased 1.9% during the fourth quarter of 2018 compared with the previous quarter, as a result of increased production at the Quifa block following the completion of the water handling expansion project, as well as production from the Coralillo discovery on the Guatiquia block.

Sales volumes for the three months ended December 31, 2018, were 50,298 boe/d, 17.6% lower than the previous quarter, reflecting the settlement of an overlift of 809 Mbbl built up in the second and third quarters of 2018 and an increase in inventory in Colombia, resulting in lower volumes available for sale.

During the fourth quarter of 2018, total capital expenditures were $156.4 million, up 26.1% than the previous quarter and 40.6% from the fourth quarter of 2017. The increase during the fourth quarter relates to the construction of additional water handling facilities in the Quifa SW field and the testing costs associated with the Acorazado-1 exploration well on the Llanos 25 block in Colombia. Additionally, Colombian exploration wells were drilled at Jaspe and Sabanero as well as two development wells at Zopilote Sur on the Cravo Viejo block.

A total of 29 wells were drilled in the fourth quarter of 2018, slightly lower than the 31 wells planned, as the Cocodrilo exploration well was deferred with the new acreage awarded at the Coralillo field on the Guatiquia block. Twenty-two heavy oil development wells and two water injection wells were drilled in the Quifa SW area in connection with the increased fluid handling capacity that was initiated during the fourth quarter. Three light oil development wells were drilled with two on the Candelilla field on the Guatiquia block and one at the Zopilote Sur field on the Cravo Viejo block. The company also completed the drilling of two exploration wells, Jaspe 7D in the Quifa North area and the Chaman well on the Sabanero block. Additionally, four of five planned water injection wells were converted from producing wells on the Neiva and Orito blocks.

During the first quarter of 2019, the company plans to drill 28 wells including 23 development wells in the Quifa SW area, two development wells in its light and medium oil areas, two exploration wells, and a conversion of an existing well to a water injection well at Orito. The company is targeting to keep seven rigs active throughout the first quarter of 2019.

2018 Reserves:

For the year ended December 31, 2018, the company’s reserves were independently evaluated by DeGolyer and MacNaughton (D&M), in accordance with the definitions, standards and procedures contained in the Canadian Oil and Gas Evaluation Handbook maintained by the Society of Petroleum Evaluation Engineers (Calgary Chapter) (COGEH) and – National Instrument 51-101 Standards for Disclosure of Oil and Gas Activities (NI 51-101) and are based on the company’s 2018 year-end estimated reserves as evaluated by D&M in their reserves report dated February 25, 2019 with an effective date of December 31, 2018 (the Reserves Report). See Advisory Note regarding Oil and Gas Information.

The company’s proved plus probable reserves before royalties of 170.5 MMboe (154.9 MMboe after royalties) for the year ended December 31, 2018. This compares with 172.7 MMboe of proved plus probable reserves before royalties (154.3 MMboe after royalties) for the year ended December 31, 2017. Proved reserves of 104.8 MMboe for the year ended December 31, 2018 represent 68% of the total proved plus probable reserves compared with 74% of the total proved plus probable reserves for the year ended December 31, 2017.

The following table provides a summary of the company’s oil and natural gas reserves based on forecast prices and costs effective December 31, 2018 as applied in the Reserves Report. The company’s net reserves after royalties incorporate all applicable royalties under Colombia and Peru fiscal legislation based on forecast pricing and production rates evaluated in the Reserves Report, including any additional participation interest related to the price of oil applicable to certain Colombian blocks, as at year-end 2018.

Fourth Quarter and Year End 2018 Conference Call Details:

As previously disclosed, a conference call for investors and analysts will be held on Thursday, March 14, 2019 at 8:00 a.m. (MDT), 9:00 a.m. (GMT-5) and 10:00 a.m. (EDT). Participants will include Gabriel de Alba, Chairman of the Board of Directors, Richard Herbert, Chief Executive Officer, David Dyck, Chief Financial Officer and select members of the senior management team.

Analysts and investors are invited to participate using the following dial-in numbers:

| Participant Number (International/Local): | (647) 427-7450 |

| Participant Number (Toll free Colombia): | 01-800-518-0661 |

| Participant Number (Toll free North America): | (888) 231-8191 |

| Conference ID: | 7391259 |

| Webcast Audio: | www.fronteraenergy.ca |

A replay of the conference call will be available until 10:59 p.m. (GMT-5) and 11:59 p.m. (EDT) Thursday, March 28, 2019 and can be accessed using the following dial-in numbers:

| Encore Toll Free Dial-in Number: | 1-855-859-2056 |

| Local Dial-in Number: | (416)-849-0833 |

| Encore ID: | 7391259 |

***