(GoldHaven, 5.Jan.2023) — GoldHaven Resources Corp. (CSE: GOH) (OTCQB: GHVNF) (FSE: 4QS) entered into a Letter of Intent (the “LOI”) dated December 21, 2022, to assess a Plan of Arrangement (the “POA”) with Oro Atacama SpA, a private Chilean mining group with three properties (India Coya, Los Sapos, Pepita) – two of which are at an advanced-stage of exploration with a clear path to gold production. All are located within Chile’s Atacama region and in close proximity to GoldHaven’s existing project portfolio in the Maricunga.

According to the POA, GoldHaven Resources Corp. will incorporate a wholly owned subsidiary, Oro Atacama Minerals Corp., which will acquire all of the outstanding common shares of Oro Atacama SpA, as well those of GoldHaven’s existing subsidiaries, GoldHaven Resources Chile SpA and 1243461 B.C. Ltd., which hold all of GoldHaven’s Chilean properties (including Roma & Alicia).

Pursuant to the POA, GoldHaven and Oro Atacama SpA shall settle and execute the definitive acquisition and arrangement agreements and upon satisfactory regulatory review, the transaction will close and the common shares of Oro Atacama Minerals Corp. shall commence trading on the CSE as a separate company.

Upon closing of the transaction, GoldHaven shareholders will receive one share of Oro Atacama Minerals Corp. for every “x” shares of GoldHaven held as of the share distribution record date which will be announced in a forthcoming news release – “x” is to be determined as part of the transaction process. Barring any unforeseen delays it is expected that this transaction could take up to 4-5 months to complete.

Oro Atacama Minerals Corp.: Chilean-Focused Gold Production and Exploration

Upon closing of the proposed POA, Oro Atacama Minerals Corp. will hold a 100% interest in GoldHaven’s Chilean exploration portfolio (see Figure 2) as well as Oro Atacama’s India Coya, Los Sapos, and Pepita production/exploration properties and will become a premium vehicle for early-stage exploration and small-scale gold production in Chile.

Following completion of the POA, GoldHaven Resources Corp. will continue to trade on the CSE and remain focused on advancing exploration at Smoke Mountain, located in the Central British Columbia Porphyry-Epithermal Belt and Pat’s Pond located in the Central Newfoundland Gold Belt. Both properties have shown promising early exploration data. GoldHaven will also actively evaluate additional Canadian exploration opportunities.

GoldHaven’s Current Land Positions in Chile

GoldHaven Resources Corp. currently owns 100% interest in 7 different properties (totalling over 250km2) in the Maricunga Gold Belt of Northern Chile. The Company’s highly skilled technical team has identified a total of 12 epithermal gold +/- silver exploration targets at its Alicia and Roma project areas which are located within a prominent regional NW-SE structural trend along strike from Gold Fields’ Salares Norte deposit (2021 probable reserves: 20.7Mt @ 5.2g/t gold [3.5Moz], 58.4g/t silver [39Moz]1).

India Coya: Most Advanced (55 Hectares)

India Coya consists of a gold-copper vein system, with a general NS strike, hosted in a Cretaceous aged intrusion (granodiorite). The property is located 25km south of Copiapó and 5km from Route 5 (Pan-American Highway).

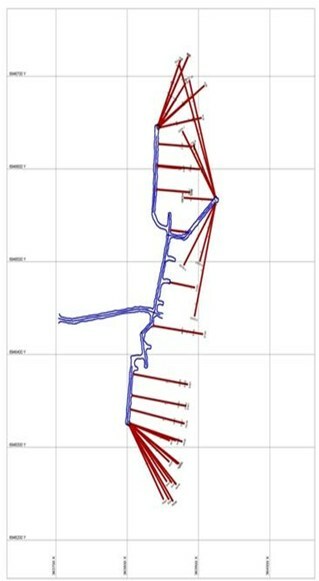

To date, an extensive 8,000 metre drill campaign has been completed (2012-2014) from the interior of the mine. To execute this campaign, 15 drilling platforms were constructed, and holes were drilled in a fan-like distribution (Figure 5).

Results from this drilling confirm the presence of a Principal Structure that aligns mineralization and has identified at least three mineralized lenses. The largest of these lenses being 201 metres long, 150 metres high and with an average width of 3.11 metres in width.

Los Sapos: Robust Grades & High Accessibility (229 Hectares)

Located 70km south of Copiapó, and 15km from Route 5, Los Sapos is situated in a district containing auriferous quartz veins where gold content ranges between below detection and 20.0 g/t2. There are three main veins on the property, the largest is continuous for 2.5 km and the other two are 0.5 and 1 km long, respectively. There are several smaller veins which are continuous from between 100 and 250 metres along strike.

To date, two drill campaigns have been completed totalling 3,400 metres of drilling and focused in the northern part of the property (~30% of the vein area).

Pepita: Under-explored Vein System

Pepita is a vein system with 500 metres of strike length that ranges between 2 and 5 metres in thickness. The vein system is oriented north-south and dips 70° toward the East. Limited exploration has been performed at Pepita to date.

Raul Dagnino, President of Oro Atacama SpA, is also President of Terraservice, a private Chilean company that provides drilling services for a number of mining and exploration companies. Raul has many years of experience in drilling and exploration in the Atacama region of Chile.

Raul comments, “This proposed strategic transaction combining Oro Atacama’s advanced stage exploration projects with GoldHaven’s longer term opportunity for larger ore discoveries is a formidable step towards unlocking the most value in Chile for both companies. I look forward to working with Justin and his team at GoldHaven to move through the due diligence process as quickly as possible and to work towards achieving our ultimate goals of fast-tracking production, generating positive cash flow and maximizing shareholder value.”

According to GoldHaven CEO, Justin Canivet, “It has always been a central focus of mine to deliver as much shareholder value as possible in Chile for GoldHaven shareholders. I am thrilled to be moving forward with Oro Atacama and our proposal to create a new and exciting gold junior with advanced stage exploration projects that have the potential to be fast tracked towards production and provide much needed cash flow. This cash flow will help fund further exploration campaigns at GoldHaven’s previously identified high priority drill targets in the Maricunga.”

Details Of Proposed Plan of Arrangement

Oro Atacama Minerals Corp. shall complete a pre-POA financing to cover transactional working capital via the issuance of 625,000 special warrants (the “Special Warrant”) at $0.40 per Special Warrant raising gross proceeds of $250,000. The Special Warrants shall be automatically exercised during the execution of the POA.

Concurrent with the close of the POA, the Company shall settle consulting fees of $468,750 due and owing at that time by the issuance of 937,500 shares.

GoldHaven and Oro Atacama SpA will also prepare the requisite technical report(s), financial statements and MD&As, audit reports, fairness opinions and additional disclosure for stock exchange review and acceptance.

Once the CSE provides its conditional approval of the proposed transaction, GoldHaven shall then apply to the Supreme Court of British Columbia for an interim court order to hold a general meeting of GoldHaven shareholders to approve the POA.

Upon the grant of such interim order, both GoldHaven and Oro Atacama shall hold general meetings for shareholder approval of the POA.

During the foregoing, GoldHaven and its financing engagement team shall secure an additional $2,000,000 in financing through the offering of 4,000,000 common shares of Oro Atacama Minerals Corp. at the price of $0.50 per common share to be held in trust by GoldHaven or a registered securities dealers pending the POA closing. Funds will be used to get production started at India Coya and Los Sapos and to continue with further surface trenching and geochem analysis at Alicia and Roma where GoldHaven has already identified 12 high priority targets.

Upon shareholder approval, GoldHaven will obtain the final court order to complete the transaction.

This distribution of the Oro Atacama Minerals Corp. shares to GoldHaven shareholders shall be based on a ratio to be calculated by dividing (i) a majority percentage of the number of Oro Atacama Minerals Corp. shares that will be issued to GoldHaven for the purchase by Oro Atacama Minerals Corp. of GoldHaven’s two Chilean property holding companies by (ii) the number of GoldHaven common shares outstanding as of the scheduled record date for the distribution of such Oro Atacama Minerals Corp. shares.

Upon the completion of GoldHaven’s $2,000,000 financing GoldHaven will present the final court order and its updated applications for the approval of Oro Atacama Minerals Corp.’s listing on the CSE.

Following shareholder approval, court order approval and CSE approval, the parties shall complete the Acquisition.

No assurance can be given at this time that the proposed POA will be completed, that the conditions to closing will be satisfied or that the terms of the Plan of Arrangement will not change materially from those described in this news release.

The details of the Acquisition will be provided in the management information circular, which will be mailed to the shareholders of GoldHaven and will be available on www.sedar.com under the profile of GoldHaven.

The Letter of Intent is binding insofar as confidentiality and exclusivity only.

About GoldHaven Resources Corp.

GoldHaven Resources Corp. is a Canadian junior precious metals exploration Company focused on acquiring and exploring highly prospective land packages in both Canada and Chile. GoldHaven maintains a strategic presence in the gold and silver rich Maricunga Gold Belt of Northern Chile which is host to several mining and advanced exploration projects including Salares Norte (Gold Fields), Esperanza (Kingsgate Consolidated), La Coipa (Kinross), Cerro Maricunga (Fenix Gold), Lobo-Marte (Kinross), Volcan (Volcan), Refugio (Kinross/Bema), Caspiche (Goldcorp/Barrick), and Cerro Casale (Goldcorp/Barrick). The Company has identified a total of 12 high-priority targets at its Alicia and Roma project areas in the Maricunga within a prominent regional NW-SE structural trend along strike from Gold Fields’ Salares Norte deposit (21.1Mt at 5.1g/t gold and 57.9g/t silver for 3.5Moz of gold1). These targets have been designated “High Priority” due to the extent, pervasive alteration, favourable geology, highly anomalous rock geochemical results, and their relative proximity to existing deposits.

GoldHaven is also making exploration progress in Canada at its Smoke Mountain property which is located in the Central British Columbia Porphyry-Epithermal Belt in close proximity to Surge Copper’s Berg project, as well as at its Pat’s Pond project in Newfoundland’s Central Newfoundland Gold Belt. Pat’s Pond is located less than 20km from Marathon Gold’s 3.14 Moz3 Valentine Gold Project and on strike from the Boomerang/Domino VMS deposit. Pat’s Pond is highly prospective for gold, copper, silver and zinc and has large scale discovery potential. GoldHaven engages proactively with local and Indigenous rights holders and seeks to develop relationships and agreements that are mutually beneficial to all stakeholders.

Daniel McNeil is the Qualified Person as defined under NI 43-101 who has reviewed and approved the contents of this release pertaining to the projects held by GoldHaven Resources Corp.

About Oro Atacama SpA

Oro Atacama is a private company focused on the development of base and precious metal deposits near Copiapo Chile, generated as a result of years of active geological exploration by numerous qualified geologists.

Two of Oro Atacama’s projects, India Coya and Los Sapos, are in an advanced stage of exploration, having significant data generated from which include geology, geophysics, geochemistry, exploration drilling and inferred resources. The company’s third project, Pepita, is at an earlier stage of exploration complete with geology, surface sampling, development of geological concepts, geochemistry and/or geophysics. All are important exploration targets with near-term potential for production.

Oro Atacama has a 100% legal and beneficial interest in all of its mining claims and all of their claims are fully permitted for exploration and exploitation.

Enrique Viteri Aldunate is the Qualified Person as defined under NI 43-101 who has reviewed and approved the contents of this release pertaining to the projects held by Oro Atacama SpA.

Note: The deposits/mines near GoldHaven’s properties provide geologic context, but this is not necessarily indicative that GoldHaven properties host similar grades or tonnages of mineralization.

____________________