(Cheniere, 23.Feb.2023) — Cheniere Energy Partners, L.P. (NYSE American: CQP) announced its financial results for fourth quarter and full year 2022.

HIGHLIGHTS

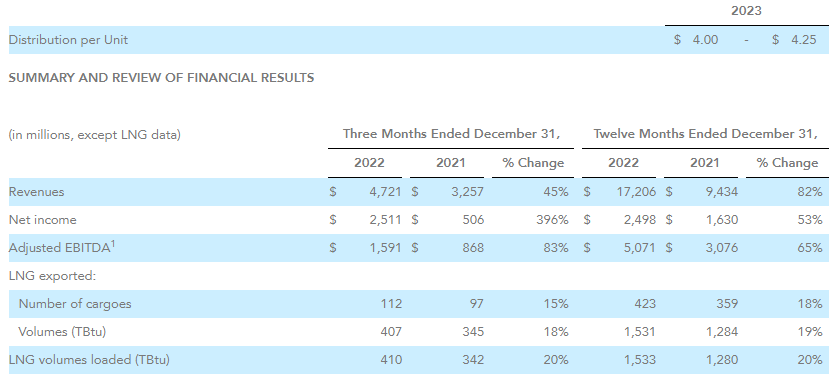

- For the three and twelve months ended December 31, 2022, Cheniere Partners generated revenues of $4.7 billion and $17.2 billion, respectively, net income of $2.5 billion and $2.5 billion, respectively, and Adjusted EBITDA1 of $1.6 billion and $5.1 billion, respectively.

- Declared a cash distribution of $1.07 per common unit to unitholders of record as of February 6, 2023, comprised of a base amount equal to $0.775 and a variable amount equal to $0.295. The common unit distribution and the related general partner distribution was paid on February 14, 2023.

- Introducing full year 2023 distribution guidance of $4.00 – $4.25 per common unit.

- In February and October 2022, respectively, substantial completion was achieved on Train 6 of the SPL Project (defined below) and the third marine berth at the Sabine Pass LNG Terminal.

- In November 2022, Cheniere Partners achieved its second investment grade issuer rating from S&P Global Ratings as a result of an upgrade from BB+ to BBB with a stable outlook.

- In February 2023, certain subsidiaries of Cheniere Partners initiated the pre-filing review process with the Federal Energy Regulatory Commission (“FERC”) under the National Environmental Policy Act for the SPL Expansion Project (defined below).

Adjusted EBITDA1 increased $0.7 billion and $2.0 billion during the three and twelve months ended December 31, 2022, respectively, as compared to the three and twelve months ended December 31, 2021. The increase in Adjusted EBITDA was primarily due to increased margins per MMBtu of LNG and increased volumes of LNG delivered. Adjusted EBITDA was also positively impacted by the recognition of the $765 million lump-sum payment made by Chevron U.S.A. Inc. throughout the six months ended December 31, 2022 related to the previously announced early termination of the Terminal Use Agreement (“TUA”) between Sabine Pass LNG, L.P. and Chevron.

Net income increased $2.0 billion and $0.9 billion during the three and twelve months ended December 31, 2022, respectively, as compared to the three and twelve months ended December 31, 2021. The increase during the three months ended December 31, 2022 was primarily due to non-cash favorable changes in fair value of commodity derivatives, increased margins per MMBtu of LNG, increased volumes of LNG delivered and the recognition of the remaining proceeds of the lump-sum payment related to the early termination of the TUA with Chevron. The increase during the twelve months ended December 31, 2022 was primarily due to increased margins per MMBtu of LNG and increased volumes of LNG delivered, the Chevron TUA payment, and was partially offset by non-cash unfavorable changes in fair value of commodity derivatives.

Substantially all derivative gains (losses) are attributable to the recognition at fair value of our long-term Integrated Production Marketing (“IPM”) agreement with Tourmaline Oil Marketing Corp., a natural gas supply contract with pricing indexed to the Platts Japan Korea Marker (“JKM”). Our IPM agreement is structured to provide stable margins on purchases of natural gas and sales of LNG over the life of the agreement and has a fixed fee component, similar to that of LNG sold under our long-term, fixed fee LNG SPAs. However, the long-term duration and international price basis of our IPM agreement makes it particularly susceptible to fluctuations in fair market value from period to period. In addition, accounting requirements prescribe recognition of this long-term gas supply agreement at fair value, but does not currently permit fair value recognition of the associated sale of LNG, resulting in a mismatch of accounting recognition for the purchase of natural gas and sale of LNG. As a result of the significant volatility in the forward JKM curves during the three and twelve months ended December 31, 2022, we recognized approximately $1.4 billion and $(0.8) billion, respectively, of non-cash favorable (unfavorable) changes in fair value attributable to the Tourmaline IPM agreement.

During the three and twelve months ended December 31, 2022, we recognized in income 410 TBtu and 1,520 TBtu, respectively, of LNG loaded from the SPL Project. Additionally, in the year ended December 31, 2022, approximately 13 TBtu of commissioning LNG was exported from the SPL Project.

BALANCE SHEET MANAGEMENT

Capital Resources

As of December 31, 2022, our total available liquidity was approximately $2.6 billion. We had cash and cash equivalents of approximately $0.9 billion. In addition, we had current restricted cash and cash equivalents of $92 million, $750 million of available commitments under our CQP Credit Facilities, and $872 million of available commitments under the Sabine Pass Liquefaction, LLC (“SPL”) Working Capital Facility.

Recent Key Financial Transactions and Updates

In November and December 2022, SPL issued an aggregate principal amount of $500 million of Senior Secured Amortizing Notes due 2037, the proceeds of which, together with cash on hand, were used to redeem the remaining outstanding amount of SPL’s 5.625% Senior Secured Notes, subsequent to the $300 million redemption in October 2022.

SABINE PASS OVERVIEW

We own natural gas liquefaction facilities consisting of six liquefaction Trains, with a total production capacity of approximately 30 million tonnes per annum (“mtpa”) of LNG at the Sabine Pass LNG terminal in Cameron Parish, Louisiana (the “SPL Project”).

As of February 17, 2023, approximately 1,990 cumulative LNG cargoes totaling over 135 million tonnes of LNG have been produced, loaded, and exported from the SPL Project.

SPL Expansion Project

We are developing an expansion adjacent to the SPL Project consisting of up to three natural gas liquefaction trains with an expected total production capacity of approximately 20 mtpa of LNG (the “SPL Expansion Project”). In February 2023, certain of our subsidiaries initiated the pre-filing review process with the FERC.

DISTRIBUTIONS TO UNITHOLDERS

In January 2023, we declared a cash distribution of $1.07 per common unit to unitholders of record as of February 6, 2023, comprised of a base amount equal to $0.775 ($3.10 annualized) and a variable amount equal to $0.295, which takes into consideration, among other things, amounts reserved for annual debt repayment and capital allocation goals, anticipated capital expenditures to be funded with cash, and cash reserves to provide for the proper conduct of the business. The common unit distribution and the related general partner distribution was paid on February 14, 2023.

INVESTOR CONFERENCE CALL AND WEBCAST

Cheniere Energy, Inc. will host a conference call to discuss its financial and operating results for fourth quarter and full year 2022 on Thursday, February 23, 2023, at 11 a.m. Eastern time / 10 a.m. Central time. A listen-only webcast of the call and an accompanying slide presentation may be accessed through our website at www.cheniere.com. Following the call, an archived recording will be made available on our website. The call and accompanying slide presentation may include financial and operating results or other information regarding Cheniere Partners.

| _________________ |

| 1 Non-GAAP financial measure. See “Reconciliation of Non-GAAP Measures” for further details. |