VANCOUVER, BRITISH COLUMBIA (By Vizsla, 19.Nov.2025, Words: 934) — Vizsla Silver Corp. announces its intention to offer convertible senior unsecured notes due 2031 in an aggregate principal amount of $250mn.

The company expects to grant the initial purchasers of the notes an option for a period of 13 days, beginning on, and including the date on which the notes are first issued, to purchase up to an additional $50mn aggregate principal amount of notes.

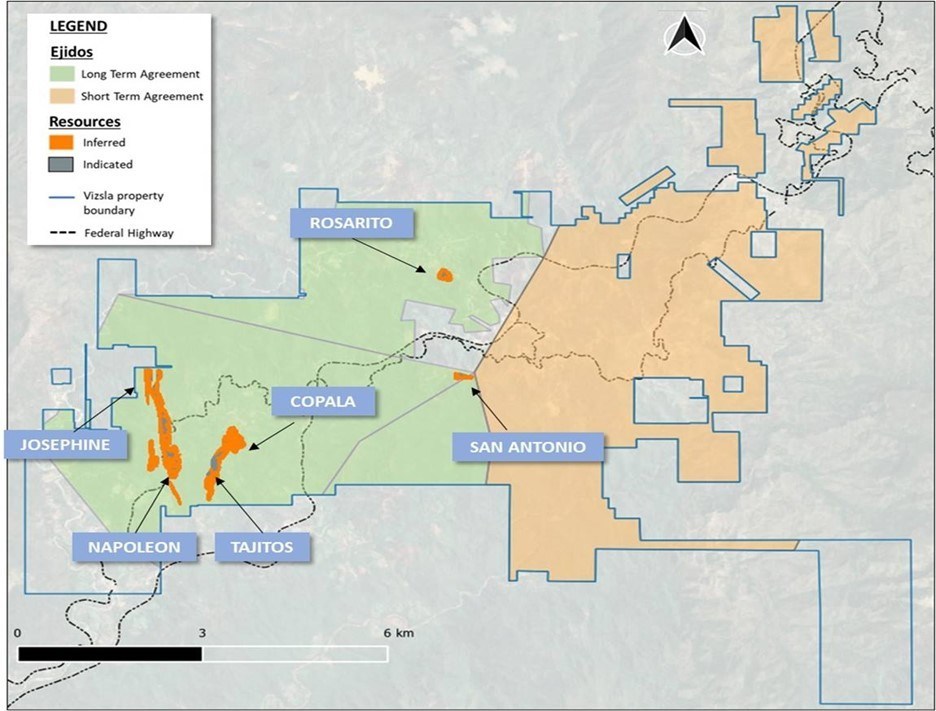

The company intends to use the net proceeds from the offering to support the exploration and development of the Panuco project, potential future acquisitions, as well as for general corporate purposes. Additionally, the company intends to pay the purchase price for the capped call transactions with a portion of the net proceeds from the offering or from existing cash on hand. If the initial purchasers exercise their option to purchase additional notes, the company expects to use a portion of the net proceeds from the sale of the additional Notes to enter into additional capped call transactions with the capped call counterparties and the remaining net proceeds for general corporate purposes.

The notes

The notes will be senior unsecured obligations of the company and will accrue interest at a rate payable semi-annually in arrears on 15 Jan. and 15 Jul. of each year, beginning on 15 Jul. 2026, and will be convertible into common shares of the company, cash or a combination of shares and cash, at the company’s election. The notes will mature on 15 Jan. 2031, unless earlier converted, redeemed or repurchased. Prior to 15 Oct. 2030, the notes will be convertible only under certain circumstances, and thereafter, the notes will be convertible at any time until the close of business on the second scheduled trading day immediately preceding the maturity date.

The interest rate, the initial conversion rate and other terms of the notes will be determined by the company and the initial purchasers and will depend on market conditions at the time of pricing of the offering. The company will have the right to redeem the notes in certain circumstances, and holders will have the right to require the company to repurchase their notes upon the occurrence of certain events.

Capped call transactions

In connection with the offering, the company expects to enter into privately negotiated cash-settled capped call transactions with one or more of the initial purchasers of the notes, their respective affiliates and/or other financial institutions (the “capped call counterparties”). The capped call transactions will cover, subject to anti-dilution adjustments substantially similar to those applicable to the Notes, the number of shares that will initially underlie the Notes. The capped call transactions are expected generally to compensate (through the payment of cash to the company) for potential economic dilution upon conversion of the notes and/or offset any cash payments that the company could be required to make in excess of the principal amount of any converted notes upon conversion thereof, as the case may be, with such compensation and/or offset subject to a cap.

In connection with establishing their initial hedges of the capped call transactions, the company expects the capped call counterparties or their respective affiliates to enter into various derivative transactions with respect to the shares and/or purchase shares concurrently with, or shortly after, the pricing of the notes, including with, or from, as the case may be, certain investors in the notes. This activity could increase (or reduce the size of any decrease in) the market price of the shares or the notes at that time.

In addition, the capped call counterparties or their respective affiliates may modify their hedge positions by entering into or unwinding various derivatives with respect to the shares and/or purchasing or selling the shares or other of the company’s securities in secondary market transactions following the pricing of the notes and prior to the maturity of the note (and are likely to do so during the 45 trading day period beginning on the 46th scheduled trading day prior to the maturity date of the Notes and, to the extent the company exercises the relevant election under the capped call transactions, following any earlier conversion, redemption or repurchase of the notes). This activity could also cause or avoid an increase or a decrease in the market price of the shares or the notes, which could affect a noteholder’s ability to convert the notes and, to the extent the activity occurs during any observation period related to a conversion of the notes, it could affect the number of shares and value of the consideration that noteholders will receive upon conversion of the notes.

The offering is subject to certain conditions including, but not limited to, the receipt of all necessary approvals, including the approval of the Toronto Stock Exchange and the NYSE American, and there can be no assurance as to whether, when or on what terms the offering may be completed.

The notes and the shares issuable upon the conversion thereof have not been and will not be registered under the US Securities Act of 1933, as amended), registered under any state securities laws, or qualified by a prospectus in any province or territory of Canada. The notes and the shares may not be offered or sold in the US absent registration under the Securities Act or an applicable exemption from registration under the Securities Act. The notes will be offered only to “qualified institutional buyers” (as defined in Rule 144A under the Securities Act). Offers and sales in Canada will be made only pursuant to exemptions from the prospectus requirements of applicable Canadian provincial and territorial securities laws.

____________________