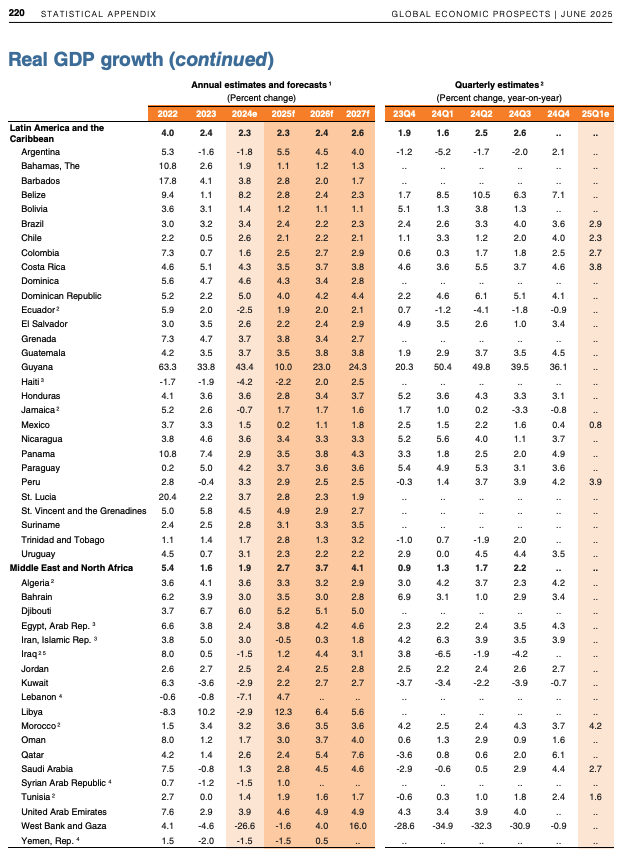

HOUSTON, TEXAS (By Ofelia Paredes, Energy Analytics Institute, 6.Aug.2025, Words: 527) — “Rising trade barriers and heightened uncertainty globally are weighing on activity in Latin America and the Caribbean (LAC), particularly through exports, investment, remittances, and confidence channels,” the World Bank Group announced in a recent report.

Other highlights from the “Global Economic Prospects” Jun. 2025 report published on 6 Aug. 2025 and related to the LAC region include:

RELATED: Sheinbaum says Plan Pemex 2025-2035 envisions higher production and lower debt [pdf download]

— “Mexico, the LAC region’s second-largest economy, has been the most directly affected, with 25% tariff on non-United States-Mexico-Canada-Agreement (USMCA)-compliant imports into the United States. … Eight percent of Mexico’s goods exports go to the United States, heightening its vulnerability to shifting US trade policy.”

— “Mexico is most vulnerable to a slowdown via its large manufacturing exports to the United States, which are part of tightly linked North American supply chains.”

RELATED: YPF and Eni take a new step in the development of the Argentina LNG project

— “Other major LAC economies, such as Argentina and Brazil, have been less impacted than Mexico because their share of exports to the United States is much smaller and then do not have the same tight manufacturing links.”

— “In LAC, although growth is expected to remain at the same pace in 2025 as in 2024, activity in many economies is likely to be impacted by the recent rise in trade barriers and policy uncertainty. Mexico will be particularly affect, largely through its high integration with the United States via goods’ trade — particularly the automotive sector. Other LAC economies, particularly those in Central America and the Caribbean, will also be affected through trade, investment, and remittance flows. These drags on LAC’s growth are expected to offset the rebound in Argentina following two years of recession.”

RELATED: TotalEnergies divests interest in 2 Vaca Muerta blocks to YPF for $500mn

— “Oil exporters such as Colombia, Ecuador and Guyana could benefit on the margin from trade diversion. For most other products, the region is unlikely to see gains from tariff-induced trade diversion toward China or other countries but instead will be weighed down by the dampening effect of uncertainty.”

— “Growth in the Caribbean economies is project to remain solid, reflecting Guyana’s continuing oil boom, with aggregate GDP expanding by 3.9% in 2025 and 6.2% on average in 2026-27.”

— “Falling oil prices have complicated government finances in Colombia, Ecuador and Mexico — and especially in Colombia, where the central government’s budget deficit widened in 2024 and worsened further at the start of this year.”

RELATED: Pemex’ 1.6 MMb/d production falling short, very short

— “Some countries, notably Brazil and Jamaica, also face tariffs on US-bound steel and aluminum exports.”

— “Colombia’s growth is projected to firm to 2.5% in 2025 and 2.8% on average in 2026-27, driven by private investment, supports by easing monetary conditions as inflation continues to moderate.”

RELATED: Iberdrola to divest businesses in Mexico for $4.2bn

RELATED: ExxonMobil says 4th FPSO offshore Guyana related to Yellowtail arrives next week

RELATED: Frontera and CGX call on Guyana government to resolve issues around Corentyne block license

___________________

By Ofelia Paredes reporting from Houston. © 2025 Energy Analytics Institute (EAI). All Rights Reserved.