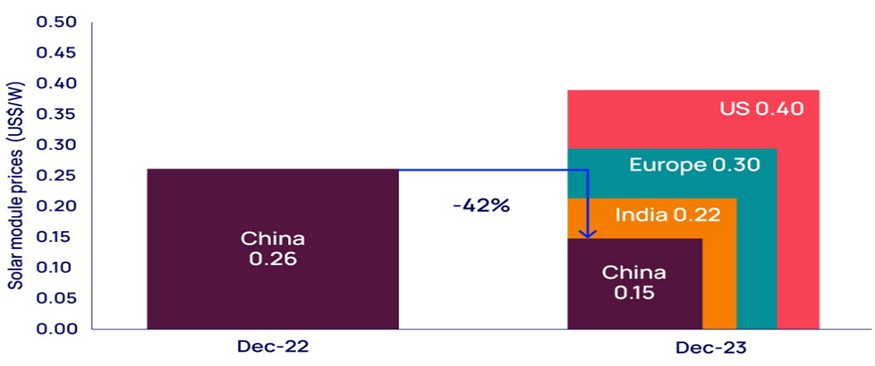

(WoodMac, 14.Dec.2023) — The cost of producing solar modules in China has dropped by 42% in the last 12 months to US$0.15 per watt (/W) giving manufacturers in the country an enormous cost advantage over international rivals according to a new Horizons report from Wood Mackenzie.

The report: ‘Top of the charts: ‘Five low-carbon tech trends worth tracking’ looks at five key charts and identifies some key underlying trends across the low-carbon landscape.

Alongside the fall in Chinese solar hardware costs the report looks at the meteoric rise of renewable energy, the efforts being made to diversify battery raw materials supply, the progress of carbon capture and storage and the growth of domestic heat pumps.

“With delegates at COP28 making a commitment to phase out fossil fuels, these five charts highlight the vital importance of all facets of the energy transition process,” says co-author Dr Steven Knell, Vice President, Power & Renewables at Wood Mackenzie.

“The charts [in the report] show the progress that is being made, but also underline how much still needs to be done,” Knell said.

The report also states that policy is widening to support the build-out of domestic supply chains for low-carbon technologies and to develop new sources of critical minerals to reduce global dependence on China. While in some cases such as Chinese solar module production, costs are coming down, in others they will remain high.

“The charts contained in the report indicate the global scale of the energy transition process and identifies some of the challenges,” says co-author Malcolm Forbes-Cable, Vice President, Upstream and Carbon Management Consulting.

“With US$70 billion needed to be invested in global CCUS [Carbon Capture, Utilisation and Storage] transport and sequestration infrastructure before 2030, the financial implications alone will require global solutions,” Forbes-Cable said.

Solar module prices1 by manufacturing location

As the world’s solar module powerhouse, China commands 80% of global manufacturing capacity and this is being reflected in soaring domestic installations. This year its domestic solar additions will be double those of the US and the EU combined.

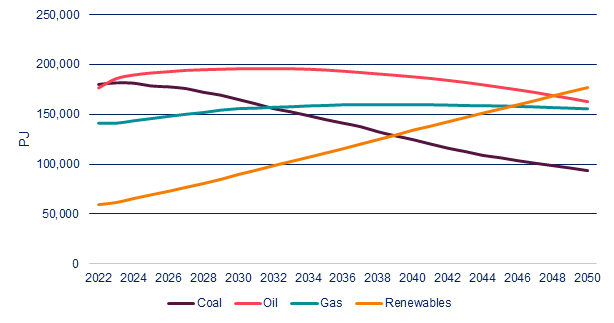

Total primary energy supply in petajoules (PJ)

The renewables success story continues to gather pace, led by the rapid growth of wind and solar. By 2050, they will account for more than 50% of the global power supply. The last decade has witnessed a transformation in power generation, with renewables delivering low-cost power at scale.

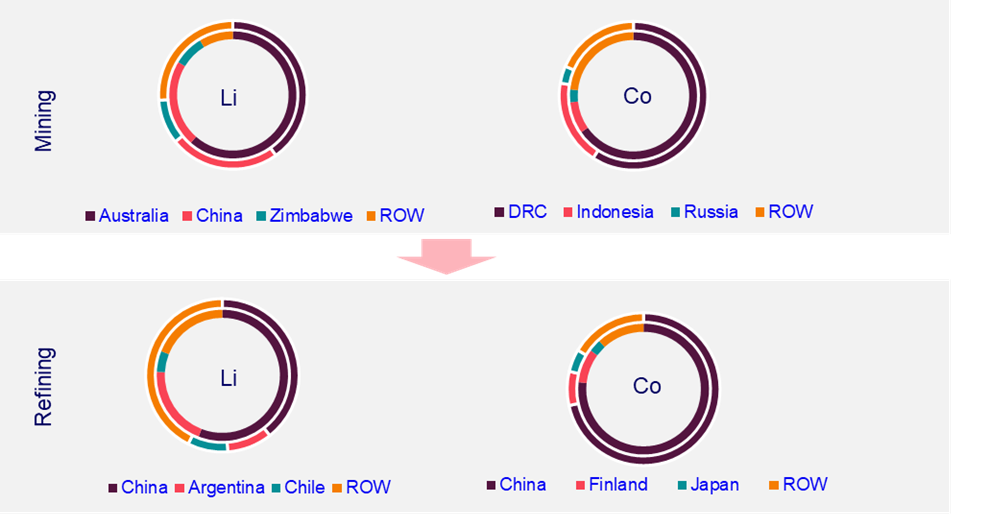

Lithium and cobalt mining and refining market 2023 (inner) to 2035 (outer)

Lithium and cobalt are compelling examples of the potential for a redistribution of the supply base. Thanks to price signals that are driving new investments and expanded capacity, the future value chains for base metals and battery raw materials will be both deeper and broader.

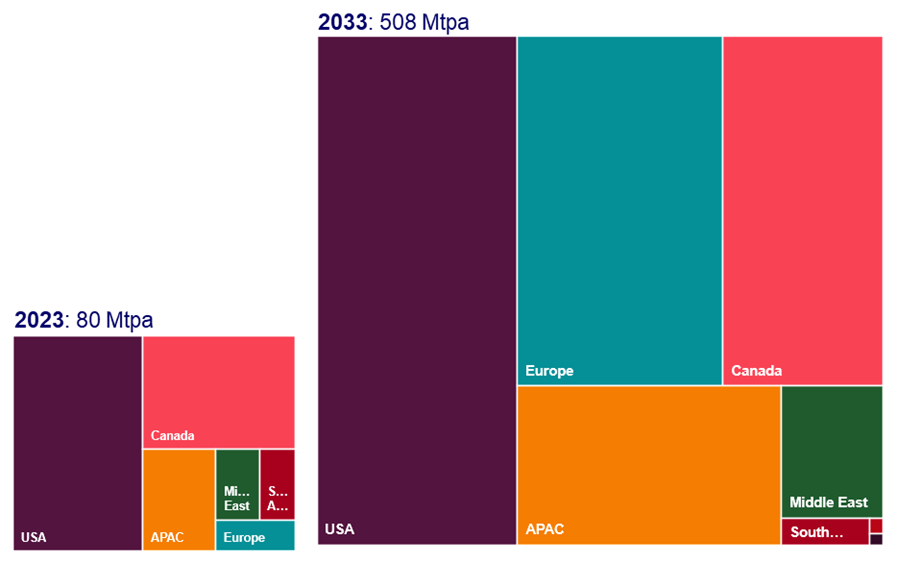

CO2 operational storage capacity 2023 to 2033 (Mtpa)

The next decade will see CCUS capacity rise from 80 million tonnes per annum (Mtpa) to 500 Mtpa as changing support and regulation inject significant momentum into the sector.

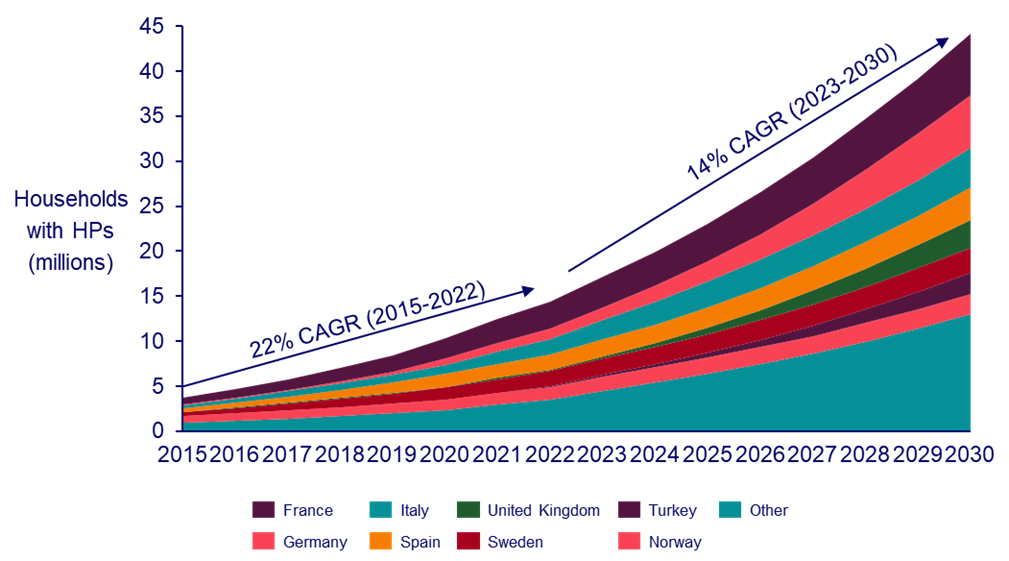

Installed European residential heat pumps, 2015 to 2030

The booming heat pump sector in Europe as further evidence that the shift to low-carbon alternatives across all sectors is gathering pace. Year-on-year growth is expected to be 14%, while connections of air- and ground-source heat pumps are breaking records.

____________________