(Talos Energy, 24.Feb.2022) — Talos Energy Inc. (NYSE: TALO) announced its operational and financial results for the fourth quarter and full year 2021. The company also announced its year-end 2021 reserves figures as well as 2022 operational and financial guidance.

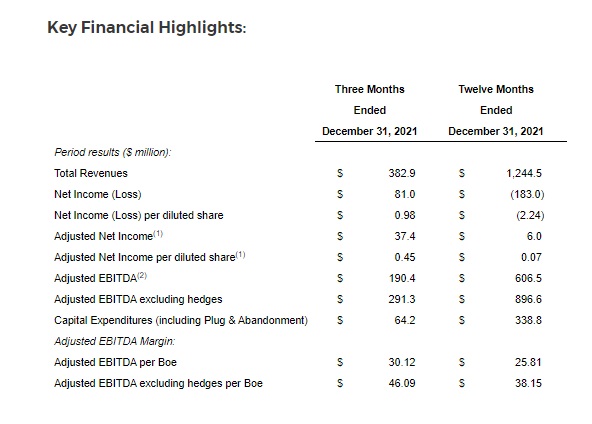

Fourth Quarter 2021 Highlights:

- Production of 68.7 thousand barrels of oil equivalent per day (“MBoe/d”) (69% oil, 77% liquids)

- Net Income of $81.0mn, or $0.98 Net Income per diluted share, and Adjusted Net Income(1) of $37.4mn, or $0.45 Adjusted Net Income per diluted share

- Adjusted EBITDA(1) of $190.4mn, or $30.12 Adjusted EBITDA per Boe; Adjusted EBITDA excluding hedges of $291.3mn, or $46.09 per Boe

- Capital Expenditures of $64.2mn, inclusive of plugging and abandonment

- Free Cash Flow(1) (before changes in working capital) of $93.0mn

Full Year 2021 Highlights:

- Production of 64.4 MBoe/d (69% oil, 77% liquids)

- Net Loss of $183.0mn, or $2.24 Net Loss per diluted share, and Adjusted Net Income(1) of $6.0mn, or $0.07 Adjusted Net Income per diluted share(1)

- Adjusted EBITDA(1) of $606.5mn, or $25.81 Adjusted EBITDA per Boe; Adjusted EBITDA excluding hedges of $896.6mn, or $38.15 per Boe

- Capital Expenditures of $338.8mn, inclusive of plugging and abandonment, equating to 56% of Adjusted EBITDA (“Reinvestment Rate”)

- Free Cash Flow(1) (before changes in working capital) of $134.5mn

- Leverage ratio of 1.7x and liquidity of $472.6mn at year-end

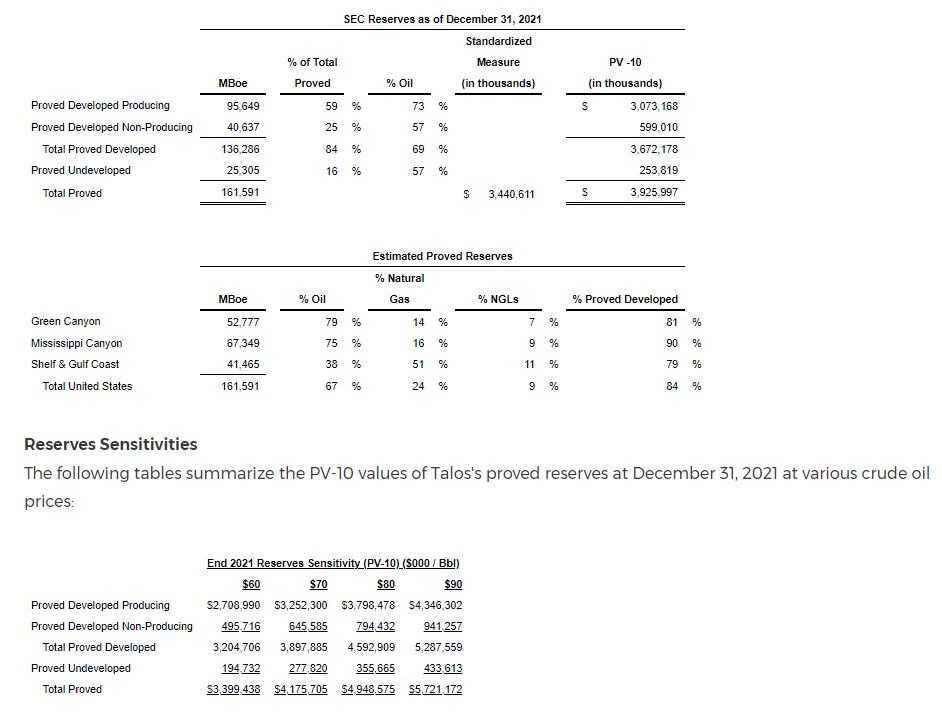

- Year-end 2021 SEC Proved reserves of 162mn barrels of oil equivalent (“MMBoe”) (67% oil, 76% liquids) with a Proved PV-10(1) of $3.9bn(2)

2022 Guidance Highlights:

- Production of 60.0 – 64.0 MBoe/d, inclusive of 3.0 – 4.0 MBoe/d of deferred production from forecasted planned downtime for the year and unplanned third-party downtime realized during the first quarter

- Capital Expenditures of $450 – $480mn, equating to an approximately 55% upstream Reinvestment Rate at current commodity prices or approximately 60% all-in including $30mn in carbon capture and sequestration (“CCS”) investments

- Reduce leverage to approximately 1.0x by year-end driven by strong free cash flow generation and focus on debt paydown

Talos President and Chief Executive Officer Timothy S. Duncan commented: “It was an outstanding fourth quarter with high operational uptime, record production, excellent oil-weighted margins and significant free cash flow generation, which allowed us to end the year with a meaningfully improved leverage ratio and liquidity profile. With a capital allocation focus around our owned infrastructure, we ended 2021 with our highest percentage of Proved Developed reserves since becoming publicly traded in 2018 and with a Proved PV-10 of $3.9bn utilizing year-end SEC pricing. It was a record year with respect to our safety and environment measurables and we are ahead of schedule in our longer-term emissions reduction goals. The CCS business we launched in 2021 made extraordinary progress and we have maintained that momentum into 2022 with our recent River Bend CCS announcement.”

Duncan continued: “Our 2022 upstream capital plan will invest across a broad range of project types, including several with short-cycle times to first production through our owned infrastructure and a series of deepwater subsea drilling projects with material resource and production rate potential that can be important contributors in 2023 and beyond. We are excited to begin the appraisal of Puma West, a high-impact exploration discovery from early 2021, with a second well in the latter half of 2022 with the goal of accelerating development. In our CCS business we will make measured investments that will lay the foundation for future success, including maturing our previously announced projects as well as aggressively pursuing more opportunities along the Gulf Coast. Even with more third-party downtime impacting production this year compared to last, we still expect 2022 to be an exciting year financially and strategically. Over the coming years, we expect that the impact of a successful infrastructure-led, subsea drilling campaign on top of our strong base business will generate in excess of $1.0bn in free cash flow through 2025, providing the company with significant flexibility for the future as it continues to grow long-term shareholder value.”

RECENT DEVELOPMENTS AND OPERATIONS UPDATE

Carbon Capture: Talos rapidly advanced its CCS business in the fourth quarter with several key announcements, including the company’s strategic alliance with TechnipFMC and its agreement with Freeport LNG and Storegga to develop a Point Source CCS solution, which could become the first active carbon sequestration project on the U.S. Gulf Coast. In February 2022, Talos and its partner, Storegga, signed a memorandum of understanding with EnLink Midstream to jointly develop the River Bend CCS project, a fully-integrated CCS offering in the Baton Rouge – New Orleans industrial corridor, one of the most concentrated sources of carbon emissions in the U.S. With an anticipated storage capacity of over 500 million metric tons of CO2, it is believed to be the one of the largest CCS projects in the country.

Additionally, in December 2021 Talos announced Robin Fielder as its first Executive Vice President – Low Carbon Strategy and Chief Sustainability Officer. Ms. Fielder will serve as the lead executive for Talos’s rapidly growing CCS business as well as oversee all ESG and sustainability initiatives and reporting. Ms. Fielder brings over 20 years of executive leadership and commercial and technical experience across the energy value chain at multiple publicly traded upstream and midstream companies.

Shareholder and Governance Update: In December 2021, Talos announced the resignation of the two representatives of Apollo Global Management and one of the two representatives of Riverstone Holdings from the company’s Board of Directors. The resignations were not due to any issues or concerns specific to Talos. Apollo’s Board members resigned as a result of Apollo’s reduced ownership after recent share sales. In January 2022, Apollo subsequently reduced its ownership stake to approximately 3.6%, down from approximately 35% at the time of Talos’s public listing in May 2018.

Eugene Island Pipeline Downtime: Talos has experienced approximately 30 days of unplanned third-party downtime to date in the first quarter of 2022 resulting from maintenance of the Eugene Island Pipeline System (“EIPS”), which carries Talos’s production from the HP-1 and Green Canyon 18 facilities. The third-party pipeline shut-in has resulted in a total production impact of approximately 3.5 – 4.0 MBoe/d for the first quarter of 2022 or 0.8 – 1.0 MBoe/d for the full year 2022 as of the date of this release. This impact is incorporated into the Company’s 2022 operational and financial guidance.

ESG Updates: Talos published its second annual environmental, social and governance (“ESG”) report in December 2021. The company substantially increased the volume and quality of disclosures and further clarified the mapping of its reporting to recognized industry standards in its report. In 2021, Talos established a 30% greenhouse gas emissions (“GHG”) intensity reduction target by 2025 from the 2018 baseline and subsequently added a 40% reduction stretch target. The Company recorded zero hydrocarbon releases of greater than one barrel offshore in 2020 from over 23 million gross operated MMBoe produced. Finally, Talos maintained solid total recordable incident rates (“TRIR”) and lost time incident rates (“LTIR”) in 2020 compared to 2018. Subsequently, in 2021 the company achieved record low LTIR and TRIR.

FOURTH QUARTER AND FULL YEAR 2021 RESULTS

Production

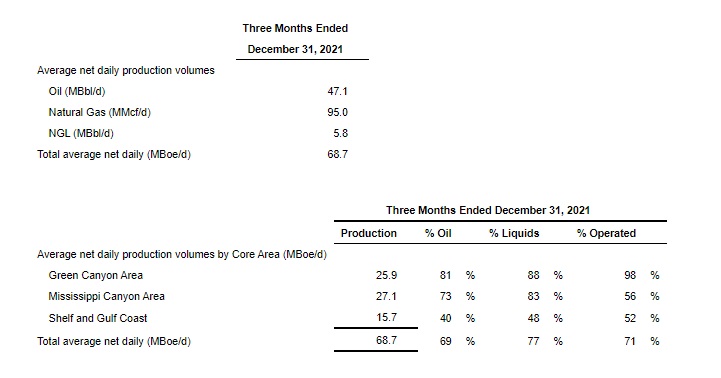

Production was 68.7 MBoe/d net for the quarter and was 69% oil and 77% liquids. Production was 64.4 MBoe/d net for the full year and was also 69% oil and 77% liquids.

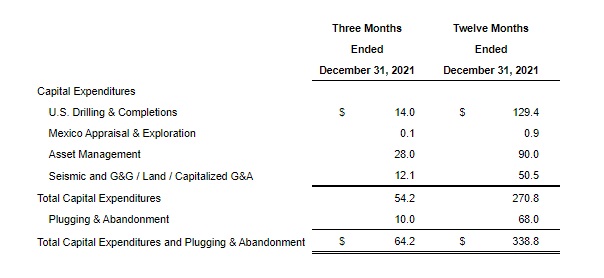

Capital Expenditures

Capital expenditures, including plugging and abandonment, totaled $64.2mn for the quarter and $338.8mn for the full year.

Liquidity and Leverage

At year-end the Company had approximately $472.6mn of liquidity, with $416.3mn undrawn on its credit facility and approximately $69.9mn in cash, less approximately $13.6mn in outstanding letters of credit. On 31 December 2021, Talos had $1,071.3mn in total debt, inclusive of $40.2mn related to the HP-1 finance lease. Net Debt was $1,001.4mn(1). Net Debt to Credit Facility LTM Adjusted EBITDA, as determined in accordance with the Company’s credit agreement, was 1.7x(1).

Footnotes:

| (1) | Adjusted Net Income (Loss), Adjusted Earnings (Loss) per Share, Adjusted EBITDA, Adjusted EBITDA excluding hedges, Adjusted EBITDA margin, Adjusted EBITDA margin excluding hedges, Credit Facility LTM Adjusted EBITDA, Net Debt, Net Debt to Credit Facility LTM Adjusted EBITDA, Free Cash Flow and PV-10 are non-GAAP financial measures. See “Supplemental Non-GAAP Information” below for additional detail and reconciliations of GAAP to non-GAAP measures. |

| (2) | Reserves figures are presented inclusive of the plugging and abandonment obligations and before hedges, utilizing SEC pricing of $66.55 WTI per Bbl of oil and $3.60 HH per Mcf of natural gas. |

YEAR-END 2021 RESERVES

SEC Reserves

As of 31 December 2021, Talos had proved reserves of 162 MMBoe, comprised of 67% oil and 76% liquids. The PV-10 of proved reserves was approximately $3.9bn, representing an increase of approximately $1.9bn from year end 2020. In addition to proved reserves, Talos’s audited probable reserves at 31 December 2021 were 60 MMBoe with a PV-10 of $1.4bn. The reserves and associated PV-10 figures are audited by NSAI and are fully burdened by and net of all plugging & abandonment costs associated with the properties included in the reserves report. Payments received by the company for processing and handling third party production through Talos-operated facilities are calculated as offsetting operating expenses on those Proved assets. The following tables summarize Talos’s proved reserves at 31 December 2021 based on SEC pricing of $66.55 per Bbl of oil and $3.60 per Mcf of natural gas:

____________________