(Sasol, 21.Feb.2022) — Sasol Limited released interim results for the six months ended 31 December 2021.

Earnings performance

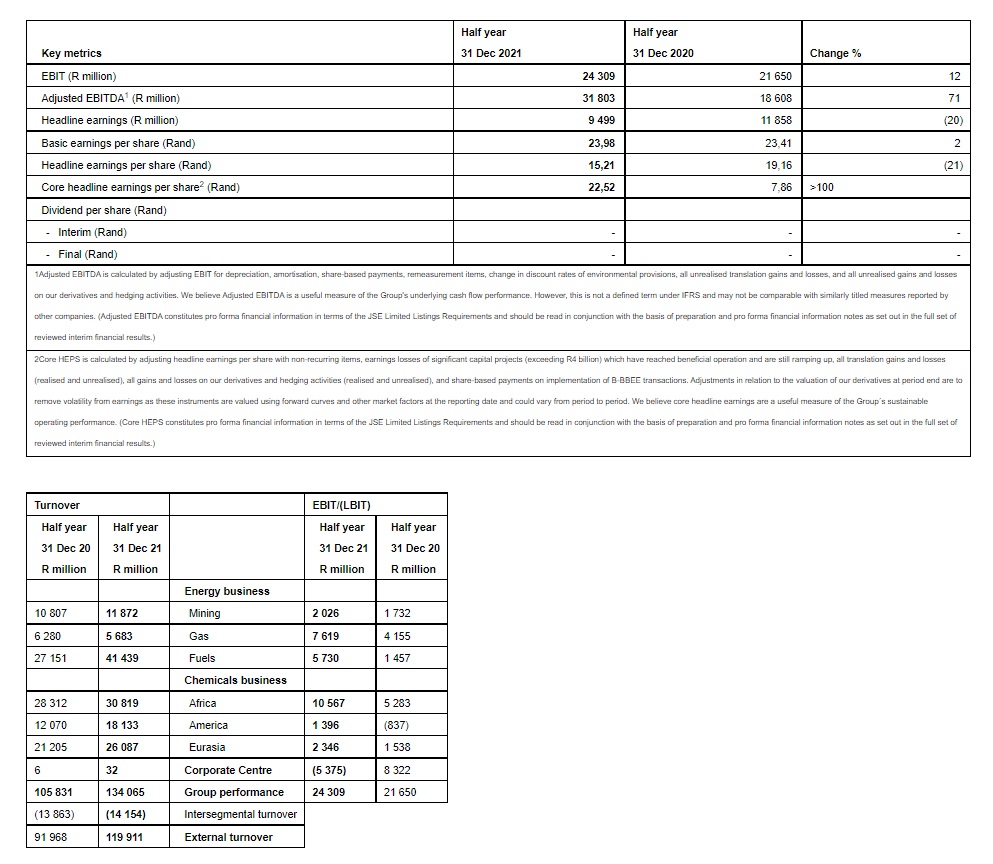

Earnings before interest and tax (EBIT) was R24,3bn, an increase of 12% compared to the prior period. This performance was underpinned by a strong macroeconomic environment with higher crude oil prices, refining margins and chemicals prices coupled with increased demand, negated by lower production volumes due to operational challenges at our Secunda Operations (SO).

Earnings were impacted mainly by the following non-cash adjustments:

Reversal of impairments of R1,4bn mainly due to a higher price outlook on the back of a sustained increase in demand for alcohols into the personal hygiene market during and post the COVID-19 pandemic;

R4,9 billion gain on the realisation of the foreign currency translation reserve (FCTR), on the divestment of our Canadian shale gas assets;

Losses of R0,1bn on the translation of monetary assets and liabilities due to a 3% weakening of the closing rand/US dollar exchange rate compared to 30 June 2021; and

Losses of R5,3bn on the valuation of financial instruments and derivative contracts.

Balance sheet management

Cash generated by operating activities increased by 73% to R20,3bn compared to the prior period. Actual capital expenditure amounted to R10,4bn compared to R7,5bn during the prior period. The higher capital expenditure is due largely to the absence of a phased shutdown at SO in the prior period and increased sustenance capital expenditure in the current period.

Our net debt to EBITDA ratio at 31 December 2021, based on the revolving credit facility (RCF) and US dollar term loan covenant definition, was 1,3 times, significantly below the threshold level of 3 times. Sasol is committed to continue with its efforts to reduce leverage and absolute debt levels.

At 31 December 2021, our total debt was R109,2bn compared to R102,9 bn at 30 June 2021. During this reporting period we repaid a portion of the RCF, however the weakened closing Rand/US Dollar exchange rate had a translation effect of R11,7bn on our debt.

Gearing has reduced to 59,1% at 31 December 2021 from 61,5% at 30 June 2021. This is mainly due to stronger cash earnings generation, offset by the weaker closing exchange rate.

As at 31 December 2021, our liquidity headroom was R91bn (US$5,7bn), well above our outlook to maintain liquidity in excess of US$1bn. We will repay the outstanding debt on the Commercial Paper (R2,2 billion) and a US$1bn bond (R16bn) in August 2022 and November 2022 respectively.

In line with our financial risk management framework, we continue to make good progress with hedging our foreign currency, crude oil and ethane exposure. We have been successful in hedging our total exposure for 2022 and we are making good progress with hedging our 2023 exposure, which increases the certainty of future cash flows and mitigates downside risk to enable our Future Sasol strategy. For further details of our open hedge positions we refer you to our Analyst Book (www.sasol.com).

Dividend

The restoration of dividends is a key priority, however, in the context of the high level of macroeconomic uncertainty the Board believes it is prudent not to declare an interim dividend at this stage. This is in line with the capital allocation framework and dividend triggers which were communicated at our Capital Markets Day in September 2021.

Director changes

Mr Z M Mkhize and Mr P J Robertson retired as non-executive directors of Sasol Limited at the end of the annual general meeting held on 19 November 2021.

Management changes: Appointment of Executive Vice Presidents for Mining and Energy Operations

The board also approved the appointment of Mr Riaan Rademan as Executive Vice President (EVP) for Mining and as a member of the Group Executive Committee, effective 9 March 2022. Riaan’s mandate is to lead mining through its current challenges and position the business over the coming months for enhanced and sustainable productivity, prioritising safety in our operations.

Riaan re-joins Sasol from Foskor (Pty) Ltd where he has been the President and Chief Executive Officer since 1 July 2019 and led a successful business turnaround programme. He previously had a 36-year career with Sasol up to 30 September 2017. During his tenure with the company he held executive accountability for several key businesses and functions, including mining and exploration and production, shared services, information management, procurement, and supply chain.

In addition, our EVP Energy Operations, Mr Bernard Klingenberg nears retirement later this year and a suitable internal successor was identified. Mr Simon Baloyi will be appointed as the EVP Energy Operations, effective 1 April 2022. He holds masters degrees in chemical engineering and engineering management, and has more than 20 years’ experience across the Sasol South African value chains.

Mr Grobler, Sasol’s President and CEO said: “I am confident that these executive changes will strengthen the business and support our drive to further embed safety and operational discipline across the portfolio. I would also like to thank Mr Bernard Klingenberg for his contribution and leadership during his 36 year tenure at Sasol and we will pay tribute to him nearer to his retirement.”

The full announcement and the reviewed interim financial results will be available on the company’s website at https://www.sasol.com/investor-centre/financial-reporting/financial-reports-2022 and https://www.sasol.com/investor-centre/financial-reporting/annual-integrated-reporting-set.

____________________