(IMF, 22.Dec.2021) — The Executive Board of the International Monetary Fund (IMF) approved a 36-month arrangement under the Extended Fund Facility (EFF) for Suriname in an amount equivalent to SDR472.8mn (about $688mn or 366.8% of quota). The Board’s decision enables an immediate disbursement equivalent to SDR39.4mn (about $55.1mn).

The IMF financial arrangement will support Suriname’s authorities’ homegrown economic plan aiming to restore fiscal sustainability through a discretionary fiscal consolidation of 10% of GDP during 2021-24, while protecting the vulnerable by expanding social safety net programs. The IMF-supported program will also help bring public debt down to sustainable levels, upgrade the monetary and exchange rate policy framework, stabilize the financial system, and strengthen institutional capacity to tackle corruption and money laundering and improve governance.

At the conclusion of the Executive Board’s discussion, Ms Kristalina Georgieva, Managing Director and Chair, issued the following statement:

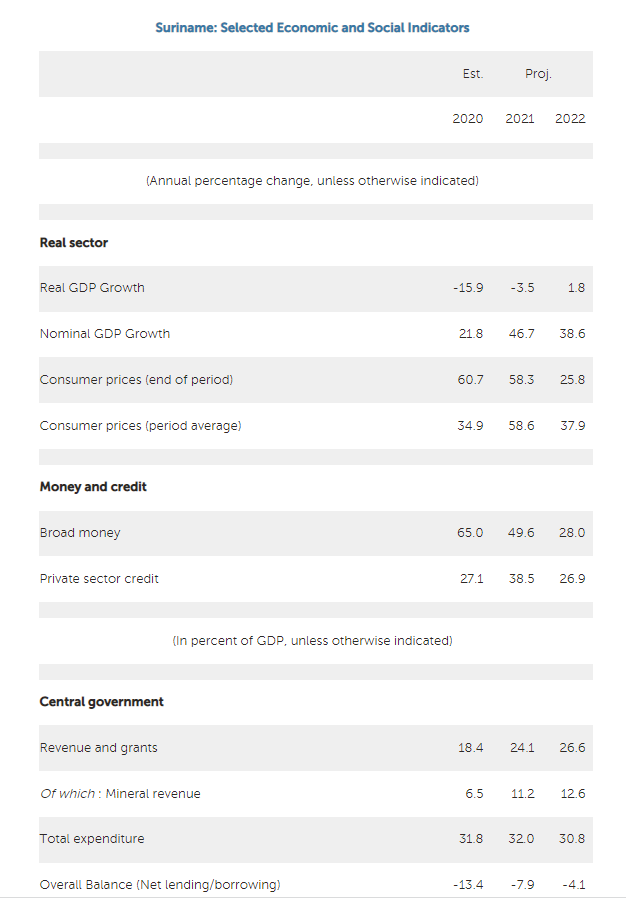

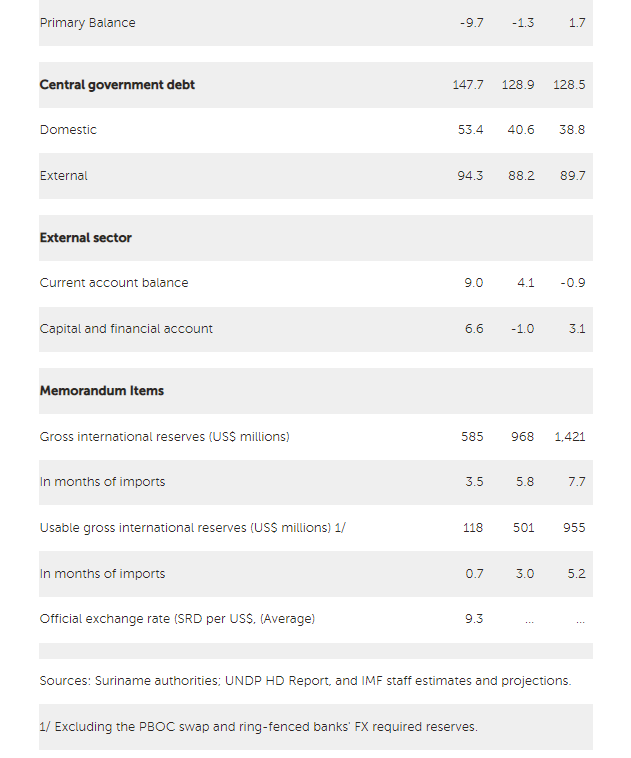

“Suriname faces systemic fiscal and external imbalances as a result of many years of economic mismanagement. These developments, combined with the COVID-19 pandemic, have caused substantial fiscal and external current account deficits, unsustainable public debt, a run-down of reserves, an economic downturn, and high inflation. In recent months, the authorities have embarked on a comprehensive economic reform program to address Suriname’s challenges, including by starting to tighten fiscal policy.

“The main objectives of the authorities’ program are to restore macroeconomic stability and confidence, and to pave the way to economic recovery, while protecting the most vulnerable during the process of adjustment. Fiscal consolidation is a clear and critical ingredient of the program in order to restore “fiscal and external stability. The fiscal reforms designed by the authorities include eliminating costly and poorly targeted electricity price subsidies and introducing a value added tax, creating an efficient source of non-mineral revenue. To help soften the negative impact on the most vulnerable, the authorities’ agenda emphasizes the strengthening of the social safety net. To achieve debt sustainability, the authorities are negotiating debt relief from private and official creditors in line with program parameters.

“The program aims to rebuild Suriname’s foreign reserves. The authorities’ decision to move to a market-determined exchange rate will strengthen the economy’s resilience to external shocks. This step, together with the program’s catalytic effect on external financing, will address external imbalances and contribute to increasing foreign reserves to prudent levels.

“To reduce inflation, the program includes steps to tighten liquidity conditions. The adoption of a reserve money targeting framework and the roll-out of open market operations will support the goal of returning inflation to single digits. The Central Bank of Suriname also needs to address rising banking sector risks, including because of the shift in the exchange rate.

“Implementing the structural reform agenda is essential to ensure a more prosperous future for Suriname. The reforms will improve the institutional capacity for macroeconomic policies, maintain financial sector stability, tackle corruption, and strengthen AML/CFT and governance. These reforms will be supported by technical assistance from development partners including the IMF, the Inter-American Development Bank, and the World Bank Group.”

____________________