(Ecopetrol, 19.Feb.2021) — Ecopetrol S.A.’s consolidated crude oil, condensates and natural gas proven reserves (1P reserves, according to the standard international denomination) as of 31 December 2020. Reserves were estimated based on US Securities and Exchange Commission (SEC) standards and methods. 99% of the reserves were audited by five recognized independent specialized firms (DeGolyer and MacNaughton, Gaffney, Cline & Associates, Netherland, Sewell & Associates, Ryder Scott Company and Sproule).

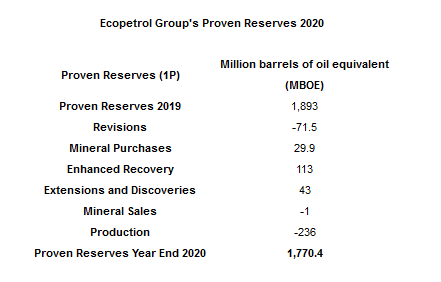

By the end of 2020, the Ecopetrol Group’s net proven reserves totalled 1,770 million barrels of oil equivalent (MBOE), which represents a 6.5% decrease versus 2019 (1,893 MBOE). The reserves replacement ratio was 48%, with an average reserve life of 7.5 years. Gas reserves represented 29% of this volume, with an average reserve life of 10.1 years, while liquids reserves represented the remaining 71%, with an average reserve life of 6.8 years.

The reduction in proven reserves was mainly due to the 32% decrease in hydrocarbon prices used for the valuation. According to the SEC methodology, the Brent price used for the 2020 valuation of reserves was US$43 per Brent barrel, versus US$63 used for 2019. Ecopetrol estimates that the price effect led to a decrease in reserves of 215 MBOE, which was partially offset by the addition of 114 MBOE attributable to new drilling projects in different fields, such as Rubiales and Caño Sur. Additionally, positive revisions of 30 MBOE were obtained due to the good performance in production and optimization of technical-economic variables in fields such as Rubiales, Castilla and other fields in North America.

In terms of enhanced recovery, there was a positive variation of 113 MBOE, primarily due to the incorporation of reserves from new projects mainly associated with water injection in fields such as Chichimene and Castilla.

Additionally, in extensions and discoveries, progress continues to be made in the progression of probable and possible reserves to proven reserves in the Rubiales field, primarily due to the continuity of drilling operations, among others. As for discoveries, the ESOX field in the Gulf of Mexico and the Andina field in Colombia achieved commercial viability.

Sales include Hocol’s interest transfer in La Punta and Santo Domingo fields for a value of 1 MBOE. Purchases include 29.9 MBOE corresponding to the acquisition of 43% of the Guajira asset by Hocol.

The largest contributions to the reserves balance came from the Castilla, Chichimene, and Rubiales fields, which are operated directly by Ecopetrol.

Ecopetrol S.A. owns 85% of the proven reserves, while the other group companies own 15%.

____________________