(YPF, 25.Jan.2021) — YPF Sociedad Anónima (YPF) announced its decision to amend the terms and conditions of its Exchange Offers and Consent Solicitation initially described in its Exchange Offer and Consent Solicitation Memorandum dated 7 January 2021, as first amended on 14 January (the “Exchange Offer and Consent Solicitation Memorandum“). Capitalized terms used herein and not otherwise defined shall have the meaning ascribed to them in the Exchange Offer and Consent Solicitation Memorandum.

The company has revised the terms and conditions of the Exchange Offers and Consent Solicitation mainly to:

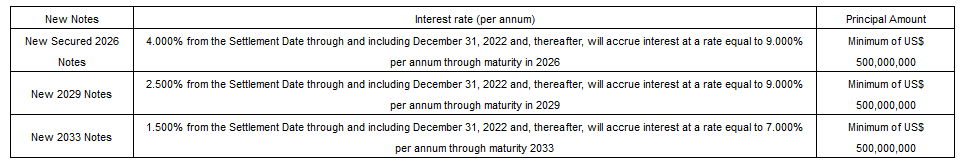

— provide for the accrual of interest under the New Notes, and their payment in cash in arrears, from the Settlement Date, at the rates set out in Table A;

— provide for an increase in interest rates from 1 January 2023 until maturity for the New Secured 2026 Notes and the New 2029 Notes, as set out in Table A;

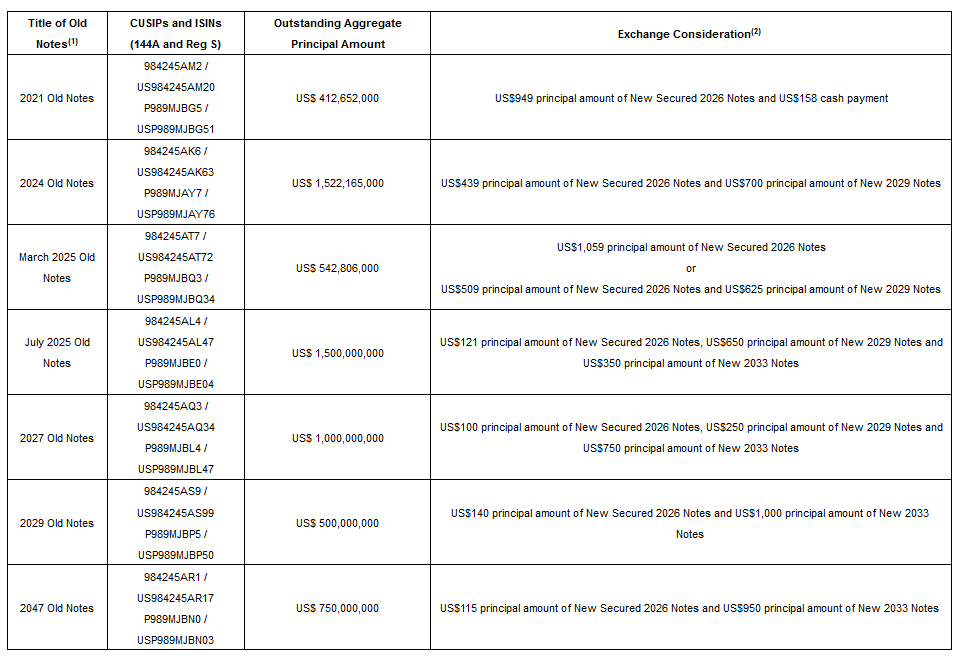

— adjust the Exchange Consideration to reflect the improvements in the accrual of interest on the New Notes from the Settlement Date, as set out in Table B;

— amend the interest payment dates for the New Secured 2026 Notes and principal amortization schedules for the New Secured 2026 Notes and the New 2029 Notes;

— amend the final stated maturity for the New Secured 2026 Notes and the New 2029 Notes;

— exclude the possibility of issuing additional New Secured 2026 Notes after the Settlement Date;

— add certain covenants to the terms and conditions of the New Notes;

— for the New Secured 2026 Notes, increase the amount of the cumulative twelve (12) months export collections required to flow through the Export Collection Account from 110% to 120% of the principal and interest payments due within twelve (12) months of the date of determination;

— increase the cash balance required to be held in the Reserve and Payment Account to 125% of the principal and interest due on the two (2) next succeeding quarterly Payment Dates under the New Secured 2026 Notes;

— include a pledge on certain shares held by YPF in YPF Energía Eléctrica S.A. as additional security for the New Secured 2026 Notes;

— amend the definitions of “Indebtedness” and “Consolidated EBITDA” for the New Notes; and

— extend the (i) Withdrawal Deadline from 5:00 pm, New York City time, on 21 January 2021 to 5:00 p.m., New York City time, on 1 February, (ii) Expiration Time from 11:59 p.m., New York City time, on 4 February to 11:59 p.m., New York City time, on 5 February, (iii) Acceptance Date from 5-8 February, (iv) Execution of the Old Supplemental Indenture from 26 January to 11 February and (v) Settlement Date from 9-11 February, in each case, unless further extended.

Table A – New Notes

Table B – Exchange Ratios

(1) The Old Notes are currently listed on the Luxembourg Stock Exchange and admitted for trading on the Euro MTF Market. The 2021 Old Notes, July 2025 Old Notes, 2027 Old Notes, 2029 Old Notes and 2047 Old Notes are currently admitted for trading in the MAE (as defined herein). The 2024 Old Notes and March 2025 Old Notes are currently listed on the ByMA (as defined herein) and admitted for trading in the MAE.

(2) Per US$ 1,000 principal amount of Old Notes validly tendered and accepted for exchange. The Exchange Consideration (as defined herein) has been calculated taking into account accrued and unpaid interest under the Old Notes being exchanged from the last applicable interest payment date to, but not including, the Settlement Date (“Accrued Interest“). Therefore, Eligible Holders who validly tender their Old Notes will not be entitled to receive any cash payment for any Accrued Interest on the Old Notes (in the case of the holders of 2021 Old Notes, such amount is included in the cash payment of the Exchange Consideration). No additional payments will be made in connection with the Consent Solicitation.

The company has prepared a revised Exchange Offer and Consent Solicitation Memorandum dated 25 January 2021 setting forth the modifications to the Exchange Offers and Consent Solicitation described herein (the “Amended Exchange Offer and Consent Solicitation Memorandum“).

Except as expressly amended in the Amended Exchange Offer and Consent Solicitation Memorandum to the extent specifically provided therein, all terms of the Exchange Offers and Consent Solicitation contemplated in the Exchange Offer and Consent Solicitation Memorandum and all other disclosures set forth in the Exchange Offer and Consent Solicitation Memorandum and the annexes thereto remain unchanged.

Eligible Holders who delivered their Proxies pursuant to the Consent Solicitation prior to the date hereof and do not revoke their Proxies prior to the Withdrawal Deadline shall be deemed to have accepted the terms and conditions of the Exchange Offers and Consent Solicitation as amended pursuant to the Amended Exchange Offer and Consent Solicitation Memorandum. Direct Participants who have already submitted Proxies do not need to take any further action.

As of 21 January 2020, 5:00p.m. New York Time, the Company had received instructions to tender and Proxies from Eligible Holders representing: (i) 6.89% of the aggregate principal amount outstanding of 2021 Old Notes (Series XLVII Notes); (ii) 18.07% of the aggregate principal amount outstanding of 2024 Old Notes (Series XXVIII Notes); (iii) 14.48% of the aggregate principal amount outstanding of March 2025 Old Notes (Series XIII Notes); (iv) 12.53% of the aggregate principal amount outstanding of July 2025 Old Notes (Series XXXIX Notes); (v) 9.47% of the aggregate principal amount outstanding of 2027 Old Notes (Series LIII Notes); (vi) 9.35% of the aggregate principal amount outstanding of 2029 Old Notes (Series I Notes); and (vi) 13.76% of the aggregate principal amount outstanding of 2047 Old Notes (Series LIV Notes).

We have not registered the New Notes under the Securities Act of 1933, as amended (the “Securities Act“), or any state securities law. The New Notes are being offered for exchange only (i) to holders of Old Notes that are “qualified institutional buyers” as defined in Rule 144A under the Securities Act (“QIBs“), in a private transaction in reliance upon the exemption from the registration requirements of the Securities Act provided by Section 4(a)(2) thereof and (ii) outside the United States, to holders of Old Notes who are (A) not “U.S. persons” (as defined in Rule 902 under the Securities Act, “U.S. Persons“) and who are not acquiring New Notes for the account or benefit of a U.S. Person, in offshore transactions in reliance on Regulation S under the Securities Act, and (B) Non-U.S. qualified offerees. Only holders of Old Notes who have returned a duly completed Eligibility Letter certifying that they are within one of the categories described in the immediately preceding sentence are authorized to receive and review the Exchange Offer and Consent Solicitation Memorandum and to participate in the Exchange Offers and Consent Solicitation (such holders, “Eligible Holders“). In addition, Eligible Holders will need to specify in the Eligibility Letter whether they are Argentine Entity Offerees or Non-Cooperating Jurisdiction Offerees (each as defined in the Eligibility Letter).

Although the company currently has no plans or arrangements to do so, it reserves the right to further amend, at any time, the terms of any Exchange Offer or Consent Solicitation in accordance with applicable law. The company will give Eligible Holders notice of any amendments and will extend the Expiration Time, if required by applicable law.

D.F. King is acting as the Information and Exchange Agent for the Exchange Offers and Consent Solicitation. Questions or requests for assistance related to any of the Exchange Offers and Consent Solicitation or for additional copies of the Exchange Offer and Consent Solicitation Documents may be directed to D.F. King & Co., Inc. by telephone at +1 (800) 848-3410 (U.S. toll free) and +1 (212) 269-5550 (collect), in writing at 48 Wall Street, New York, New York 10005, by email to ypf@dfking.com or by facsimile transmission at (212) 709-3328. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Exchange Offers and Consent Solicitation. The Exchange Offer and Consent Solicitation Documents are available for Eligible Holders at the following web address: www.dfking.com/ypf.

Citigroup Global Markets Inc., HSBC Securities (USA) Inc., Itau BBA USA Securities, Inc., and Santander Investment Securities Inc. are acting as dealer managers (the “Dealer Managers“) for the Exchange Offers and Consent Solicitation.

__________