(Frontera, 18.Feb.2020) — Frontera Energy Corporation announced the results of its annual independent reserves assessment and provided notice of fourth quarter and full year 2019 financial results and conference call. All dollar amounts in this news release and the Company’s financial disclosures are in United States dollars, unless otherwise noted. The financial and operational information contained below is based on the Company’s unaudited expected results for the year ended December 31, 2019.

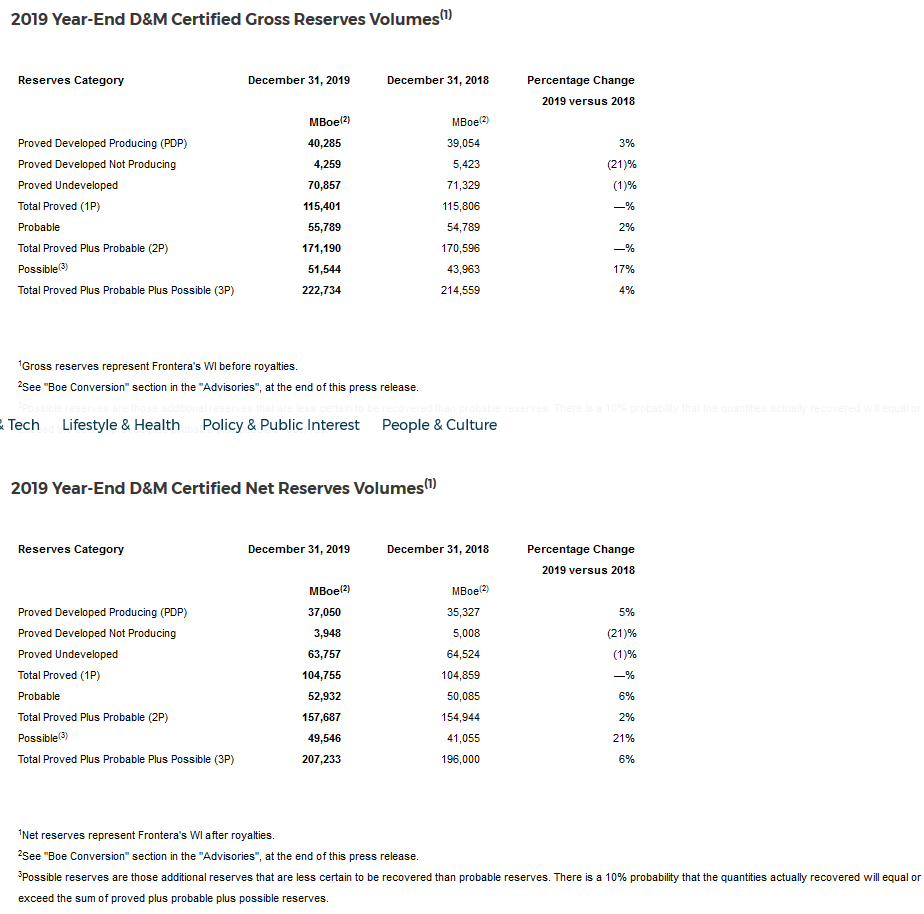

For the year ended December 31, 2019, the Company’s reserves were independently evaluated by DeGolyer and MacNaughton (“D&M“), in accordance with the definitions, standards and procedures contained in the Canadian Oil and Gas Evaluation Handbook maintained by the Society of Petroleum Evaluation Engineers (Calgary Chapter) (“COGEH“) and National Instrument 51-101 Standards for Disclosure of Oil and Gas Activities (“NI 51-101“) and are based on the Company’s 2019 year-end estimated reserves as evaluated by D&M in their reserves report dated February 12, 2020 with an effective date of December 31, 2019 (the “Reserves Report“). Additional reserve information as required under NI 51-101 will be included in the Company’s F1 Form which is expected to be filed on SEDAR on March 5, 2020. See “Advisory Note Regarding Oil and Gas Information” section in the “Advisories“, at the end of this news release. Numbers in tables may not add due to rounding differences.

2019 Reserves Report Highlights

For the year ended December 31, 2019:

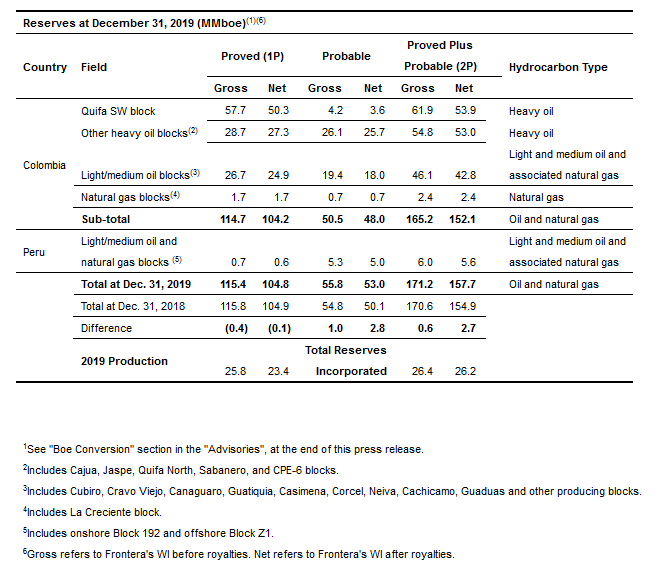

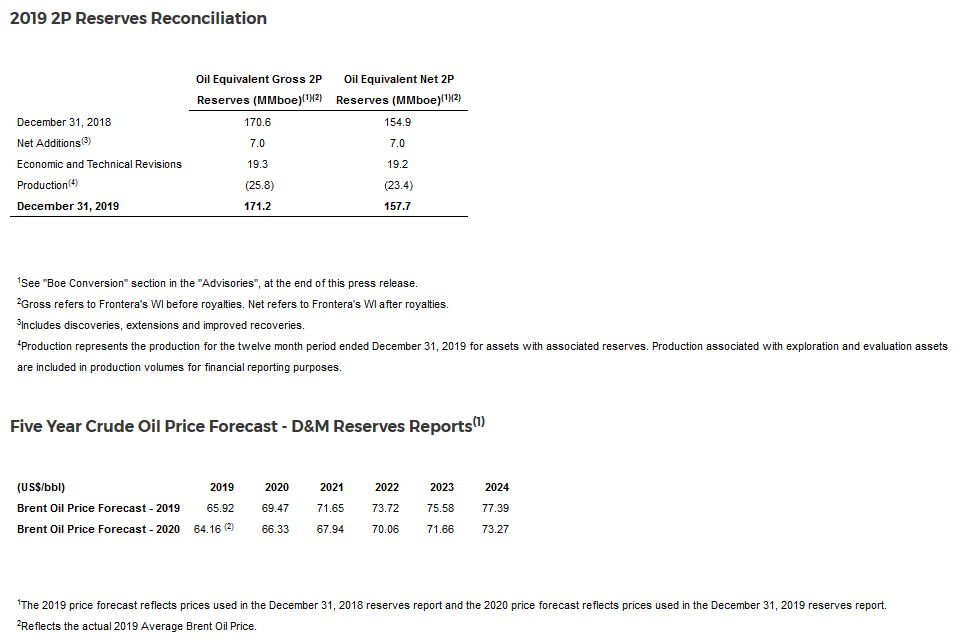

— Added 26.4 MMboe of Proved plus Probable (“2P“) reserves on a gross basis and 26.2 MMboe of 2P reserves on a net basis, representing a reserve replacement ratio of 102% and 112% respectively. 75% of the reserves replacement resulted from improved production performance at Quifa, which was driven by the additional water handling expansion project combined with stronger than previously modeled production from Sabanero, Guatiquia and Arrendajo, while positive exploration results and improved horizontal well performance at CPE-6 delivered the remainder.

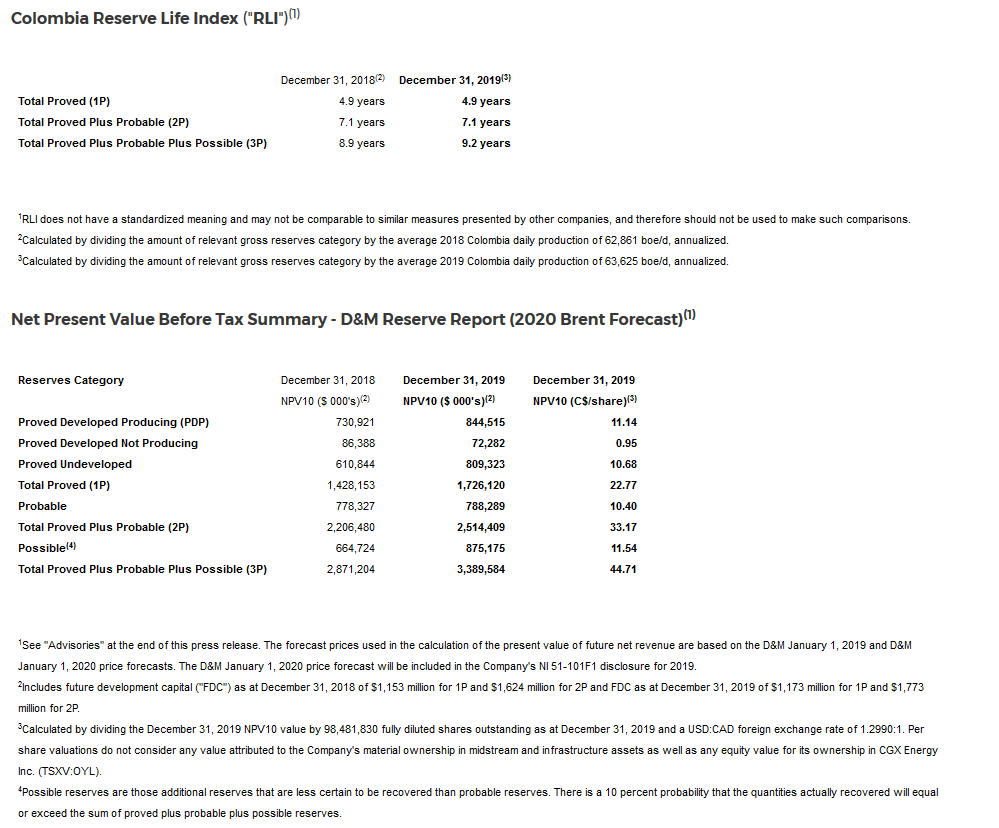

— An 11% increase in Proved Developed Producing (“PDP“) reserves in Colombia to 39.6 MMboe. The addition of 27.2 MMboe of PDP reserves represents a 117% reserve replacement ratio for Colombian PDP on a gross basis. Colombia 2P reserve life index remains stable at 7.1 years, reflecting increased 2019 production and reserves.

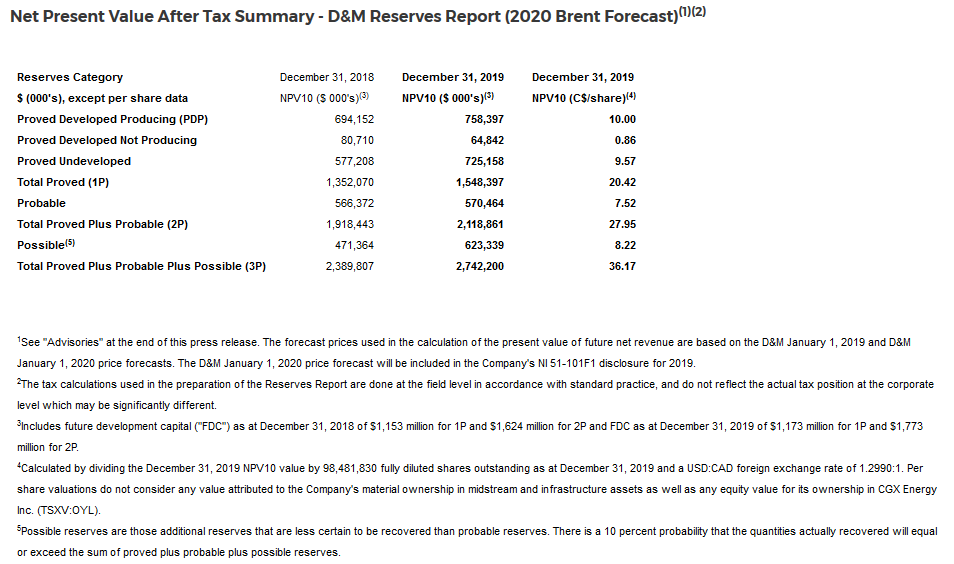

— Has a 2P Net Present Value (“NPV“) of upstream assets, discounted at 10% after tax, of $2.1 billion, or C$27.95/share ($33.17/share before tax), compared to $1.9 billion, or C$26.24/share as at December 31, 2018, representing an increase of 10% on a dollar value basis and 7% on a per share basis, or an increase in per share value of 12% on a constant currency basis.

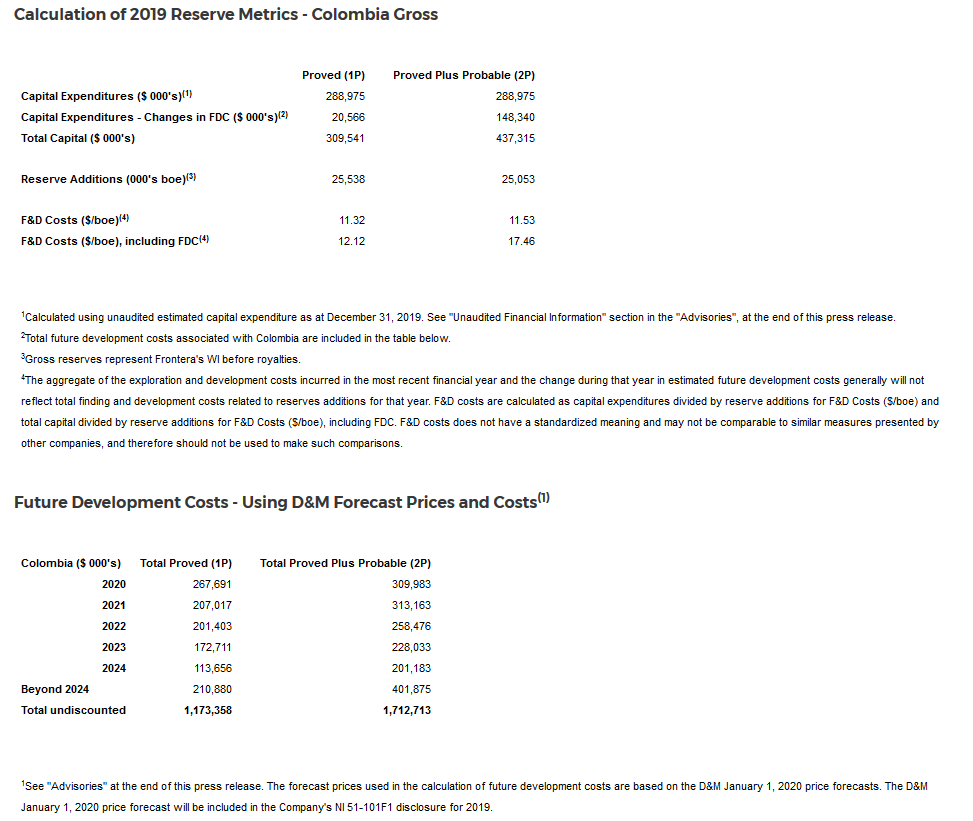

— Achieved a finding and development cost of $11.53/boe in 2019 on a 2P basis in Colombia with upstream reserves based capital expenditures of $289 million. Including changes in future development costs, 1P finding and development cost was $12.12/boe and $17.46/boe on a 2P basis in Colombia.

— A 6% increase in net Proved plus Probable plus Possible (“3P“) reserves, highlighting the improvement in the Company’s longer term development prospects resulting from exploration success on the CPE-6 block during 2019.

— The 2019 reserves evaluation does not include any of the positive impact associated with the recent announced exploration discovery on the La Belleza well on the VIM-1 block in the Lower Magdalena Valley, onshore Colombia.

The following tables provide a summary of the Company’s oil and natural gas reserves based on forecast prices and costs effective December 31, 2019 as applied in the Reserves Report. The Company’s net reserves after royalties incorporate all applicable royalties under Colombia and Peru fiscal legislation based on forecast pricing and production rates evaluated in the Reserves Report, including any additional participation interest related to the price of oil applicable to certain Colombian blocks, as at year-end 2019.

***

Is there any way to recover deleted call records? Those who have cloud backup can use these backup files to restore mobile phone call records.