(Touchstone, 27.Mar.2019) — Touchstone Exploration Inc. announces its financial and operating results for the three months and year ended December 31, 2018. Selected financial and operational information is outlined below and should be read in conjunction with Touchstone’s December 31, 2018 audited consolidated financial statements, the related Management’s discussion and analysis and the Annual Information Form, all of which will be available under the Company’s profile on SEDAR (www.sedar.com) and the Company’s website (www.touchstoneexploration.com). Unless otherwise stated, tabular amounts herein are in thousands of Canadian dollars, and amounts in text are rounded to thousands of Canadian dollars.

Paul Baay, President and Chief Executive Officer, commented:

“I am pleased to announce that we have delivered a substantial increase in all key performance indicators in 2018, which was a direct result of the hard work and determination demonstrated by our team during a busy operational period. Touchstone became the most active onshore upstream company in Trinidad, as we expanded our original drilling program and hit our initial production milestone of 2,000 bbls/d. We also displayed financial and operational discipline during 2018, allowing us to achieve a 53% annual increase in operating netback.”

“Following the £3.8 million private placement post year-end, Touchstone is funded to commence drilling the first exploration well on our Ortoire block where there is a significant opportunity to achieve a step-change in future reserves and production. We will take a measured approach to our 2019 capital drilling program as we focus on our exploration opportunities.”

Highlights

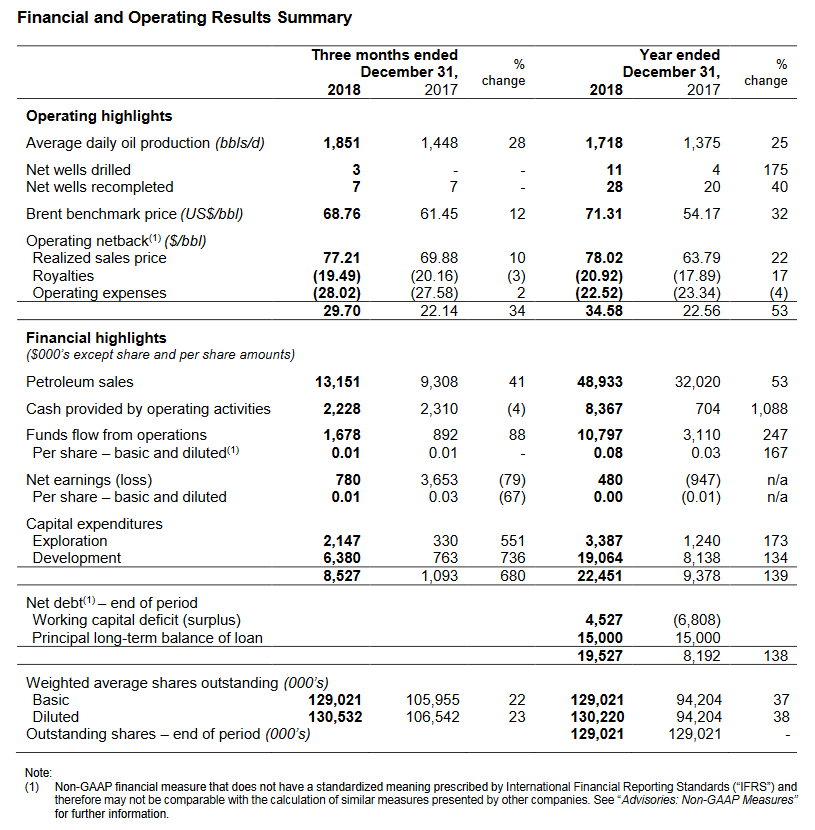

- Achieved annual average crude oil production of 1,718 barrels per day (“bbls/d”), a 25% increase relative to the average 1,375 bbls/d produced in 2017.

- Executed a $19,064,000 development program to drill 11 successful wells, complete nine wells, and perform 28 well recompletions.

- Increased petroleum sales 53% from the prior year, generating $48,933,000 versus $32,020,000 in 2017.

- Realized an operating netback of $34.58 per barrel, an increase of 53% from the $22.56 per barrel generated in 2017.

- Reduced per barrel operating costs by 4% and general and administrative expenses by 3% from the prior year. • Generated funds flow from operations of $10,797,000 ($0.08 per share) compared to $3,110,000 ($0.03 per share) realized in 2017.

- Recognized net earnings of $480,000 ($0.00 per share) compared to a net loss of $947,000 ($0.01 per share) reported in 2017.

- Exited the year with cash of $4,845,000 (which excluded 2018 crude oil sales of $6,014,000 collected subsequent to year-end) and net debt of $19,527,000, representing 1.8 times net debt to annual 2018 funds flow from operations.

- Subsequent to year-end, we issued 31,666,667 common shares raising gross proceeds of $6,615,000 to primarily fund an exploration well on our Ortoire block, which is expected to spud in June 2019.

Operating Results

Touchstone was the most active onshore upstream company in Trinidad in 2018, drilling a total of 11 developmental oil wells, nine of which were completed and on production prior to the end of the year. 2018 development capital expenditures totaled $19,064,000, which included drilling and completion activities and the recompletion of 28 wells. Fourth quarter 2018 development field activity included drilling three crude oil development wells, completing one of these wells and recompleting seven legacy wells with a total capital spend of $6,380,000. The remaining two wells of the 2018 drilling program were completed subsequent to year-end.

Fourth quarter 2018 crude oil production averaged 1,851 bbls/d, a 28% increase relative to the 1,448 bbls/d produced in the fourth quarter of 2017. Fourth quarter average daily production increased 5% from the third quarter of 2018, with growth slowed by multiple wells requiring lengthy workovers. Annual 2018 production averaged 1,718 bbls/d, representing a 25% increase from the 1,375 bbls/d average produced in the prior year. The nine wells drilled and completed in 2018 combined to add an average of 342 bbls/d and 198 bbls/d of incremental production in the fourth quarter and the year, respectively. In addition, the four wells drilled in 2017 continued to perform ahead of internal expectations, contributing an average of 354 bbls/d in the fourth quarter of 2018 and 343 bbls/d throughout 2018.

Exploration expenditures were mainly focused on our Ortoire property, as we invested $2,147,000 and $3,387,000 during the three months and year ended December 31, 2018, respectively (2017 – $330,000 and $1,240,000). We continue to focus on advancing our internally identified exploration prospects on the property in order to complete our four well drilling obligations in 2019 and 2020. The Company has submitted four Certificate of Environmental Compliance (“CEC”) applications which are required prior to the preparation of drilling locations. Two CECs covering seven drilling locations have been approved by regulatory authorities to date.

Financial Results

Our fourth quarter operating netback was $5,059,000 ($29.70 per barrel), an improvement of 71% compared to $2,950,000 ($22.14 per barrel) recorded in the fourth quarter of 2017. A 10% increase in realized prices and a 28% increase in crude oil production resulted in a $3,843,000 increase in petroleum sales relative to the fourth quarter of 2017. This was offset by higher royalties of $634,000 from increased production and the sliding scale effect of increased commodity pricing to royalty rates, slightly offset by new well production that qualified for royalty incentives. 2018 fourth quarter operating costs increased by $1,100,000 from the prior year comparative quarter based on non-recurring lease expense adjustments of $528,000, elevated variable costs from increased production and increased well servicing costs.

Operating netback was $34.58 per barrel in 2018, a 53% increase from $22.56 per barrel recognized in 2017. Realized pricing for crude oil averaged $78.02 (US$60.01) per barrel in 2018 versus $63.79 (US$49.18) per barrel received in 2017. Relative to 2017, Petroleum sales increased 53% to $48,933,000 based on a 22% annual increase in realized crude oil prices and a 25% increase in production volumes. Royalty expenses represented 26.8% of petroleum sales during the year ended December 31, 2018 versus 28.1% in the prior year. The decrease was a result of incremental production achieved from our 2018 drilling program which qualified for royalty incentives. Despite the aforementioned $528,000 one-time charge, annual operating costs decreased 4% on a per barrel basis, which was primarily attributable to increased production.

During the three months and year ended December 31, 2018, Touchstone generated funds flow from operations of $1,678,000 and $10,797,000, representing increases of $786,000 and $7,687,000 from the prior year comparative periods, respectively. The variances were mainly a result of elevated operating netbacks based on increases in both production and realized pricing. In addition to the $528,000 operating cost adjustment, the Company incurred a non-recurring $620,000 general and administrative charge related to the restoration of legacy office leases that expire on March 31, 2019.

Earnings before income taxes for the year were $11,866,000, representing an increase of 113% from the $5,579,000 recorded in 2017. The increased operational financial performance achieved in 2018 was slightly offset by decreased property and equipment impairment recoveries reported in the year, as $4,335,000 and $7,851,000 in net impairment recoveries were recorded during the 2018 and 2017 fiscal years respectively. $2,437,000 in current taxes were reported throughout 2018 versus $440,000 in 2017, mainly due to increased supplemental petroleum taxes based on increased realized prices received in 2018. 2018 deferred taxes increased $2,863,000 from the $6,086,000 recorded in 2017 based on increased capital activity performed in the year. After current and deferred taxes, we recorded net earnings of $480,000 during the year ended December 31, 2018 compared to a net loss of $947,000 in 2017.

Touchstone exited the year with a cash balance of $4,845,000, a working capital deficit of $4,527,000 and a $15 million principal term loan balance. Our cash and working capital balances decreased from December 31, 2017 based on the capital-intensive nature of the Company’s development activities. The investments increased both production and funds flow from operations from the prior year, as net debt to trailing twelvemonth funds flow from operations was 1.8 times as of December 31, 2018 versus 2.6 times as at December 31, 2017. Touchstone’s $15 million credit facility does not require the commencement of principal payments until January 1, 2020, and the Company was well within the financial covenants as at December 31, 2018.

Subsequent to year-end, we raised gross proceeds of $6,615,000 (£3,800,000) by way of a placing of 31,666,667 new common shares at a price of $0.21 (12 pence) per common share. We intend to use the net proceeds from the private placement to fund the first exploration well on our Ortoire property. Touchstone will carefully monitor commodity pricing volatility and will continue to take a measured approach to our 2019 capital drilling program in an effort to manage working capital and reduce net debt levels.

***