(GeoPark, 15.May.2024) — GeoPark Limited (NYSE: GPRK) reports its consolidated financial results for the three-month period ended 31 Mar. 2024 (“First Quarter” or “1Q2024”). A conference call to discuss these financial results will be held on 16 May 2024, at 10:00 am (Eastern Daylight Time).

FIRST QUARTER 2024 SUMMARY

In 1Q2024, GeoPark delivered $111.5mn Adjusted EBITDA, an Adjusted EBITDA margin of 67%, and $30.2mn net profit that was 15% higher than in 1Q2023. Quarterly average oil and gas production in 1Q2024 reached 35,473 boepd, down 3% compared to 1Q2023, mainly due to the divestment of the Chilean business on 18 Jan. 2024.

GeoPark invested $48.8mn in capital expenditures in 1Q2024, focused on i) continuing the development of its core operations in the Llanos 34 (GeoPark operated, 45% WI) and CPO-5 (GeoPark non-operated, 30% WI) blocks in Colombia; ii) delineating the new plays opened in 2023 in the Llanos Basin in Colombia and in the Oriente Basin in Ecuador and iii) preparing the new Llanos 86 and 104 blocks (GeoPark operated, 50% WI) for future exploration.

Capital efficiency was once again a key feature of the quarter. Each dollar invested in capital expenditures yielded $2.3 in Adjusted EBITDA, and the return on average capital employed reached 35%.

GeoPark ended 1Q2024 with a strong balance sheet, illustrating its sustained commitment to financial discipline. The cash position continued to strengthen and reached $150.7mn at the end of the quarter, while net leverage stood at 0.8x times and the debt profile remained robust with no principal maturities until January 2027.

These financial achievements and discipline allowed GeoPark to continue rewarding its shareholders with quarterly dividends of $7.5mn ($0.147 per share) and a successful tender offer of 4.4 million shares at $10 per share that was launched in the first quarter and ended in April 2024, reducing shares outstanding by approximately 8%.

Looking forward to the remainder of 2024, GeoPark’s activity set will be focused on continuing the development of its core operations in the Llanos 34 and CPO-5 blocks, incorporating into the portfolio the recently acquired Mata Mora and Confluencia assets in Vaca Muerta, and delineating the new plays opened in 2023 in the Llanos Basin in Colombia and in the Oriente Basin in Ecuador, and preparing new blocks for future exploration.

Andrés Ocampo, Chief Executive Officer of GeoPark, said: “GeoPark delivered robust financial results in 1Q2024, underpinned by our long-standing commitment to capital efficiency. The recently announced access to Vaca Muerta creates an immediate inventory of quality drilling opportunities in one of the most productive oil and gas basins in the world. We are making steady progress towards the promised step-change in our underlying performance and growth path.”

Supplementary information is available at the following link:

FIRST QUARTER 2024 HIGHLIGHTS

Oil and Gas Production and Operations

- 1Q2024 average oil and gas production of 35,473 boepd reflected stable production in the Llanos 34 Block, but was impacted by localized blockades in the CPO-5 Block and maintenance activities in the Manati gas field (GeoPark non-operated, 10% WI)

- Production in the Manati gas field has been suspended since mid-March 2024, and is expected to be restored in late second quarter or early third quarter 2024

- GeoPark’s average production in April 2024 increased to approximately 37,500 boepd, reflecting higher production from successful development activities in the Llanos 34 and CPO-5 blocks

Revenue, Adjusted EBITDA and Net Profit

- Revenue of $167.4mn

- Adjusted EBITDA of $111.5mn (67% Adjusted EBITDA margin)

- Operating profit of $84mn (50% operating profit margin)

- Cash flow from operations of $87.6mn

- Net profit of $30.2mn ($0.55 earnings per share)

Cost and Capital Efficiency

- Capital expenditures of $48.8mn

- 1Q2024 Adjusted EBITDA to capital expenditures ratio of 2.3x

- Last twelve-month return on average capital employed of 35%[1]

Balance Sheet Reflects Financial Quality

- Cash in hand of $150.7mn

- Net leverage of 0.8x and no principal debt maturities until January 2027

Accelerated Shareholder Returns

- Cash dividends of $7.5mn (representing an annualized dividend of approximately $30mn, or a 6% dividend yield[2])

- Successful tender of 4.4 million shares (8% of outstanding shares) at a purchase price of $10 per share in April 2024

- Quarterly cash dividend of $0.147 per share, or approximately $7.5mn, payable on 14 Jun. 2024, to the shareholders of record at the close of business on 31 May 2024

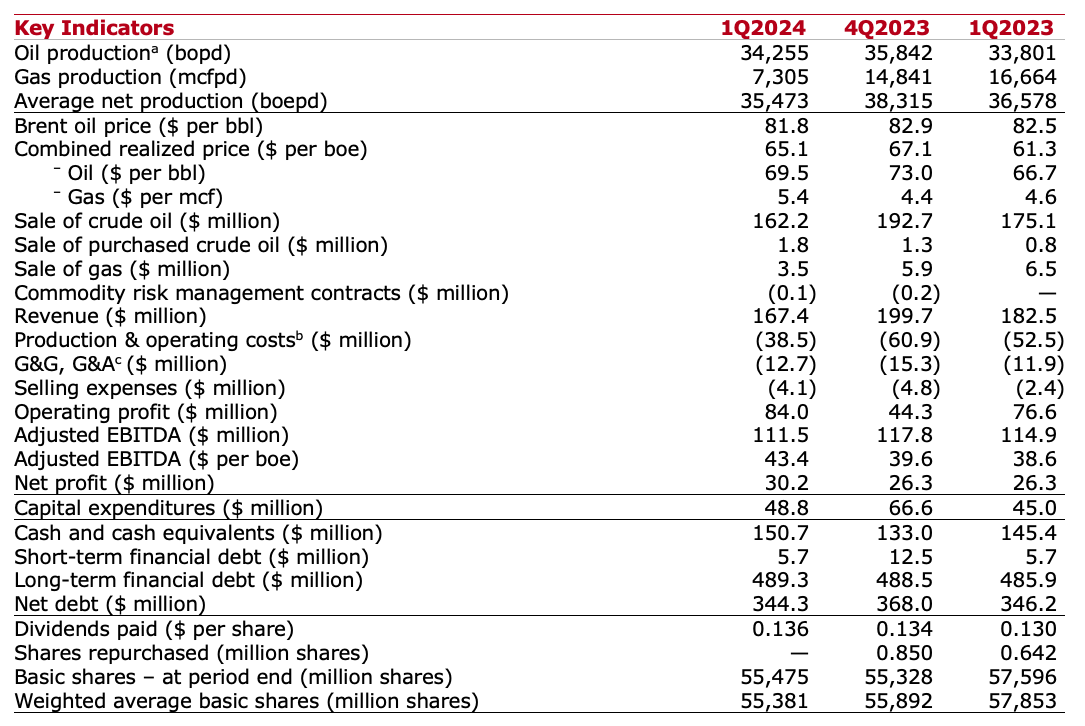

CONSOLIDATED OPERATING PERFORMANCE

a. Includes royalties and other economic rights paid in kind in Colombia for approximately 5,916 bopd, 4,923 bopd, and 1,665 bopd in 1Q2024, 4Q2023 and 1Q2023, respectively. No royalties were paid in kind in other countries. Production in Ecuador is reported before the Government’s production share.

b. Production and operating costs include operating costs, royalties and economic rights paid in cash, share-based payments and purchased crude oil.

c. G&A and G&G expenses include non-cash, share-based payments for $1.5mn, $1.8mn, and $1.4mn in 1Q2024, 4Q2023 and 1Q2023, respectively. These expenses are excluded from the Adjusted EBITDA calculation.

All figures are expressed in US Dollars and growth comparisons refer to the same period of the prior year, except when specified. Definitions and terms used herein are provided in the Glossary at the end of this document. This press release and its supplementary information do not contain all of the company’s financial information and the company’s consolidated financial statements and corresponding notes for the period ended 31 Mar. 2024, will be available on the company’s website.

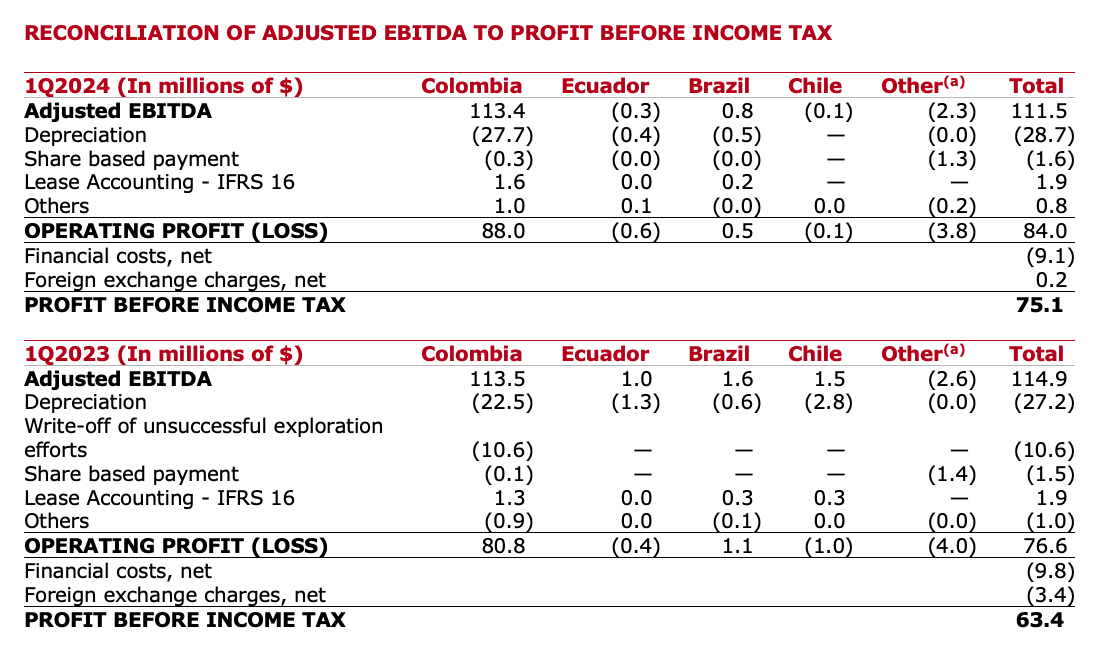

RECONCILIATION OF ADJUSTED EBITDA TO PROFIT BEFORE INCOME TAX

a. Includes Argentina and Corporate.

[1] ROCE is defined as last twelve-month operating profit divided by average total assets minus current liabilities.

[2] Based on GeoPark’s market capitalization as of 14 May 2024.