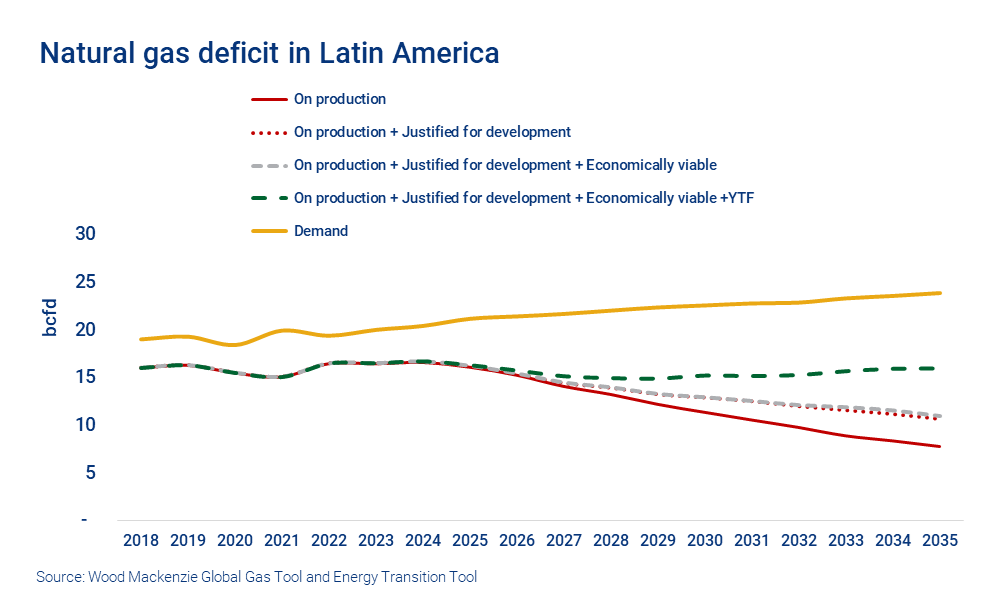

(WoodMac, 3.May.2023) — Latin America has significant gas resources that have not been prioritised for development. Natural gas demand in the region will continue to grow, however, driven by the replacement of coal in power generation and industrial processes. To meet this demand, Latin America will need to maximise its gas supply to counter production declines in some countries.

Latin America’s natural gas deficit will continue to widen. Without regional upstream developments, net imports in the overall region could range from 7 bcfd to 12 bcfd by 2035. The region’s gas demand is forecast to remain stable and account for 6.3% of world demand by 2035.

In a recent insight, Touring natural gas resources in Latin America, we analysed the main issues hindering the development of gas projects in countries where gas resources have already been discovered. We explored the region’s supply-demand balance, the amount of undeveloped, potentially viable gas reserves that exist in various Latin American and Caribbean countries, the CO2 emissions intensity of gas projects in the region and the level of integration of gas markets in the northern, mid- and southern subregions of Latin America.

Fill in the form for a complimentary extract and read on for a brief introduction.

Gas has a role to play in the energy transition

In many regions of the world, gas resources have not been prioritised for development and oil projects have generally been favoured. Oil markets were considered more established with available export routes. Now, some companies consider gas a key component in their energy transition strategy, and gas projects are set to increase in their portfolios.

Undeveloped gas reserves exist in several countries and can potentially be produced at low cost and have a lower carbon footprint than oil or coal. Potential gas developments, however, although with large enough reserves, still face market or infrastructure restrictions.

Yet to find (YTF) resources could stabilise supply at approximately 15 bcfd. However, these resources are challenged in most Latin American countries, due to policies that discourage exploration and geological challenges.

Mexico is increasingly integrated with the US natural gas market

In the northern cone of the continent, Mexico is increasingly integrated with the US natural gas market and is expected to import 8.6 bcfd from US by 2030. This volume will not just supply domestic demand, but also feed Mexico’s LNG export capacity, planned at 620 mmcfd by 2026.

Countries in the mid-continent are the most challenged in their regional gas integration. Colombia’s gas production needs to offset declines of at least 300 mmcfd by 2030 or it will require a higher level of gas imports. Gas production has declined at an average annual rate of 3% over the last 10 years.

Venezuela has a significant amount of undeveloped gas resources in the Mariscal Sucre offshore assets, some of which could be jointly developed with Trinidad and Tobago. Peru also has discovered undeveloped resources in the Camisea region, but development of these has been postponed due to regulatory hurdles and a lack of additional pipelines to the south of the country.

The southern cone countries could further increase the integration of their natural gas markets, which would help balance out declines in some nations. Gas demand continues to outgrow supply in most countries, while upcoming gas projects are limited in number and size of reserves.

Argentina could supply gas to neighbouring countries – though above-ground issues pose a challenge

The main change in the subregion is the potential role of Argentina in supplying gas to its neighbouring countries. Gas exports to Chile are streaming through the GasAndes pipeline, with lower volumes also flowing through the Gasoducto del Pacifico and Methanex pipelines. There are also plans to install LNG capacity in Argentina, which could incentivise exports to other geographies at the expense of flows within the southern cone.

Argentina is not without its challenges, however, amid the persistence of above-ground issues, such as energy policy changes and macroeconomic instability. Still, it has the potential to replace Bolivia as the key regional exporter. The decline in Bolivia’s gas production could have a drastic impact on its exports. Without additional discoveries, the decline will not be reversed. It is possible that, by the end of the decade, Bolivia will only be producing enough gas to meet domestic demand.

____________________