(Rystad Energy, 4.Apr.2024) — As the deadline for US sanctions relief on Venezuela ends on 18 Apr. 2024, the outlook for the South American nation’s oil industry appears uncertain.

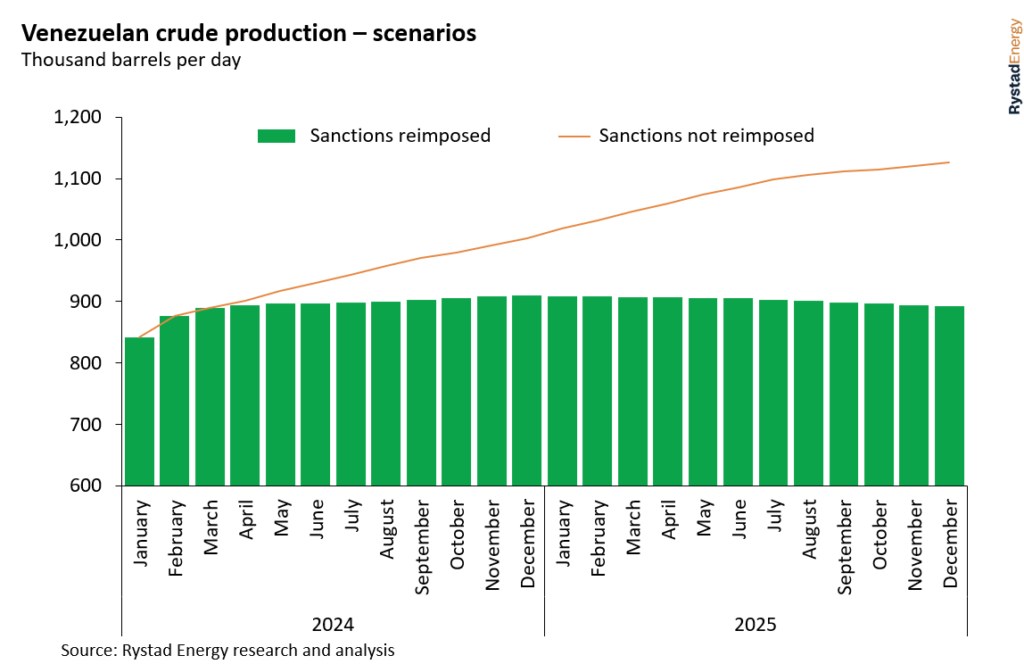

If the US does not reimpose sanctions, Venezuela could surpass the 1 million barrels per day (bpd) threshold as early as December this year, rising to 1.12 million bpd by the end of 2025, according o Rystad Energy Senior Vice President Jorge León.

If sanctions are reimposed, production is expected to remain flat at about 890,000 bpd.

There are myriad arguments for and against reimposing sanctions, so the path that the US remains uncertain.

The sanctions were initially removed in exchange for the promise of fair and free, internationally-monitored elections in 2024.

Although elections look set to happen this year, their exact nature is raising some eyebrows.

The leading opposition presidential candidate, Maria Corina Machado, who won her party’s primary election with 93% of the votes in October 2023, has been banned from standing for office by the country’s Supreme Court.

The election is set for 28 July, far before the rumored Dec. election, a decision that gave the opposition party less than two weeks to name a candidate.

Not re-imposing sanctions could be viewed as validation of a rushed election in which the main opposition leader could not stand.

However, new sanctions would further tighten an already constrained global oil market, with prices approaching $90 per barrel, adding more upside price pressure and raising pump prices for consumers.

As we approach summer and the expected spike in gasoline demand, you have to think that keeping pump prices subdued will be a major priority for President Joe Biden’s administration.

Market tightness is particularly acute in the heavy sour crude segment, the quality of most Venezuelan production, with the Trans Mountain pipeline expansion project diverting Canadian barrels away from the US into Asia.

Adding to this is the commissioning of the Olmeca refinery in Mexico, which could potentially further limit sour crude supply to the US.

Also, doubts persist over whether re-imposing sanctions would benefit President Biden among Hispanic voters.

Venezuelans make up a large portion of Hispanic voters in the US, but views on the sanctions are divided.

Re-introducing sanctions could even spur a nationalist reaction in Venezuela in favor of Maduro.

And, perhaps more importantly, new sanctions could penalize Venezuelan citizens and aggravate the existing immigration issues the US is facing – an integral issue in the upcoming presidential elections.

As things stand, the US looks more likely to keep sanctions lifted than re-impose them.

However, the US could choose to issue a cosmetic reversal of the sanctions that looks good politically but still allows crude to flow out of the country.

For instance, Venezuela could continue to sell crude to international customers, but instead of in US dollars, they would sell in Venezuela’s national currency, the bolivar, through debt relief payments.

____________________