HOUSTON, TEXAS (By Editors at Energy Analytics Institute, 10.Jun.2025, Words: 273) — A plan by Tallgrass Energy to construct a natural gas pipeline from the Permian Basin to Rockies Express Pipeline (REX) has shaken up the midstream space.

“The project would be a boon for Permian producers, but could also affect how REX receives gas from traditional supply sources,” East Daley Analytics (EDA) said on 10 Jul. 2025 in a research note.

Highlights from the report include:

— On 13 May 2025, Tallgrass announced precedent agreements for the new pipeline out of the Permian;

— Currently, REX has contracts to source ~3.1 billion cubic feet per day (Bcf/d) from Northeast interconnects, ~0.9 Bcf/d from Rockies interconnects, and ~0.275 Bcf/d from interconnects in the Midwest;

— “Some of this supply could be displaced if Tallgrass can sign up Permian customers for the full 2.4 Bcf/d offered in the upcoming open season.”: EDA

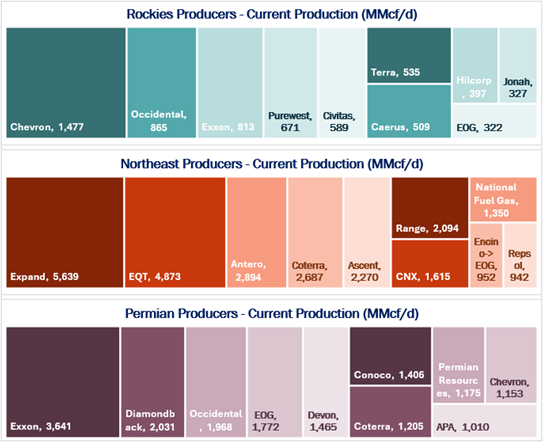

— gross Permian Basin gas production is expected to grow 1.7 Bcf/d by 2030. Northeast gas production grows 3.5 Bcf/d, according to EDA, and supply from Rockies basins increases 0.5 Bcf/d over the same period;

— some of this growth potential in the Northeast and Rockies may be at risk if the Tallgrass project runs full, according to EDA;

— if increased Permian production does push back on Northeast and Rockies growth, exploration & production companies in these regions face downside risk to the growth outlook;

— EQT and Antero Resources are the 2nd and 3rd largest producers in the Northeast but don’t have offsetting exposure to potential Permian growth. These 2 companies are also among the top 3 shippers on REX, and could see more competition as their gas competes directly with Permian sources.

____________________

By Editors at Energy Analytics Institute. © 2025 Energy Analytics Institute (EAI). All Rights Reserved.