BOGOTÁ, COLOMBIA (By Ecopetrol, 13.Aug.2025, Words: 673) — During the first-half 2025 (1H:25), Ecopetrol maintained a solid operating performance, demonstrating its ability to generate sustainable value and respond in advance and effectively to challenging market conditions such as the decline in Brent benchmark crude prices, external environment events, and geopolitical tensions.

“Our financial results were underpinned by market and portfolio diversification, integration across the hydrocarbons value chain, cost cutting maximization, and operational optimization, enabling us to achieve competitive profitability levels within the industry,” Ecopetrol president Ricardo Roa Barragán announced on 13 Aug. 2025 in the company’s second-quarter 2025 financial press release.

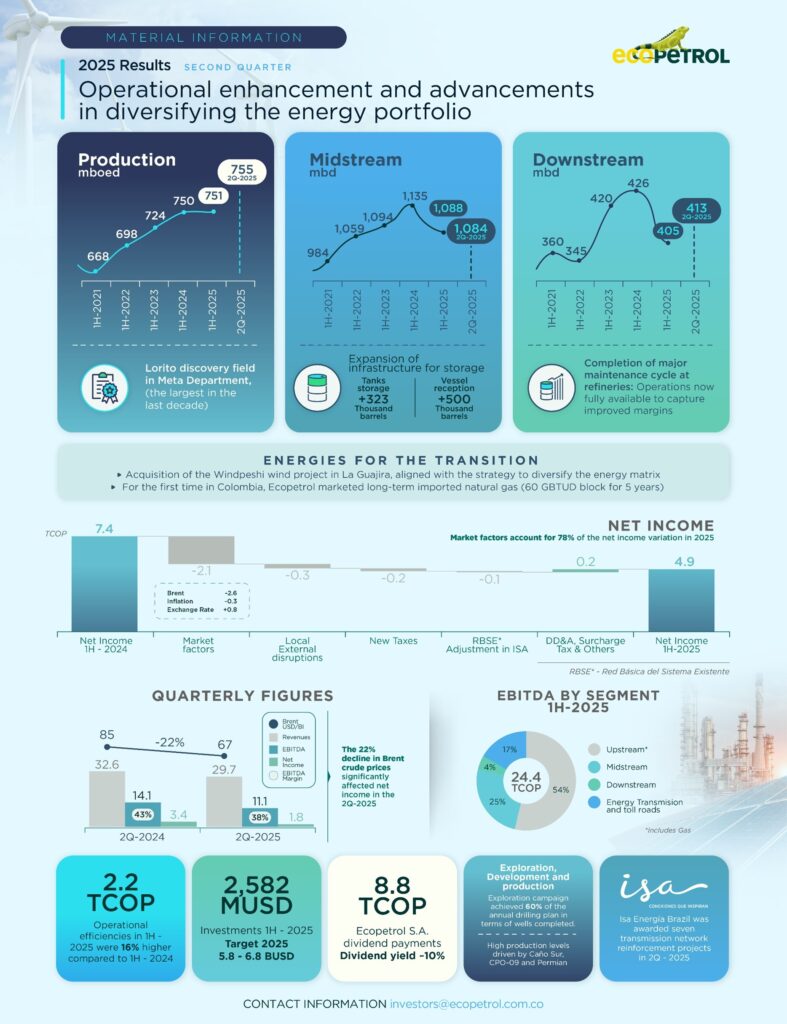

“In 2Q25, revenues totaled COP 29.7 trillion, EBITDA reached COP 11.1 trillion with an EBITDA margin of 37.5%, and a net income of COP 1.8 trillion. For the first half of the year, we reported revenues of COP 61.0 trillion, EBITDA of COP 24.4 trillion with a 40% EBITDA margin, and net income of COP 4.9 trillion.

Ricardo Roa Barragán

Our cash management strategy in response to falling prices has progressed through the identification of cost, expense, and CAPEX optimization initiatives; early collection of the 2024 FEPC receivable balance; implementation of foreign exchange hedging; and tax credit offsets, among others, allowing us to uphold the value promise of 2025’s financial plan. We have also completed the payment of dividends to shareholders totaling COP 8.8 trillion, delivering a dividend yield of approximately 10%.

In the Hydrocarbons business, we continued our growth trend, reaching a production of 751 mboed during the first half of the year, driven by strong performance in Colombian fields such as Caño Sur and CPO-09, as well as in the Permian Basin in the U.S., which enabled us to overcome challenges stemming from local external events. Transported volumes reached 1,088 mbd, supported by repair and alternative evacuation strategies that partially mitigated third-party disruptions. Refining throughput reached 405 mbd, following the completion of major maintenance at the Barrancabermeja refinery, restoring operational availability and full processing capacity for the second half of the year.

A key milestone for the country’s energy security was the declaration of commercial feasibility for the Lorito discovery in Meta Department, the largest in the last decade, realizing the benefits of acquiring a 45% stake in CPO-09.

In the commercial segment, we highlight the strong contribution of our subsidiaries in Houston and Singapore, which have successfully captured market opportunities and maximized financial results for Ecopetrol S.A. and its subsidiaries (the “Group”). During 2Q25, we achieved the best crude trading differential for the past four years at -USD 3.7/Bl.

In the Energy Transition business line, we closed the acquisition agreement for the Windpeshi wind project, with 205 MW of self-generation capacity in La Guajira, recognized worldwide as one of the world’s most promising regions for solar and wind energy development. This marks the first project of its kind to be executed and built by Ecopetrol. We also highlight the commercialization of natural gas for an average of 58 GBTUD for the next four years, and the long-term commercialization of imported gas at 60 GBTUD (starting 2Q26 for five years), a first in the Company’s history, marking a significant step in addressing the country’s gas supply deficit while advancing on our gas supply portfolio.

In the Transmission and Toll Roads line, we maintained stable operational results, including the award and commissioning of seven transmission network reinforcements in Brazil. Financial results reflect a one-time recognition of the revised methodology for calculating financial compensation for Brazil’s Existing System Basic Network, as determined by the Brazilian Electricity Regulatory Agency (ANEEL), amounting to approximately COP 0.6 trillion.

Finally, I would like to emphasize that the Group continues to invest strategically to maximize long-term results, maintaining operational growth across all business lines, with total investments reaching USD 2,582 million as of the end of 2Q25.

We will continue to strengthen our operational and strategic flexibility, while monitoring market prices and global developments to effectively navigate external challenges and protect and maximize value for all our shareholders, whilst seeking to accomplish our year’s financial targets.”

President of Ecopetrol S.A.

____________________