PARIS, FRANCE (By TotalEnergies, 24.Jul.2025, Words: 421) — The Board of Directors of TotalEnergles SE, chaired by CEO Patrick Pouyanné, met on July 23, 2025, to approve the 2nd quarter 2025 financial statements. On the occasion, Patrick Pouyanné said: “TotalEnergies delivered robust financial results in the second quarter: cash flow only decreased by 5% to $6.6 billion despite a 10% decrease In oil price, notably thanks to accretive hydrocarbon production growth. The Company posted adjusted net income of $3.6 billion for the quarter, resulting in first half adjusted net income o/ $7.8 billion.

RELATED: Mexico Pacific’s Saguaro Energy LNG project downsized from 6 trains to 3

In the first half of the year TotalEnergies continued to successfully execute its balanced multi-energy strategy, supported by sustained growth in hydrocarbon and electricity production:

— 2.53 Mboe/d of hydrocarbon production, which is an increase of more than 3% year-on-year and benefiting notably from the start-up of the Ballymore field in the United States and Mero-4 in Brazil, a quarter ahead of schedule

— nearly 23 7Wh of electricity production in the first half of 2025, an increase of over 20% year-on-year

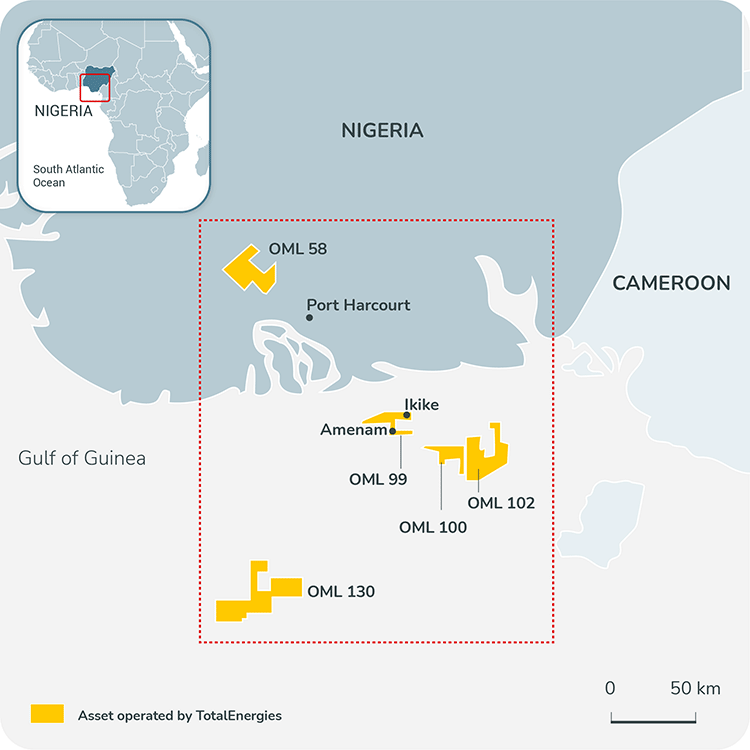

Exploration & Production reported adjusted net operating income of $2.0 billion and cash flow of $3.8 billion in the second quarter, benefiting from accretive project start-ups in 2024 and 2025. Consistent with our strategy, the Company continued to actively manage its low-cost, low-emission portfolio by divesting non-operated interests in noncore projects in Nigeria and Brazil, and entering into new exploration permits in the United States, Malaysia, Indonesia, and Algeria.

Integrated LNG achieved adjusted net operating income of $1.0 billion and cash flow of $1.2 billion this quarter, reflecting a 10% decrease in the LNG selling price, in line with oil price evolution, and low market volatility for gas trading activities. The Company strengthened its LNG portfolio by signing a 1.5 MTPA LNG offtake agreement from Rio Grande LNG Train 4 and taking a positioning in the future Ksi Lisims LNG plant located on the Pacific Coast of Canada.

Integrated Power posted adjusted net operating income and cash flow of close to $0.6 billion this quarter, resulting in cash flow of $1.2 billion In the first half of 2025, in line with the annual guidance. As part of its business model, the Company divested 50% of a renewable asset portfolio in Portugal.

Downstream delivered adjusted net operating income of $0.8 billion and cash flow of $1.5 billion, refleeting improved refining margins (but still in the context of a globally weak environment) and utilization rate. Downstream results benefitted from the positive seasonal effect of Marketing & Services activities, with stronger results year on-year.”

____________________

RELATED: Mexico Pacific seeks DOE/FECM approval to extend export operations deadline to 2032