HOUSTON, TEXAS (Editors at Energy Analytics Institute, 24.Jun.2025, Words: 440) — The board of directors of Cheniere Energy, Inc. announced a positive final investment decision (FID) with respect to the Corpus Christi midscale trains 8 & 9 and debottlenecking project (CCL Midscale Trains 8 & 9). As a result, Cheneire has issued full notice to proceed to Bechtel Energy, Inc. for construction of CCL Midscale Trains 8 & 9.

CCL Midscale Trains 8 & 9 is being built adjacent to the Corpus Christi stage 3 project (CCL Stage 3) and consists of 2 midscale trains with an expected total liquefaction capacity of over 3 million tonnes per annum (MTPA) of liquefied natural gas (LNG) and other debottlenecking infrastructure, Cheniere announced on 24 Jun. 2025 in an official statement.

Upon completion of CCL Midscale Trains 8 & 9, and together with expected debottlenecking and CCL Stage 3, the Corpus Christi LNG terminal is expected to reach over 30 MTPA in total liquefaction capacity later this decade.

Increased run-rate production guidance

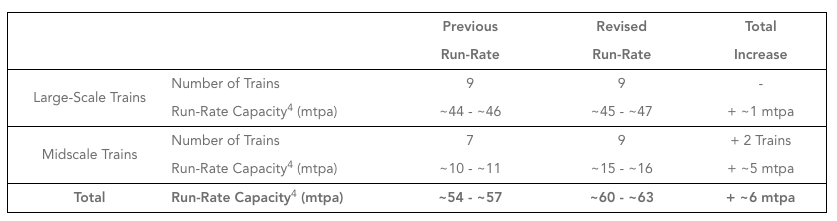

Cheniere also announced an updated run-rate LNG production outlook, which reflects an increase in the combined liquefaction capacity across the Cheniere platform at Sabine Pass and Corpus Christi by over 10% to over 60 MTPA inclusive of CCL Midscale Trains 8 & 9, CCL Stage 3, and identified debottlenecking opportunities across the platform.

NOTE 4: Run-rate capacity based on 20-year annualized average of LNG produced, accounting for asset availability, reliability and planned maintenance.

Further capacity expansions in development

In addition, Cheniere is developing further brownfield liquefaction capacity expansions at both the Corpus Christi and Sabine Pass terminals. The company expects these expansions to be executed in a phased approach, starting with initial single-train expansions at each site which, if completed, would grow Cheniere’s LNG platform to up to 75 MTPA of capacity by the early 2030s.

Capital allocation plan update

With the aforementioned FID and the existing share repurchase authorization, Cheniere is on track to meet its previously announced ’20/20 Vision’ capital allocation plan of deploying $20bn of capital by 2026 and reaching approximately $20 per share of run-rate distributable cash flow (DCF). Cheniere is increasing and extending its committed capital allocation targets, starting with a planned over 10% increase of its third quarter 2025 dividend from $2.00 to $2.22 per share annualized.

Going forward, Cheniere expects to generate over $25bn of available cash through 2030 as of this quarter, which the company plans to allocate across disciplined accretive growth and shareholder returns in the form of buybacks and dividends, as well as balance sheet management. With this enhanced plan, Cheniere now expects to reach over $25 per share of run-rate DCF, the company said.

____________________

By Editors at Energy Analytics Institute. © 2025 Energy Analytics Institute (EAI). All Rights Reserved.