(Noble, 2.May.2022) — Noble Corporation (NYSE: NE) reported first quarter 2022 results.

Robert W. Eifler, President and Chief Executive Officer of Noble Corporation, stated “Our strong operational performance, highlighted by the successful commencement of operations for the Noble Gerry de Souza in Suriname, coupled with significant contracting success across the fleet, sets the stage for an exciting year for Noble. The combination of our performance in the first quarter and continued improvements across all markets has increased our financial expectations for 2022. I would like to thank the entire Noble organization for their continued hard work and their commitment to operating safely every day.”

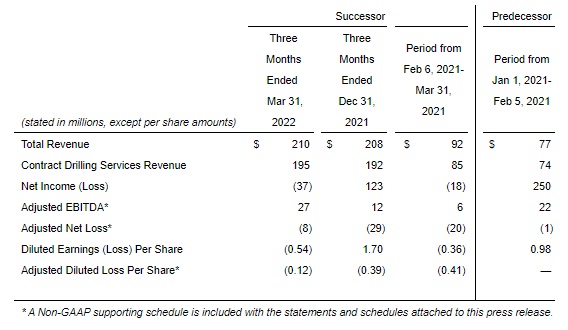

First Quarter Results

Contract drilling services revenue for the first quarter of 2022 totaled $195mn compared to $192mn in the fourth quarter of 2021. Marketed fleet utilization was 75 percent in the three months ended 31 March 2022 compared to 77 percent in the fourth quarter of 2021. Contract drilling services costs for the first quarter were $166mn, down from $183mn in the fourth quarter of 2021.

Adjusted EBITDA for the three months ended 31 March 2022 was $27mn compared to $12mn in the fourth quarter of 2021. Capital expenditures totaled $45mn in the first quarter, which includes $11mn of client reimbursable investments.

Upon emergence from restructuring, Noble adopted fresh-start accounting which resulted in Noble becoming a new reporting entity for accounting and financial reporting purposes. Accordingly, financial statements and notes after 5 February 2021 are not comparable to financial statements and notes prior to that date. As required by GAAP, results must be presented separately for the predecessor period up to 5 February 2021 (the “Predecessor” period) and the successor period from February 6, 2021 through all dates after (the “Successor” period).

Operating Highlights

In the first quarter, the Noble Regina Allen was awarded a contract for six wells in Trinidad and Tobago. The work is expected to commence shortly after the conclusion of the rig’s contract with Repsol in Guyana. In the U.K. North Sea, the Noble Sam Hartley was contracted by TotalEnergies for one firm well with an anticipated start in the third quarter of 2022. The contract also includes two one-well options. Noble also received a binding Letter of Award (“LOA”) from Qatargas for the Noble Houston Colbert and Noble Mick O’Brien. The LOA is for 3.5 years of firm work per rig. The Noble Mick O’Brien contract will be in direct continuation with Qatargas and the Noble Houston Colbert is preparing to mobilize out of the UK North Sea this summer and begin operations in the third quarter of 2022. The associated revenue will be included in our backlog once the contracts have been executed.

The Noble Gerry de Souza, upgraded with an MPD system and second BOP, safely mobilized to Suriname and began its contract with APA Corp near the end of the first quarter. APA Corp has two one-well options for the rig. The Noble Globetrotter I is expected to conclude its 10-year contract with Shell in the third quarter and demobilize for an out-of-service period. Shortly after its shipyard stay, the Noble Globetrotter I is expected to mobilize to Mexico for a one-well contract with CNOOC and a two well program with Petronas. On 1 April 2022, the four drillships operating under the Commercial Enabling Agreement (“CEA”) were awarded 7.4 years of incremental term in connection with the sanctioning of the Yellowtail development in Guyana. Each rig is now contracted to the fourth quarter of 2025. Additionally, the Noble Clyde Boudreaux, a moored semisubmersible, was divested in the first quarter.

Backlog and Balance Sheet Highlights

As of 1 April 2022, Noble’s estimated revenue backlog is approximately $1.9bn. This includes the 7.4 rig year award under the CEA but does not include the 7 years of firm term associated with the LOA from Qatargas.

As of 31 March 2022, the company had total liquidity of $767mn, including cash and cash equivalents of $105mn, and availability under its revolving credit facility of $662mn. The company experienced an increase in accounts receivable in the first quarter above the expected level, but this is anticipated to normalize over the coming quarters.

Maersk Drilling Business Combination Update

On 29 April 2022, Noble provided an update on the merger control process for obtaining clearance in the UK for the previously announced business combination with Maersk Drilling. The process remains ongoing following the UK Competition and Markets Authority’s (“UK CMA”) Phase 1 decision on 22 April 2022 pursuant to which the UK CMA stated that the transaction gives rise to a realistic prospect of a substantial lessening of competition and that a remedy to address such effect would be required to avoid a reference to a Phase 2 review. As a result, Noble and possibly Maersk Drilling plan to offer to divest certain jackup rigs currently located in the North Sea (the “Remedy Rigs”) to seek to obtain conditional antitrust clearance from the UK CMA in Phase 1 of the merger control process. The Remedy Rigs will comprise the Noble Hans Deul, Noble Sam Hartley, Noble Sam Turner, Noble Houston Colbert, and either the Maersk Innovator or the Noble Lloyd Noble, both of which are a CJ-70 design. Noble expects there to be clarity on which of the CJ-70 rigs will be included in the Remedy Rigs in the coming weeks. On this basis, Noble is examining different options to divest the Remedy Rigs. The duration and outcome of the UK CMA review process remains uncertain. If Noble is able to obtain a conditional Phase 1 antitrust clearance from the UK CMA, the closing of the business combination is expected to occur in mid-2022.

Outlook

The company’s full-year 2022 guidance range for Adjusted Revenue and Adjusted EBITDA increased to $1,130 to $1,180mn and $320 to $350mn, respectively. This increase, which is primarily driven by improved drillship activity and dayrates, is partially offset for Adjusted EBITDA by inflationary pressures. Full-year 2022 capital expenditure guidance range, net of client reimbursables, increased by $15mn to $145 to $160mn. This increase is primarily driven by contract preparation investments required by recent commercial awards for the Noble Globetrotter I and the Noble Houston Colbert. Further details may be found in the guidance table included at the back of this press release.

Commenting on Noble’s outlook for 2022, Mr. Eifler stated, “We are encouraged by the steadily improving fundamentals in the offshore drilling market and expect to continue to see positive dayrate momentum. We anticipate realizing a meaningful improvement in financial results in the second quarter and have visibility to exiting the year at an Adjusted EBITDA run-rate of $125mn per quarter. As we look forward to the closing of the combination with Maersk Drilling, we remain focused on operating safely, serving the needs of our customers, and creating long-term value for our shareholders.”

Fleet Status Report

In conjunction with first quarter results, the company has also provided an updated “Fleet Status Report” which reflects the current status and contract information for each of its rigs. The updated report can be found under the “Our Fleet” section of the company’s website.

Conference Call

Noble will host a conference call related to its first quarter 2022 results on Tuesday, 3 May 2022, at 7:30 a.m. US Central Time. Interested parties may dial +1 929-203-0901 and refer to conference ID 31391 approximately 15 minutes prior to the scheduled start time. Alternatively, a live webcast link will be available on the Investor Relations section of the company’s website. A webcast replay will be accessible for a limited time following the scheduled call.

For additional information, visit www.noblecorp.com or email investors@noblecorp.com

____________________