(S&P Global, 23.Mar.2021) — The ExxonMobil-operated Liza Phase 1 development offshore Guyana achieved its nameplate capacity output of 120,000 b/d in December and continues to produce at that rate, the top executive of Liza partner Hess Corp. said March 23.

The partners at the Stabroek Block where Liza is located, and where two additional developments in various stages of construction will lead to their production in 2022 and 2024, also foresee two more developments that will come online in 2025 and 2026, Hess CEO John Hess said at the virtual Scotia Howard Weil Energy Conference.

The total five developments will underpin production estimates of more than 750,000 barrels of oil equivalent a day in 2026, John Hess said.

“We continue to see multibillions of future exploration potential remaining” in Guyana, where the three partners including China’s CNOOC have made 18 discoveries with recoverable resources of more than 9 billion boe, he said.

The partners eventually foresee up to 10 separate developments produced by floating production, storage and offloading vessels.

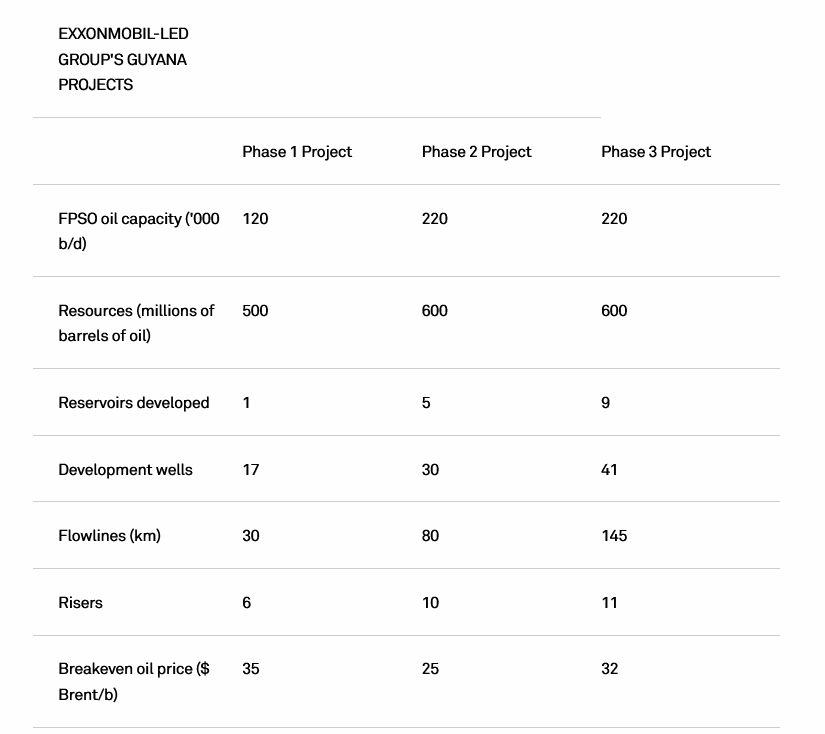

Liza Phase 2, the second Stabroek development, will have nearly double the FPSO capacity of 220,000 b/d, as will Payara, the third development on the block under construction north of the Liza field.

A fourth planned development, Yellowtail, sited southeast of Liza, has not yet been sanctioned.

Liza Phase 1 has a breakeven oil price of $35/b Brent, for Liza Phase 2 it’s $25/b, and for Payara, $32/b, John Hess said.

“Guyana’s reservoirs rank among the highest quality in the world,” with high recovery rates, he added. “The reservoirs are relatively shallow with no salt, so wells can be drilled faster than other deepwater basins in the world.”

Drilling time and costs at Stabroek are less than half those of a typical offshore deepwater exploration, a Hess slide accompanying the CEO’s presentation said.

Second Bakken rig added

While Guyana is a growth engine for Hess, its operation at the Bakken Shale play in North Dakota is a cash engine.

Hess, which averaged 193,000 boe/d of output from the Bakken last year, expects to hold its production in the play steady at 170,000 boe/d in 2021.

Of the company’s 2,850 future potential drilling locations, 1,800 can generate “strong” financial returns at $50/b WTI, John Hess said, well below the current prices of just under $60/b. Moreover, Hess’ inventory represents about 60 rig-years of activity.

In 2021, the company plans to bring on 45 new Bakken wells, each with an estimated ultimate recovery near 1.2 million boe and average internal return rates near 80% at near-$50/b WTI, he said.

After running six drilling rigs in the Bakken in 2019, the company dropped to a single rig last year after the pandemic slashed oil prices and demand. Hess has added a second rig in the Bakken and will stay at that level for the rest of the year, the CEO said.

While the company’s operating strategy will be guided by what John Hess called a “long-term commitment to sustainability,” and recognizes climate change as “one of the greatest scientific challenges of the 21st century,” he said the company surpassed its five-year targets for Scope 1 and Scope 2 greenhouse gas emissions intensity.

Last year, the company reduced GHG emissions and flaring intensity by about 40% and 60%, respectively, compared to 2014, he said.

Its new five-year targets for 2025 are to reduce operated Scope 1 and Scope 2 GHG emissions intensity 44% and methane emissions intensity 50% versus 2017. And for 2021, the company has added continued Bakken Shale flaring reductions at its operations in the North Dakota play in its annual incentive plan.

It is also investing in technology to reduce and store carbon emissions, including what the CEO called “groundbreaking work” conducted by the Salk Institute.

Even so, he cited the International Energy Agency’s 2020 World Outlook, which provides an “aggressive sustainable scenario,” but added that even if all the pledges of the Paris Climate Agreement were met, oil and gas would still make up 46% of the energy mix in 2040.

“The energy transition will still take time, cost a lot of money and major breakthroughs in technology will be needed,” John Hess said. “While we need policies to encourage renewable energy to battle climate change, oil and gas will still be needed for many decades to come.”

____________________