(Petrobras, 16.Sep.2020) — Petrobras announced the expiration and expiration date results of the previously announced offers to purchase for cash by its wholly-owned subsidiary Petrobras Global Finance B.V. (“PGF”) of any and all of its outstanding notes of the series set forth in the table below (the “Notes” and such offers, the “Offers”).

The Offers were made pursuant to the terms and conditions set forth in the offer to purchase dated 10 September 2020 (the “Offer to Purchase” and, together with the accompanying notice of guaranteed delivery, the “Offer Documents”).

The Offers expired at 5:00 p.m., New York City time, on 16 September (the “Expiration Date”). The settlement date with respect to the Offers will occur on 21 September (the “Settlement Date”).

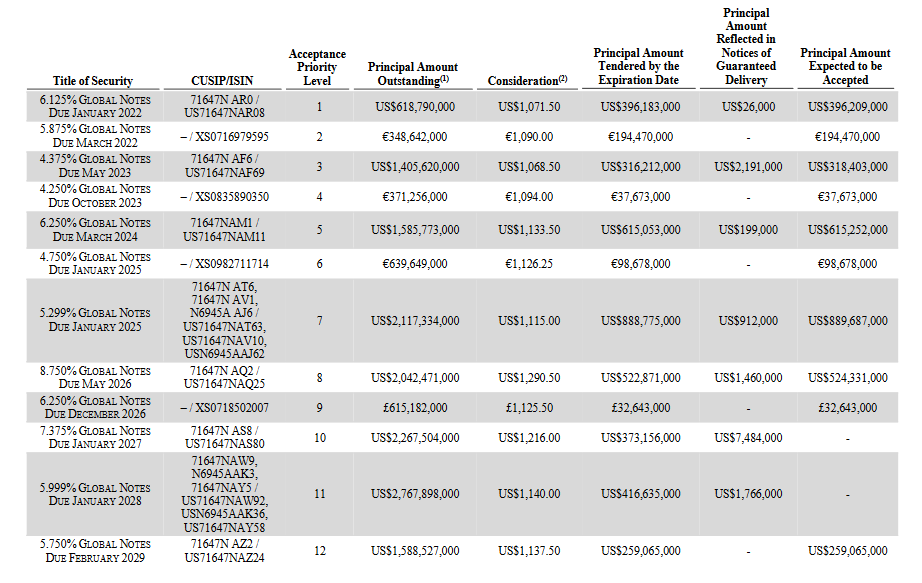

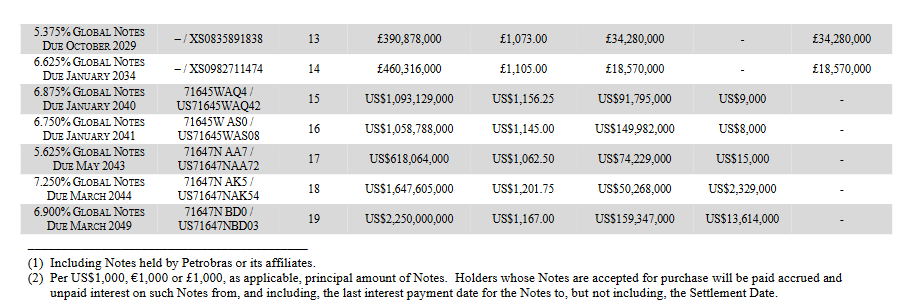

The table below sets forth the aggregate principal amount of Notes validly tendered in the Offers and not validly withdrawn, and the aggregate principal amount of Notes reflected in notices of guaranteed delivery delivered, at or prior to the Expiration Date, the consideration payable for Notes accepted for purchase in the Offers and the acceptance priority level (the “Acceptance Priority Level”) in connection with the Maximum Consideration Condition described in the Offer to Purchase:

In order to be eligible to participate in the Offers, holders of Notes reflected in notices of guaranteed delivery received by PGF prior to the Expiration Date must deliver such Notes to PGF by 5:00 p.m., New York City time, on September 18, 2020 (the “Guaranteed Delivery Date”).

On the terms and subject to the conditions set forth in the Offer to Purchase, because the purchase of all Notes validly tendered in the Offers would cause PGF to purchase an aggregate principal amount of Notes that would result in an aggregate amount to be paid by PGF in excess of the Maximum Consideration described in the Offer to Purchase, PGF expects that it will accept for purchase all of the Notes validly tendered, including Notes for which PGF received notices of guaranteed delivery and that are delivered on or prior to the Guaranteed Delivery Date, in Acceptance Priority Levels 1 through 9, 12, 13 and 14 (the “Covered Notes”). PGF expects to reject tenders of Notes, including Notes for which PGF received notices of guaranteed delivery, in Acceptance Priority Levels 10, 11 and 15 through 19 (the “Non-Covered Notes”). Non-Covered Notes will be returned or credited without expense to the holders’ accounts promptly after the Expiration Date. The principal amount of Covered Notes that will be purchased by PGF on the Settlement Date is subject to change based on deliveries of Covered Notes pursuant to the guaranteed delivery procedures described in the Offer to Purchase. A press release announcing the final results of the Offers is expected to be issued on or promptly after the Settlement Date.

The total cash payment to purchase on the Settlement Date the Covered Notes, excluding accrued and unpaid interest, will be approximately US$3,978 million based on the Pounds Sterling to U.S. dollar exchange rate of US$1.2975 per Pound Sterling, and the Euro to U.S. dollar exchange rate of US$1.1828 per Euro, in each case calculated as of 2:00 p.m., New York City time on the Expiration Date, as reported on Bloomberg screen page “FXIP” under the heading “FX Rate vs. USD.”

__________