(CSI Compressco, 3.Aug.2020) — CSI Compressco LP announced second quarter 2020 results.

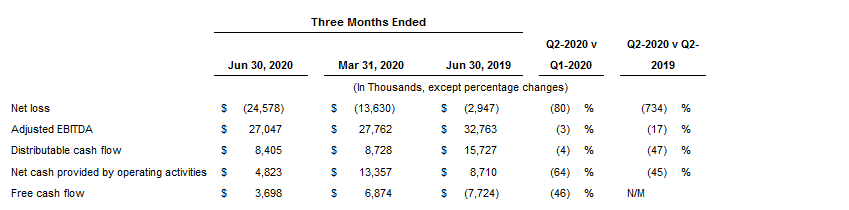

Net loss for the second quarter ended 30 June 2020 was $24.6 million, inclusive of $15.8 million of non-recurring charges. This compares to a net loss of $13.6 million, in the first quarter of 2020, which included $6.0 million of non-recurring charges. Adjusted EBITDA in the second quarter was $27.0 million compared to $27.8 million in the first quarter of 2020. Revenues for the quarter ended 30 June were $96 million, an increase of 7% from the first quarter of 2020 driven by $17.8 million of incremental equipment sales.

Brady Murphy, President of CSI Compressco commented, “Our second quarter results reflect the exceptional job by our management team and employees of managing costs, maintaining strong Adjusted EBITDA margins and generating positive cash flow in one of the most challenging quarters our industry has ever experienced due to the COVID-19 pandemic. With steep declines in spending by the oil and gas operators, as evidenced by a 64% decline in the US onshore rig count during the quarter, CSI Compressco was able to maintain Adjusted EBITDA relatively flat at $27 million compared to the first quarter. Working in a very difficult and dynamic environment, our employees and management team continued to safely and efficiently service our customers as we dealt with challenging working conditions while simultaneously taking the required actions to reduce our cost structure in line with the steep decline in activity.”

“During the quarter we saw the benefit of our quick and decisive cost reduction initiatives. Compression Services costs were reduced by 20% from the first quarter compared to a 14% sequential decline in Compression Services revenue and a decline in the utilization rate from 86.5% to 82.1%. As a result of difficult but decisive cost actions, Compression Services gross margins increased by 300 basis points to 54.9% – the highest Compression Services gross margins in CSI Compressco’s history. Approximately 15% of our total domestic horsepower was on standby during the quarter as customers shut in production given the low commodity prices. As oil prices stabilized and began to improve during the latter part of the quarter, many operators started to bring production back online. A large majority of our remaining units are on standby with our two largest customers – both super majors that have the balance sheet to maintain shut in production in anticipation of higher oil prices. One of them will go operational with most of their standby units starting 1 August.”

“Aftermarket Services revenue declined 12% while gross margins improved sequentially from 9.6% in the first quarter to 14.6% in the second quarter. Equipment Sales revenue increased from $6.5 million in the first quarter to $24.3 million in the second quarter on delivery of several large units to Latin America. We previously announced plans to close our fabrication operations given the decline in demand. Our final shipments will occur in the third quarter of 2020. In early July we completed the sale of the Midland, Texas fabrication facility for gross proceeds of $17 million. These funds were received in early July.”

“Cash from operations was $4.8 million in the second quarter, compared to $13.4 million in the first quarter. Distributable cash flow in the second quarter of 2020 was $8.4 million, down 4% from the first quarter of 2020, resulting in a distribution coverage ratio of 17.5x.”

This press release includes the following financial measures that are not presented in accordance with generally accepted accounting principles in the United States (“GAAP”): Adjusted EBITDA, Adjusted EBITDA Margin, distributable cash flow, distribution coverage ratio, free cash flow, and net leverage ratio. Please see Schedules B-E for reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures.

Unaudited results of operations for the quarter ended 30 June compared to the prior quarter and the corresponding prior year quarter are presented in the table below.

As of 30 June 2020, service compressor fleet horsepower was 1,178,721 and fleet horsepower in service was 967,505 (we define the overall service fleet utilization rate as the service compressor fleet horsepower in service divided by the total compressor fleet horsepower). Idle horsepower equipment under repair is not considered utilized, but we do count units on standby as utilized when the client is being billed a standby service rate.

During the quarter we incurred $15.8 million of non-recurring charges. These include non-cash charges of $9.0 million to write-down the value of certain compressors and related inventory. Non-recurring costs in the quarter also included $4.8 million of transaction, accounting and legal fees associated with the recently completed bond exchange. Additionally, $2.1 million of other costs, mainly severance and costs associated with right-sizing the organization were incurred.

Balance Sheet

Cash on hand at the end of the second quarter was $6.8 million. Drawn and outstanding on the Partnership’s asset-based loan at the end of the second quarter was $1.5 million.

During the second quarter we successfully completed an exchange of $215 million of the August 2022 unsecured bonds into $50 million first lien secured bonds due in 2025 and into $156 million second lien secured bonds due in 2026. As part of the exchange, total long-term amounts outstanding on the bonds was reduced by $9 million. The coupon on the August 2022 unsecured bonds is 7.25%, the coupon on the 2025 first lien secured bonds is 7.5% and the coupon on the 2026 second lien secured bonds is either 10% cash or 7.25% cash plus 3.50% payment in kind, at CSI Compressco’s option.

Our debt maturity schedule now reflects $81 million of unsecured bonds due in August, 2022, $400 million of first lien secured bonds due in 2025 and $156 million of second lien secured bonds due 2026. Our net leverage ratio at the end of the quarter was 5.1X.

CSI Compressco initiated a series of actions to generate incremental liquidity and further strengthen our balance sheet. The Midland, Texas fabrication facility and real estate was sold in early July for $17 million in gross cash proceeds (funds were received in early July). We also completed or expect to complete in two separate transactions the sale of idle compressors for $9 million during the third quarter. We further expect to provide aftermarket services on some of these units that are being sold to an existing customer. The combination of these asset sales would generate approximately $26 million of cash, before transaction expenses, to further strengthen our balance sheet.

Capital Expenditures – 2020 Expectations

We expect capital expenditures for 2020 to be between $28 million and $35 million, unchanged from our prior guidance. The forecast includes between $5 million and $8 million for new fleet additions. Maintenance capital expenditures are expected to be between $20 million and $22 million. Investments in technology and automation are expected to be between $3 million and $5 million.

Second Quarter 2020 Cash Distribution on Common Units

On July 20, 2020, CSI Compressco announced that the board of directors of its general partner declared a cash distribution attributable to the second quarter of 2020 of $0.01 per outstanding common unit, which will be paid on 14 August, to common unit holders of record as of the close of business on August 1, 2020. The distribution coverage ratio for the second quarter of 2020 was 17.5x.

Conference Call

CSI Compressco will host a conference call to discuss second quarter 2020 results today, 3 August, at 9:30 a.m. Eastern Time. The phone number for the call is 1-866-374-8397. The conference call will also be available by live audio webcast and may be accessed through CSI Compressco’s website at www.csicompressco.com.

An audio replay of the conference call will be available at 1-877-344-7529, conference number 10138621, for one week following the conference call and the archived webcast will be available through CSI Compressco’s website for thirty days following the conference call.

__________