(TPHL, 25.Jun.2019) — Trinidad Petroleum Holdings Limited (TPHL) today announced the expiration and final results of its previously announced offers to exchange any and all of its outstanding notes, originally issued by Petroleum Company of Trinidad and Tobago Limited (“Petrotrin”), for newly issued debt securities of TPHL (the “Exchange Offers”), upon the terms and subject to the conditions described in the Offering Memorandum, dated April 15, 2019 and amended by the related press releases dated April 29, 2019, May 6, 2019, May 13, 2019, May 24, 2019, May 31, 2019, June 6, 2019 and June 20, 2019 (as may be further amended or supplemented from time to time, the “Offering Memorandum”), and the related letter of transmittal (as may be amended or supplemented from time to time, the “Letter of Transmittal”), and to its solicitation of consents to certain proposed amendments to the existing indentures (the “Consent Solicitations”). The Exchange Offers and Consent Solicitations expired at 5:00 p.m., New York City time, on June 21, 2019 (the “Extended Expiration Date”).

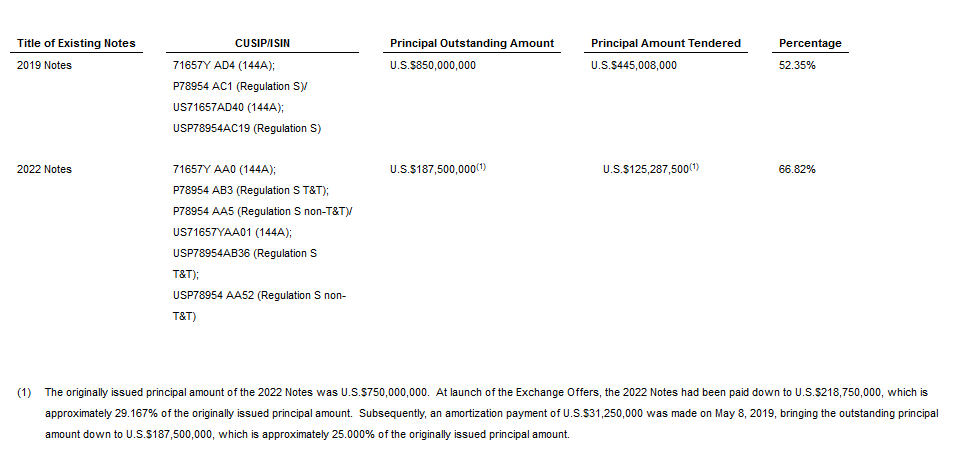

As of the Extended Expiration Date, the aggregate principal amount of Existing Notes validly tendered was U.S.$570,295,500. The valid tender, without subsequent withdrawal, of at least U.S.$150 million aggregate principal amount of Existing Notes (the “Amended Minimum Tender Condition”) has been met. The breakdown of the principal amount of validly tendered 2019 Notes and 2022 Notes is as set forth in the table below.

In connection with the Exchange Offers, TPHL also announced that it has modified the Financing Condition to, instead of requiring the receipt of the proceeds from the Term Loan Facility (as defined in the Offering Memorandum), now require the execution (without the actual receipt of proceeds at or prior to settlement of the Exchange Offers) of a credit agreement in an amount up to U.S.$720,000,000 with Credit Suisse AG, Cayman Islands Branch, Banco Latinoamericano de Comercio Exterior, S.A., First Citizens Bank Limited and The Bank Of Nova Scotia, as joint lead arrangers. As of the Extended Expiration Date, the modified Financing Condition has been met.

The settlement of the Exchange Offers is expected to occur on June 28, 2019. Eligible holders of Existing Notes who validly tendered and did not validly withdraw such notes at or prior to the Extended Expiration Date are eligible to receive the Total Consideration or Exchange Consideration (as defined in the Offering Memorandum), as applicable. The aggregate principal amount of TPHL’s 9.75% Senior Secured Notes due 2026 to be issued as consideration for the Exchange Offers payable on the Settlement Date is U.S.$570,265,000, which reflects the rounding down to the nearest integral multiple of U.S.$1,000. No additional consideration will be paid in lieu of fractional New Notes not received as a result of such rounding down. Because the amount of 2019 Notes tendered is less than the 2019 New Notes Cap, the Total Consideration or Exchange Consideration will include only New Notes and will not include cash, other than as payment for the Consent Fee or Additional Early Tender Consideration, if applicable.

Eligible Holders who validly tendered Existing Notes at or prior to the Early Tender Deadline will receive the Additional Early Tender Consideration (an additional U.S.$10 of cash for each U.S.$1,000 principal amount of Existing Notes accepted for exchange) because the Amended Minimum Tender Condition of at least U.S.$350 million in aggregate principal amount of 2019 Notes tendered was met. As previously stated, Supporting Existing Notes Holders and any additional Eligible Holders whose Existing Notes were validly tendered and accepted after May 10, 2019 will receive a Consent Fee of U.S.$10 per U.S.$1,000 or one percent (1%) of Existing Notes and, because Eligible Holders of Existing Notes validly tendered and did not withdraw U.S.$150 million or more in aggregate principal amount of Existing Notes on or after June 5, 2019, a portion of their Consent Fee will be deducted and used to pay the reasonable and documented fees and costs of the advisors of the Supporting Existing Notes Holders in an amount up to U.S.$2.85 million (the “Fees and Expenses Deduction”). The Consent Fee payable will be U.S.$6.80 per U.S.$1,000 for Existing Notes tendered after May 10, 2019 after taking into account the Fees and Expenses Deduction for the applicable tendering Eligible Holders.

As discussed in the Offering Memorandum, Existing Noteholders who tendered their Existing Notes in the Exchange Offers were deemed to have delivered their consent to the Proposed Amendments to the 2019 Notes Indenture or the 2022 Notes Indenture, as applicable. As of the Extended Expiration Date, the requisite consents for the 2019 Notes Indenture and the 2022 Notes Indenture were obtained. As such, supplemental indentures to the 2019 Notes Indenture and the 2022 Notes Indenture effecting the Proposed Amendments (the “Supplemental Indentures”) will be executed on or before June 28, 2019. The Supplemental Indentures will be valid and enforceable upon execution but will only become operative upon the settlement of the Exchange Offers and Consent Solicitations.

***