(Argus, 27.Apr.2020) — The two Maduro loyalists who have been effectively running Venezuela's national oil industry for two months were officially appointed today as acting heads of the oil ministry...

(Argus, 12.Mar.2020) — A presidential commission tasked with reorganizing Venezuela's state-owned PdV is sowing confusion among the oil company's joint venture partners over who is running the firm after chief...

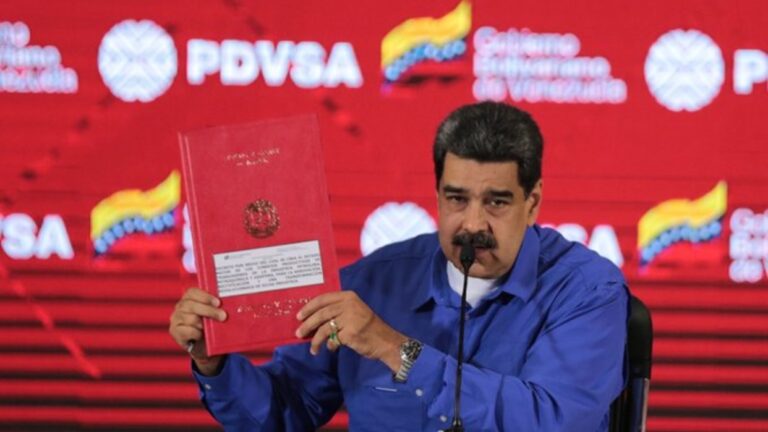

(Reuters, 19.Feb.2020) — Venezuelan President Nicolas Maduro said on Wednesday he would create a presidential commission to restructure the country's beleaguered oil industry, which will be led by Vice President...

(Bloomberg, 19.Feb.2020) — Venezuela’s President Nicolas Maduro declared an “energy emergency” as he announced a commission to revamp state oil company Petroleos de Venezuela SA, redoubling efforts to shore up...

(Reuters, 2.Jul.2019) — Venezuela will stick to its plan of blending domestic and foreign crude to maintain and even increase oil production and exports in the face of sanctions prohibiting...

(Reuters, 29.Mar.2019) — Russian Energy Minister Alexander Novak said on Friday he planned to discuss with his Venezuelan counterpart ways to increase oil exports from Venezuela. He did not give...

(Energy Analytics Institute, Ian Silverman, 14.Mar.2019) — Heard on the street and LatAmNRG briefs on PDVSA reporting a fire at three Petro San Félix storage tanks and Venezuela’s Manuel Quevedo...

(Reuters, 4.Mar.2019) — Venezuela’s oil minister will visit Russia soon to formally complete the move of state oil company PDVSA’s office to Moscow from Lisbon, the Interfax news agency cited...

(Petroleum Economist, Charles Waine, 22.Feb.2019) — Despite severe US sanctions, President Maduro is standing firm. But how long can the political impasse last while oil production continues to decline? Venezuela...

(Argus, 11.Feb.2019) — India´s two leading refiners will continue to import Venezuelan crude but will no longer supply oil products to Venezuela´s state-owned PdV because of US sanctions, Indian downstream...

(Energy Analytics Institute, Piero Stewart, 29.Jan.2019) — Officials from PDVSA and Venezuela’s Oil Ministry continue to evaluate the different options they can take to counter the recent sanctions announced by...

(Bloomberg, Tina Davis and Javier Blas, 23.Jan.2019) — Will there be two OPEC presidents now? With Venezuela boasting two proclaimed heads of state, it’s worth remembering that the nation with...

(AFP, 7.Jan.2019) — French oil company Maurel & Prom will invest $400 million in an oil field in Venezuela, whose production is in free fall, President Nicolas Maduro said on...

(Reuters, Luc Cohen and Brian Ellsworth, 7.Jan.2019) — Venezuelan state oil firm PDVSA [PDVSA.UL] has signed a deal with little-known U.S. energy firm Erepla that is part-owned by a prominent...

(Oilprice.com, Nick Cunningham, 27.Dec.2018) — Last Friday, the Guyanese government fell after a no-confidence vote, a move that likely was viewed as an opportune moment of weakness in Caracas. A...

(Reuters, Alexandra Ulmer and Marianna Parraga, 26.Dec.2018) — Last July 6, Major General Manuel Quevedo joined his wife, a Catholic priest and a gathering of oil workers in prayer in...

(S&P Global Platts, 19.Dec.2018) — OPEC enters a pivotal third year of production cuts in a volatile oil market with its least experienced minister at the helm. Venezuela’s Manuel Quevedo,...

(Trinidad Express, 15.Nov.2018) — Venezuela’s minister of energy, Manuel Quevedo, said yesterday that his country’s state-owned oil giant PDVSA expects to start sending natural gas to Trinidad from the Dragon...

(Reuters, 11.Nov.2018) — Venezuela is hoping to steeply raise oil output next year but will respect any new deal if OPEC agrees to reduce output from December, Oil Minister Manuel...

(Reuters, 15.Oct.2018) — Venezuela’s state-owned oil company PDVSA is preparing to pay holders of its 2020 bond some $950 million this month, after failing to make interest payments on most...

(Energy Analytics Institute, Piero Stewart, 29.Sep.2018) — Venezuela’s Oil Minister Manuel Quevedo announced the South American country would continue to seek equilibrium in the petroleum market. “Under the leadership of...

(S&P Global, Mery Mogollon, 30.Aug.2018) — State-owned Venezuelan oil company PDVSA signed a $430 million service agreement with seven companies to boost its oil production by 641,000 b/d, company president...

(OilPrice.com, Tsvetana Paraskova, 30.Aug.2018) — Venezuela’s state oil firm PDVSA has said that it signed a US$430 million joint service agreement with seven companies that would help it increase its...

[caption id="attachment_3316" align="alignright" width="800"] Venezuelan oil workers march thru the streets of Caracas. Source: PDVSA[/caption] (Energy Analytics Institute, Ian Silverman, 21.Aug.2018) — Oil workers at state oil company PDVSA marched...

(Energy Analytics Institute, Jared Yamin, 19.Aug.2018) – Former PDVSA President Rafael Ramírez says Venezuela produced 3 million barrels per day until December 2013. That figure has dropped by 1.8 million,...

(Energy Analytics Institute, Piero Stewart, 10.Aug.2018) – PDVSA President Manuel Quevedo assured that Venezuelan crude oil production had stabilized. Quevedo, who also serves as Venezuela’s Petroleum Minister, said last week...

(UPI, Daniel J. Graeber, 10.Aug.2018) – Though it holds the largest reserves of oil in the world, production levels put it only in the middle of the pack among OPEC...

[caption id="attachment_3321" align="alignright" width="300"] Venezuela's Manuel Quevedo and Saudi Arabia's Ambassador to Venezuela Saad Bin Abdullah al Saad in Caracas. Source: PDVSA[/caption] (Energy Analytics Institute, Ian Silverman, 8.Aug.2018) — Officials...

(Reuters, Marianna Parraga, Mircely Guanipa, 7.Aug.2018) – Reuters) - Venezuela’s state-run oil company PDVSA has limited the damage from an unprecedented slump in crude exports by transferring oil between tankers...

(Energy Analytics Institute, Piero Stewart, 23.Jul.2018) – It has been 11 years and the 7,000 direct and indirect Venezuelan workers of US oil company Exxon Mobil still haven’t received their...

(OilPrice.com, Tsvetana Paraskova, 17.Jul.2018) – Venezuela’s Oil Minister Manuel Quevedo has discussed plans with state-held oil company PDVSA to raise the country’s crude oil production in the second half of...

(Energy Analytics Institute, Piero Stewart, 8.Jul.2018) – Venezuela’s Oil Minister General Manuel Quevedo prayed to God in search of divine assistance to boost Venezuela’s oil production. The prayer was made...

(Energy Analytics Institute, Piero Stewart, 28.Jun.2018) – Officials from both oil companies held meetings in Caracas to discuss partnerships. PDVSA President Manuel Quevedo, who also serves as Venezuela’s Oil Minister,...

(LoopTT, 27.Jun.2018) – Minister in the Office of the Prime Minister, Minister in the Ministry of the Attorney General and Legal Affairs and Minister of Communications Stuart Young led a...